Governments in the GCC are facing pressure to secure social protection and well-being for their citizens. But state resources are under stress. Lack of income tax, declining oil prices, and the COVID-19 pandemic, combined with strong citizen dependence on the state and expectations for subsidized services, have resulted in an unsustainable social welfare model.

What can GCC governments do to secure and enhance citizen well-being?

A social investment approach optimizes human capital productivity and turns citizens into contributors to the economy, ultimately making them a vital force for economic growth, while also reducing government costs.

What are the guiding principles behind a social investment approach?

Implementing a social investment model involves:

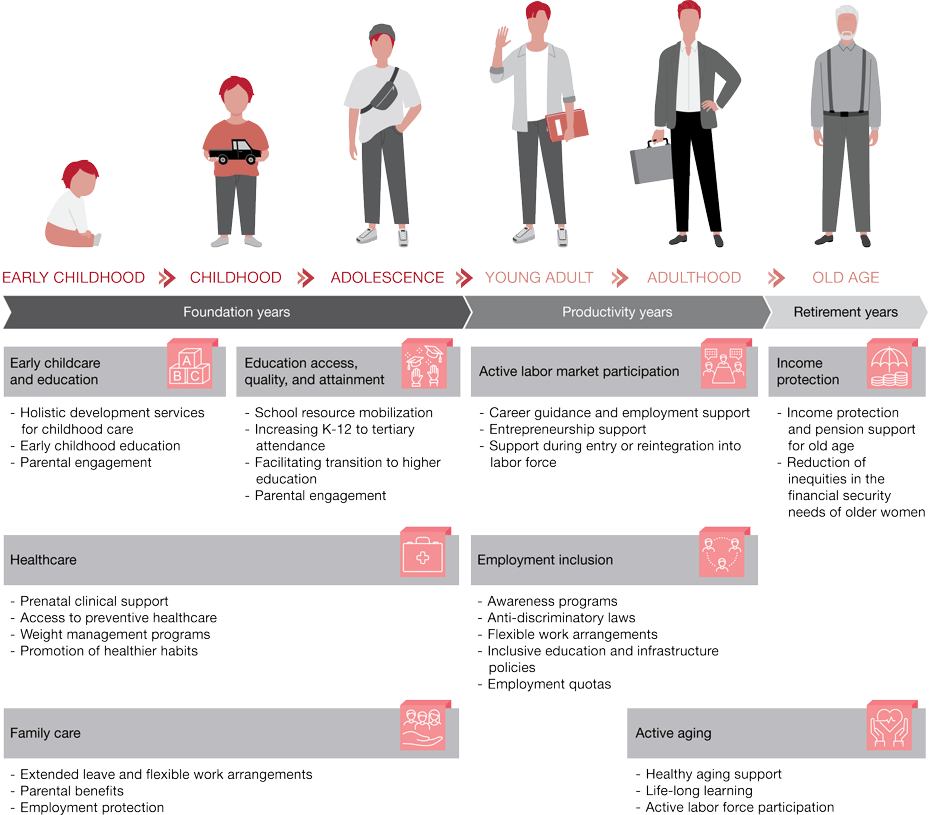

1. Adopting a life course portfolio approach

Governments need to go back to early childhood to identify the root causes of social issues and lay the foundations at an early age to help citizens transition to productivity during adulthood. Such early intervention can consequently turn citizens into contributors to the economy, while also preserving the safety net for old age. Governments must, therefore, institute policies that cover the full life-course of an individual. This approach focuses on the interdependence of all life stages as generations move from being welfare recipients during childhood and youth, to being contributors during adulthood, to recipients again during old age.

2. Applying systems thinking to address the root causes

Governments should adopt a systems thinking approach, which will allow them to build a holistic understanding of the social system. They will then be able to manage social challenges more efficiently by accounting for gaps and interdependencies among the different components. Consequently, they will be able to adopt a preventive approach that addresses the root causes and limits the number of citizens at risk and increases the share of the population that contributes to the economy.

3. Evaluating social and financial returns

Governments need to assess the potential impact and outcomes that could be generated from various policy options, including short- and long-term social and financial effects, and the difference between not intervening and taking action. The government can then use these assessments to compare various social investment proposals and decide on the most impactful combination. While governments might find this approach costly in the short-term, it is worth noting that benefits-to-costs ratios are high in the long-term. For instance, an increase in pre-school enrollment for nationals to be in line with the OECD average has the potential to generate a return on investment of US$133 in the UAE and US$25 in Saudi Arabia for each US$1 dollar invested.

4. Sharing the responsibility

Governments need to engage citizens and the private sector to share the social and financial responsibilities of securing the well-being of individuals. Citizens need to increase their sense of responsibility and reduce their dependence on the state. In parallel, the private sector needs to engage in the delivery of public services through innovative financial tools that address a social issue while generating a financial return. These tools are known as social impact investments.

Contact us

Menu