If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

Netflix stock is down almost 60% from its all-time closing high, but it's still a big-time market beater.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Netflix (NFLX (opens in new tab)) stock is notoriously volatile. And while some nimble traders have surely used NFLX's gut-wrenching swings to their advantage over the years, plenty of punters with less fortunate timing have just as assuredly had their faces ripped off.

Netflix's truly long-time shareholders are in another class entirely. Those who bought stock in the streaming media giant two decades ago – and then held and held and held through NFLX's many vertiginous ups and downs – have enjoyed outstanding returns vs the broader market.

Alas, these same patient investors who have done so well over the years can still relate to damaged day traders. For even they have seen a large chunk of their wealth evaporate on paper since late 2021.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

That's because as successful as Netflix has been – and may continue to be – it remains at its core a fundamentally insecure business model. (Just look at NFLX stock's volatility for proof.)

On the plus side, Netflix is the king of on-demand streaming entertainment, serving TV series, films and games via 231 million paid memberships in more than 190 countries. It furthermore lays claim to arguably the best brand in the industry.

On the downside, Wall Street puts relentless pressure on the company to grow its subscriber base. As a consequence, Netflix must spend tens of billions of dollars on content to attract and retain viewers. Competition from the likes of Walt Disney (DIS (opens in new tab)), Apple (AAPL (opens in new tab)), Paramount (PARA (opens in new tab)), Amazon.com (AMZN (opens in new tab)) and others have forced Netflix to splurge on efforts to acquire, license and produce content over the past several years.

After peaking at $17.7 billion in 2021 – a whopping 50% increase vs the previous year – Netflix managed to cut spending on content by about 5% in 2022 to $16.8 billion.

Investors are very much counting on the company to keep a lid on that cash burn going forward. But it's going to be hard.

After all, nothing hurts NFLX stock like losing subscribers. Recall that in April 2022, shares plunged after Netflix reported its first loss of subscribers in more than a decade. The company shed in excess of $50 billion in market value overnight.

It's also worth recalling that Netflix stock was already in a steep decline at that point. Sluggish subscriber growth and rising costs had long knocked it off its perch. Indeed, shares hit an all-time closing high of $691.69 back in November 2021.

Note well that NFLX stock still trades about 58% below that level.

The bottom line on Netflix stock?

Which brings us to what you would have today if you had invested $1,000 in Netflix stock 20 years ago.

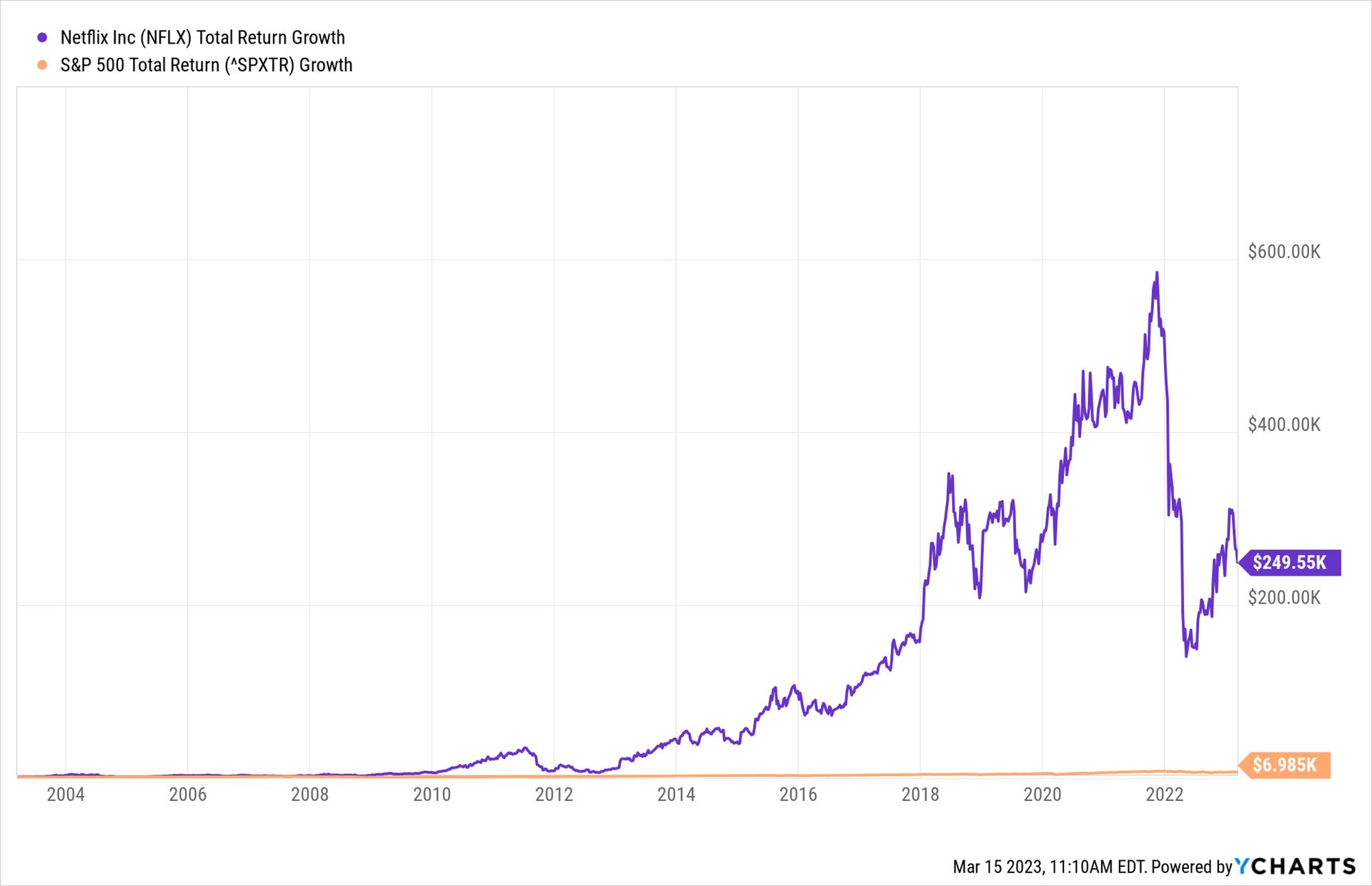

First things first, however: if you purchased $1,000 worth of NFLX stock in mid-March 2003 and sold it at its November 2021 peak, you would have grossed $585,000 on that investment.

However, as noted, things have turned south since then. Have a look at the above chart, and you'll see that if you invested $1,000 in NFLX stock 20 years ago – and did not sell at the peak – you would be sitting on $249,550 today.

For comparison's sake, the same amount invested in the S&P 500 over the same span would theoretically be worth $6,985 today.

The good news is NFLX stock has clobbered the broader market over the long term. The less good news is that it remains far below its all-time high – and it's probably not getting back there anytime soon.

True, the Street's consensus recommendation on Netflix stock comes to Buy, but with somewhat mixed conviction. Of the 42 analysts issuing opinions on NFLX tracked by S&P Global Market Intelligence (opens in new tab), 20 rate it at Strong Buy, two say Buy and 17 call it a Hold. Another two analysts rate it at Sell, while one says it's a Strong Sell.

Meanwhile, their average price target of $357.51 gives NFLX stock implied upside of about 14% over the next 12 months or so.

Patient investors have done exceedingly well sticking by Netflix stock thus far. Unfortunately, it looks like they're going to have to wait quite a bit longer to recover what their brokerage statements said they once had.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

IRS Service Improvements Could Bring Faster Tax Refunds

IRS Service Improvements Could Bring Faster Tax RefundsRecent IRS improvements mean taxpayers could see faster tax refunds next year and beyond.

By Katelyn Washington • Published

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

Stock Market Today: UPS, First Republic Earnings Drag on Stocks

Stock Market Today: UPS, First Republic Earnings Drag on StocksDismal guidance from logistics giant UPS and dreary deposit data from regional lender First Republic kept a lid on the major indexes Tuesday.

By Karee Venema • Published

-

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have TodayMicrosoft Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

By Dan Burrows • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published