If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Not too long ago, Microsoft (MSFT (opens in new tab)) stock's glory days looked to be behind it as sales of desktop PCs slipped into a seemingly irreversible decline amid the consumer shift to mobile technology. Although the dot-com days of the 1990s minted many a "Microsoft millionaire," the aftermath of the tech bust led MSFT stock to trade mostly sideways for more than a decade.

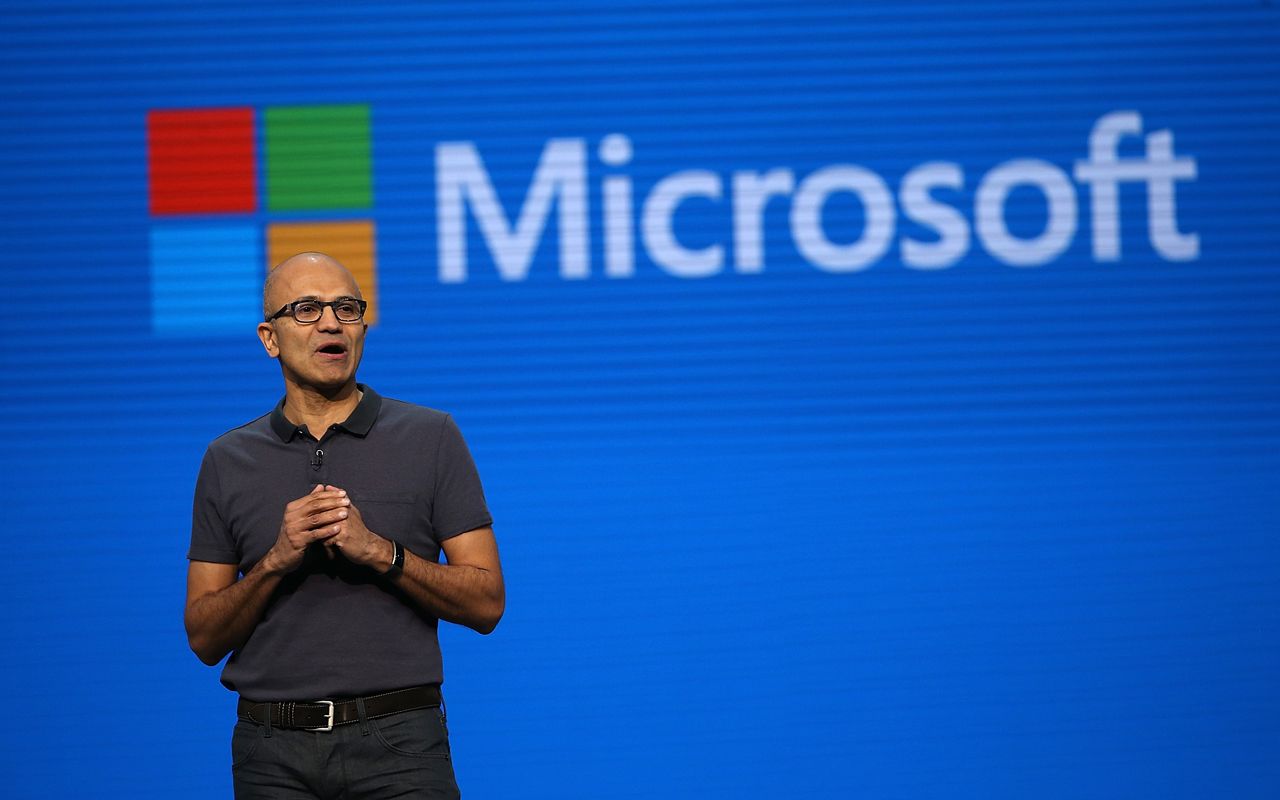

But the past 10 years have been nothing short of a renaissance for the software giant. When CEO Satya Nadella ascended to the top job in 2014, he not only began instituting cultural changes, he transformed Microsoft's core strategy too. Cloud computing and subscription-based services were in; the days of selling software licenses via physical compact disks were passé.

That focus on enterprise customers and – most importantly – Microsoft's shift to selling cloud-based services such as Azure and Office 365 have been an astounding success. Today, Microsoft is a dominant player in cloud computing – and MSFT's stock price proves it.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Indeed, Microsoft stock has been so remunerative since Nadella took over that long-term investors might not even notice that dud decade-plus following the tech bust. Between January 1990 and December 2020, shares in Microsoft, which joined the Dow in 1999 at the height of the dot-com boom, generated a total return of 57,730%. The S&P 500's total return came to a mere 1,950% over the same span.

Along the way, Microsoft stock generated $1.91 trillion in wealth for shareholders, good for an annualized dollar weighted return of 19.2%, according to Hendrik Bessembinder (opens in new tab), professor of finance at the W.P. Carey School of Business (opens in new tab) at Arizona State University.

Only Apple (AAPL (opens in new tab)) generated more wealth for shareholders over those three decades, making MSFT one of the very best stocks of the past 30 years, per Bessembinder's findings, which account for cash flows in and out of the business and other adjustments.

The bottom line on Microsoft stock

Which brings us to what $1,000 invested in MSFT stock 20 years ago would be worth today.

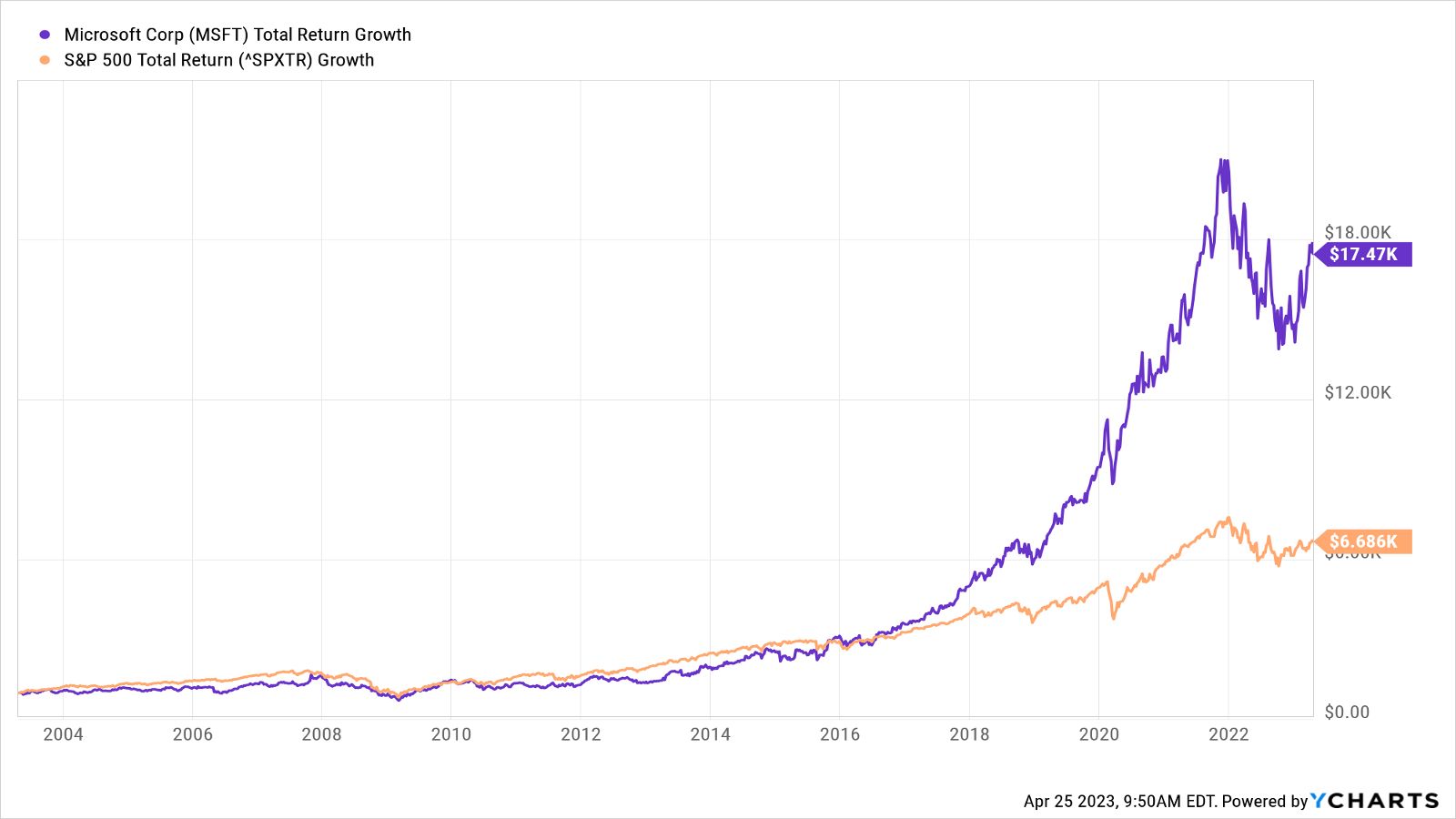

But first things first. As you can see in the above chart, if you had invested $1,000 in MSFT stock in late April 2003 and sold at its height in November 2021, you would have grossed more than $21,000.

MSFT stock remains about 18% off its all-time closing high, however, shedding roughly $480 billion in market value in the process. To put that enormous sum in perspective, only eight companies in the S&P 500 (Microsoft included) have market capitalizations of more than $500 billion.

As a result, that $1,000 investment made 20 years ago is today worth $17,500. By comparison, the same amount invested in the S&P 500 over the same time frame would theoretically be worth $6,700 today.

Of course, that is still a fabulous return by any measure. Over its entire life as a publicly traded company, MSFT has generated an annualized total return (price change plus dividends) of almost 26%. The S&P 500's total return comes to not quite 10% over the same period.

Microsoft stock: buy, sell or hold?

Perhaps most importantly, Wall Street remains confident that Microsoft stock will continue to beat the market by wide margins going forward. In addition to regularly making the list of hedge funds' top stock picks, MSFT routinely takes the top spot in analysts' rankings of all 30 Dow stocks.

Just have a look at how the Street collectively views MSFT stock. Of the 51 analysts issuing opinions on Microsoft stock tracked by S&P Global Market Intelligence, 32 call it a Strong Buy, 13 say Buy, five have it at Hold and one slaps a rare Strong Sell rating on the name. That works out to a consensus recommendation just shy of Strong Buy.

We'll let a bull – Stifel analyst Brad Reback, who rates MSFT at Buy – summarize the investment thesis on Microsoft shares:

Microsoft has refocused the company around Azure and Office 365, which we view as several large, multi-year secular growth engines that should help drive mid- to high-single-digit Productivity and Business Process growth and low-double-digit Intelligent Cloud growth in coming years. On the More Personal Computing front, while we remain cautious on the Windows franchise, we think areas such as Bing, Surface, and Xbox are gaining scale. Overall, we believe strong commercial cloud revenue and gross margin growth and expense discipline should lead to accelerating operating profit and free cash flow generation in coming quarters. This, coupled with consistent capital return (more than $20 billion in annual buybacks/dividends), should enable Microsoft to post at least high-single-digit total returns (earnings per share growth + dividend yield) in coming years.

With an average price target of $306.97, industry analysts give Microsoft stock implied upside of about 10% in the next 12 months or so. Add in the dividend yield, and the implied total return comes to about 11%.

Should the Street's highest target price of $420 come to pass, MSFT stock would rise about 50% from current levels. On the other hand, the Street's lowest price target – at $212 a share – gives Microsoft stock implied downside of about 25% in the next year or so.

Where Microsoft goes from here remains to be seen. What's not in doubt is that $1,000 invested in MSFT stock 20 years ago turned out to be an absolutely market-crushing deployment of capital.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Is Inflation a Big Retirement Worry? How to Protect Savings

Is Inflation a Big Retirement Worry? How to Protect SavingsConcerns about how inflation eats into your resources or limits your ability to save sufficiently for retirement are real, but there are four things you can do to cope.

By Jason “JB” Beckett • Published

-

Short-Term Financial Planning for First-Time Parents

Short-Term Financial Planning for First-Time ParentsA seasoned wealth adviser shares his experience with the financial planning he and his wife did for the arrival of their first bundle of joy.

By Kara Duckworth, CFP®, CDFA® • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published

-

Stock Market Today: Big Bank Earnings Fail to Lift Stocks

Stock Market Today: Big Bank Earnings Fail to Lift StocksThe major indexes closed lower Friday on hawkish Fed speak and dismal retail sales data.

By Karee Venema • Published

-

Stock Market Today: Stocks Climb After Promising PPI, Jobless Claims

Stock Market Today: Stocks Climb After Promising PPI, Jobless ClaimsThe major market indexes notched a win Thursday as wholesale prices unexpectedly fell and jobless claims hit their highest level in over a year.

By Karee Venema • Published