Best Blue Chip Stocks: 21 Hedge Fund Top Picks

What is the reputed smart money up to lately? Here are the 21 most popular blue chip stocks among the hedge fund crowd.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Thanks in part to their massive market caps and deep liquidity, blue chip stocks are a natural home for hedge funds and other large pools of institutional capital.

Of course, not all blue chip stocks are created equal. And hedge funds, as a group, actually have a rather poor long-term track record vs. the broader market.

Still, there's something irresistible about knowing what the putative smart money has been up to. Besides, you've got to give hedge funds credit where credit is due.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Hedging strategies by definition limit upside when stocks are rising, which helps explain the industry's years of underperformance during the last bull market. By the same token, however, hedging strategies limit downside when everything is selling off. And goodness knows investors have seen plenty of red on their screens recently.

Consider 2022, when hedge funds earned their keep during a truly dismal year for equities. The Eurekahedge (opens in new tab) Hedge Fund Index delivered a total return (price appreciation plus dividends) of -4.8% last year. The S&P 500, meanwhile, generated a total return of -18.1%.

In other words, in the worst year for U.S. stocks since the Great Financial Crisis, hedge funds beat the broader market by almost 14 percentage points.

We won't know how hedge funds are dealing with the current market selloff until they disclose their first-quarter buys and sells in mid-May. But we do know what they were up to in Q4, thanks to a recent batch of regulatory filings.

It turns out that much of what they were up to involved the large-scale dumping of the market's biggest and best-known blue chip stocks. "Funds played defense in 2022," notes Goldman Sachs strategist Ben Snider.

Be that as it may, hedge funds, as always, remain heavily invested in most of the market's biggest and bluest of blue chip stocks – particularly Dow stocks.

That's partly a function of Dow stocks' massive market capitalizations and attendant liquidity, which, as noted above, creates ample room for institutional investors to build or pare large positions.

Big-name blue chip stocks also carry a lower level of reputational risk for professional money managers. (It's a lot easier to justify holding a large position in a Dow stock than a no-name small-cap if restive clients start grumbling about their returns.)

It also happens to be the case that almost half these names are not in the famed blue chip barometer. A few of these picks might even surprise you.

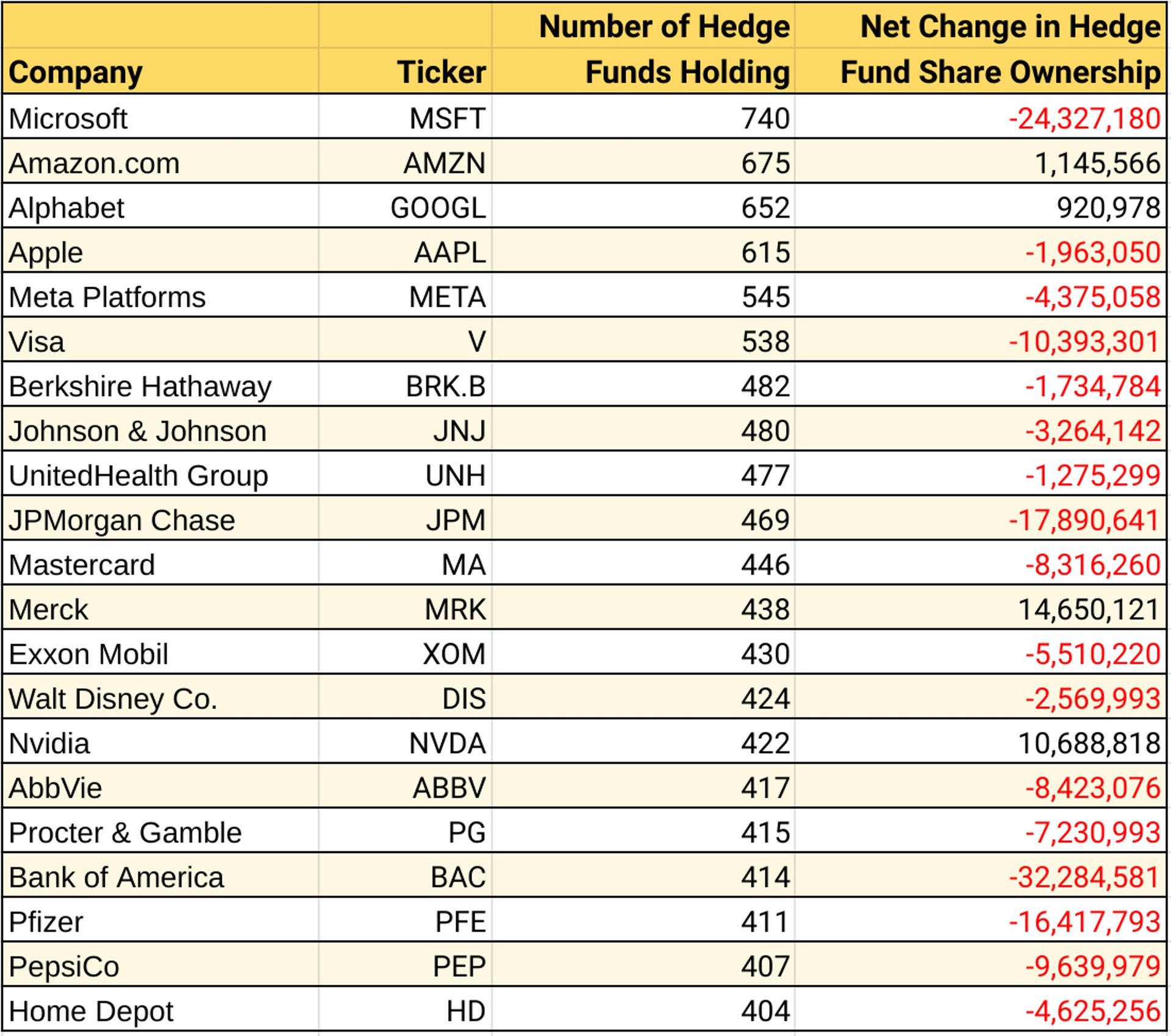

Have a look at hedge funds 21 top blue chip stock picks as of Dec. 30, 2022 in the chart below. Note that defense did indeed prevail in Q4. Only four names saw a positive net change in share ownership by hedge funds.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

From SECURE Act to SECURE 2.0: Is Your Estate Plan Safe?

From SECURE Act to SECURE 2.0: Is Your Estate Plan Safe?The ever-evolving legislative landscape provides both challenges and opportunities when it comes to making plans for your retirement and your estate. A key focus: tax planning.

By Lindsay N. Graves, Esq. • Published

-

Stock Market Today: UPS, First Republic Earnings Drag on Stocks

Stock Market Today: UPS, First Republic Earnings Drag on StocksDismal guidance from logistics giant UPS and dreary deposit data from regional lender First Republic kept a lid on the major indexes Tuesday.

By Karee Venema • Published

-

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have TodayMicrosoft Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

By Dan Burrows • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published