If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Nvidia stock has been a market-beater recently, but has it always been such a winner?

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Nvidia (NVDA (opens in new tab)) stock has been a rare winner amid the market's recent swoon, but then long-time shareholders should be used to that sort of thing by now.

That's because despite its high volatility – and some rather vertiginous ups and downs along the way – this semiconductor stock has vastly outperformed the broader market since going public at the end of the last century.

But before we take a look at Nvidia stock's illustrious past, let's recap how it's been doing recently.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

After losing half its value last year – and attracting some bargain-hunting billionaire investors around its share-price nadir – NVDA stock was up 62% through the first eight weeks of 2023. That led the S&P 500 by a whopping 57 percentage points.

A chunk of those returns came on Feb. 23 alone, when shares rallied 14% following Nvidia's quarterly earnings report (opens in new tab). The market was especially happy to see robust growth in the firm's data center business. For that week as a whole, NVDA stock gained 8.9%. Meanwhile, the S&P 500 suffered its worst weekly performance since early December of last year.

Nvidia stock's market-beating ways go much farther back than that, however. In fact, few stocks have done more for investors over the past few decades than Nvidia. From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business (opens in new tab) at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other adjustments, Nvidia is one of the 30 best stocks of the past 30 years.

Looked at another way, over just 24 years as a publicly traded company, Nvidia stock generated an annualized total return of 26.9%. The S&P 500, with dividends reinvested, returned an annualized 9.8% over the same period.

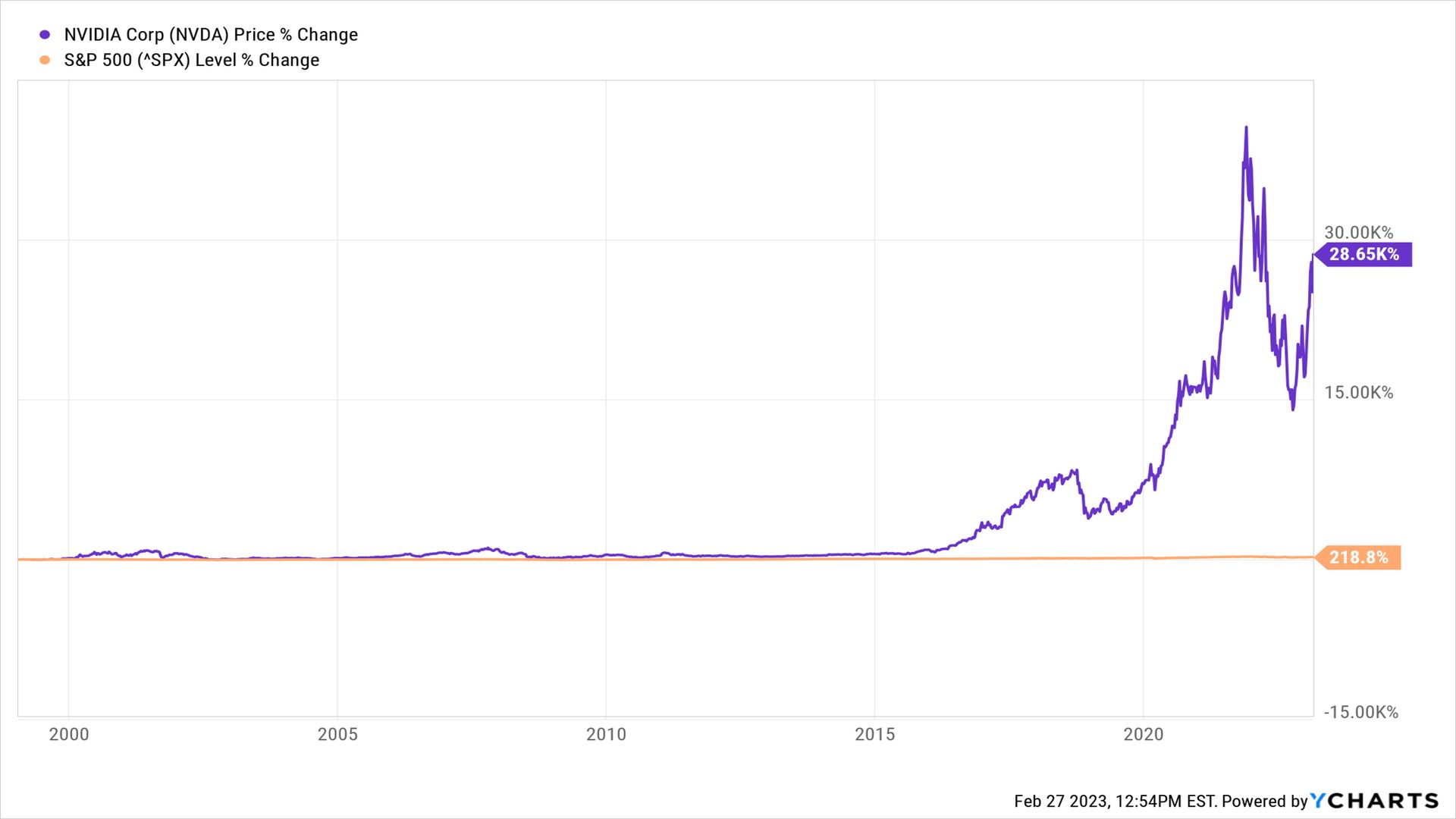

Have a look at the chart below comparing Nvidia stock's all-time performance vs. the performance of the broader market.

As you can see in the chart, most of the shareholder wealth generated by Nvidia came over just the past four years. That's because back in the day, the primary market for Nvidia's graphics processing units (GPUs) consisted of PC and console video game enthusiasts.

Happily for Nvidia, it just so happens that the company's powerful GPUs and related intellectual property are indispensable to the fields of artificial intelligence (AI), professional visualization, cryptocurrency mining and more. As noted above, NVDA processors are increasingly in demand for use in data centers.

Few blue chip stocks offer so much exposure to so many emerging endeavors, which helps explain NVDA stock's meteoric rise.

But as remarkable as the above chart may be, it doesn't quite get to the heart of what NVDA stock has meant to long-term shareholders and their brokerage statements. For that, consider the following facts about Nvidia stock:

The Bottom Line on Nvidia Stock?

Over the past two decades, Nvidia stock generated a total return of more than 24,000%, or 31.6% annualized.

Therefore, if you invested $1,000 in Nvidia stock 20 years ago, today it would be worth more than $241,000.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

IRS Service Improvements Could Bring Faster Tax Refunds

IRS Service Improvements Could Bring Faster Tax RefundsRecent IRS improvements mean taxpayers could see faster tax refunds next year and beyond.

By Katelyn Washington • Published

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

Stock Market Today: UPS, First Republic Earnings Drag on Stocks

Stock Market Today: UPS, First Republic Earnings Drag on StocksDismal guidance from logistics giant UPS and dreary deposit data from regional lender First Republic kept a lid on the major indexes Tuesday.

By Karee Venema • Published

-

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have TodayMicrosoft Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

By Dan Burrows • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published