Did Tweets Help Crash Silicon Valley Bank? Paper Shows New Social Media Risks

A new study on Silicon Valley Bank's demise links depositor flight and stock crash with Twitter mentions.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Did panicky tweets kickstart a bank run on Silicon Valley Bank (SVB) last month?

Five researchers from universities across the U.S. and Europe tackled this thorny question in a new working paper (opens in new tab) analyzing extensive data on Twitter posts published before, during and after the bank run. Their startling argument: Twitter activity was an active, central factor in the biggest bank failure since the 2008 financial crisis – rather than passive commentary on a deteriorating situation.

Silicon Valley Bank's path to ruin

But how did SVB arrive at the point where tweets could potentially topple an institution worth $209 billion (according to Forbes (opens in new tab)) in roughly one day?

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The first domino was SVB's effort to increase profits in 2020 and 2021 by buying long-term Treasuries. After a surge in deposits from startups flush with cash, the bank wanted a way to increase profits from its enormous pile of deposits. SVB and other banks bet big on the low interest rates staying at a relatively low level for the foreseeable future – a bet that turned out to be wrong.

The second domino was the Federal Reserve's unexpected campaign to fight soaring inflation by raising interest rates by nearly 5% between March 2022 and March 2023. The value of SVB's Treasury holdings fell precipitously through 2022 and early 2023 against rising rates. According to the National Bureau of Economic Research (NBER), only 10% of all banks in the U.S. had larger unrealized losses than SVB in March 2023.

The third domino was an unfortunately-timed announcement from SVB's parent company SVB Financial Group. On March 8, 2023, the group decided to announce its sale of Treasuries and other assets for a nearly $2 billion loss – and to launch a massive stock offering in order to raise capital. However, tech-focused Silvergate Bank (opens in new tab) had announced its own voluntary liquidation earlier that same day, producing an atmosphere of uncertainty in the sector. SVB's stock plummeted more than 60% the next day, and Moody's downgraded its credit rating.

The final domino? The social media meltdown that led directly to SVB's collapse, according to the researchers. Word of SVB's losses spread rapidly throughout Twitter and other platforms.

Reuters (opens in new tab) reported that depositors raced to withdraw $42 billion from the beleaguered bank within 24 hours. An unusually large percentage of SVB's tech-heavy depositors had account balances well above the FDIC-insured threshold of $250,000, so they had much more to lose in a potential bank run than depositors in a more traditional U.S. bank.

On March 10, the FDIC (opens in new tab) officially stepped in and took over SVB's remaining assets.

Research methods

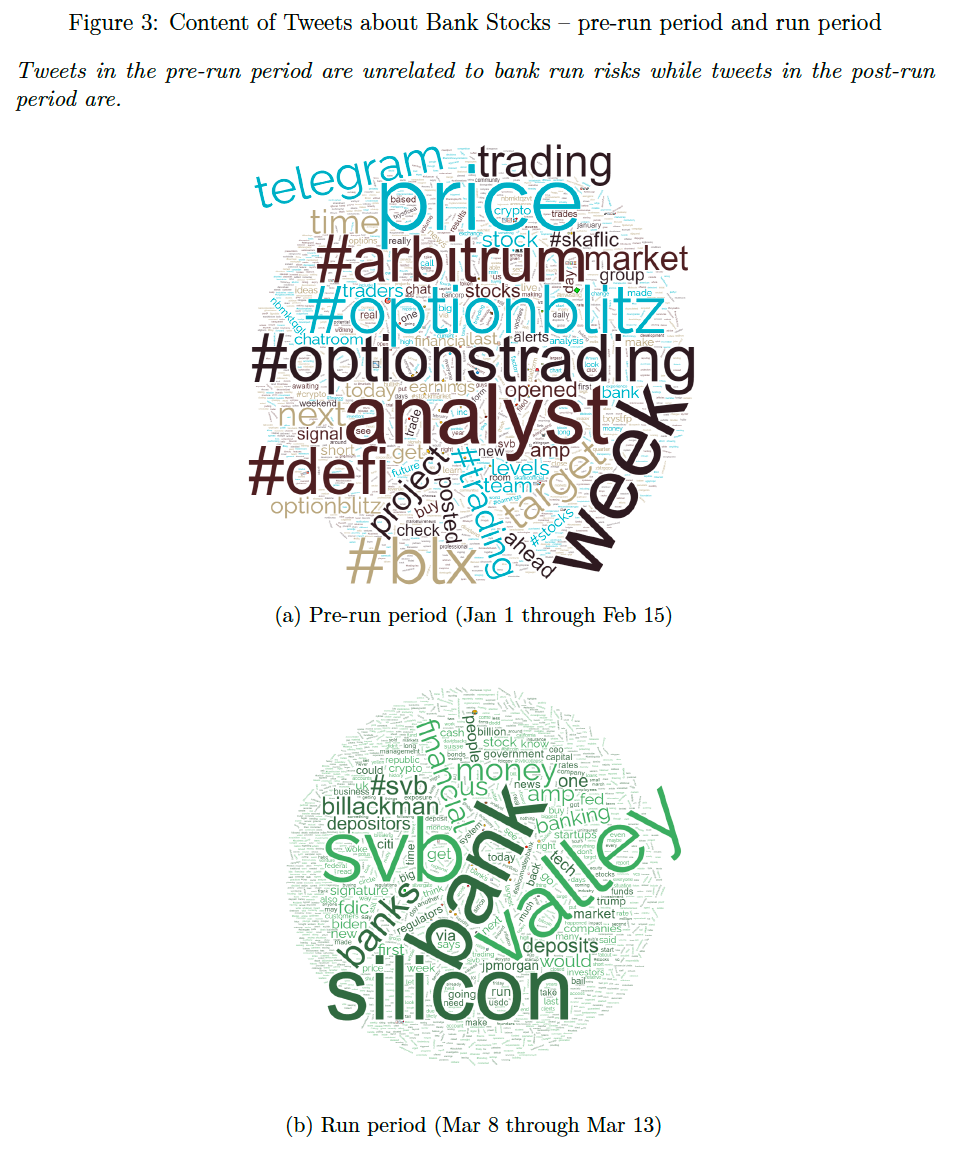

In the weeks following SVB's crash, the five researchers (opens in new tab) obtained and analyzed a set of all tweets segmented into two periods: the months leading up to the run, and during the bank run period from March 1 to 14. They filtered this data set further to include only tweets mentioning SVB and other banks relevant to the bank run study.

The researchers tracked whether tweets were positive or negative using a sentiment tracker called "VADER." They also flagged tweets that originated from members of the tech startup community.

Lastly, the authors separated banks into categories of "high bank-run risk" or "low bank-run risk," as determined by their mark-to-market losses and percentage of uninsured deposits.

Research findings

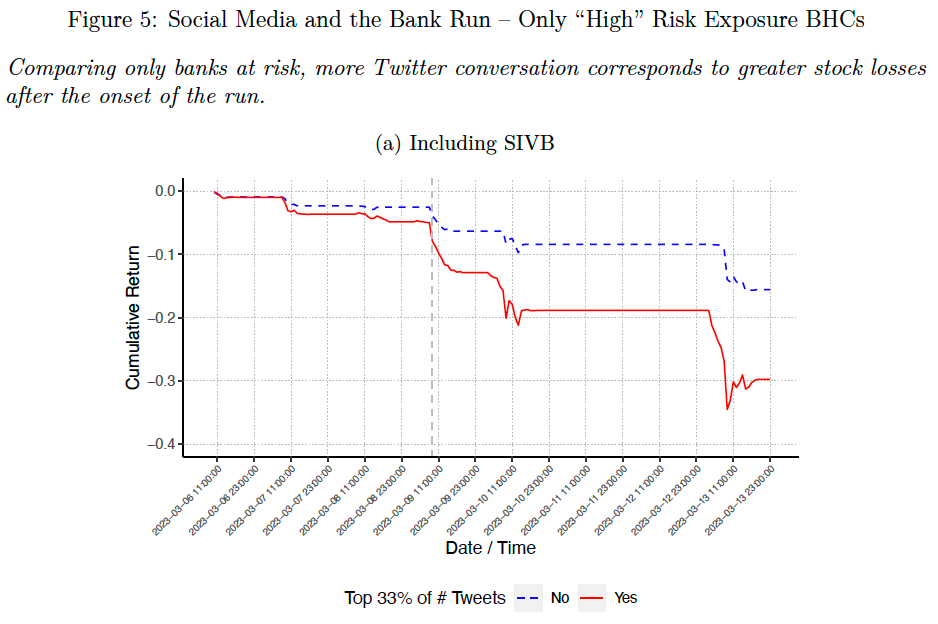

The researchers found that negative tweets during the run period had a negative effect on bank returns, even when you filter out other central factors of uninsured deposits and mark-to-market losses.

The authors further found that "the intensity of Twitter conversation about a bank predicts stock market losses at the hourly frequency," and even at intervals as rapid as 10 minutes before or after said conversation.

This effect is stronger, the researchers said, when the negative tweets came from users active in the startup scene, or when they include phrases like "contagion." The researchers said banks with more Twitter mentions in the months before experienced steeper stock losses during the bank run period.

These results are consistent with actual SVB depositors using Twitter to communicate in real time during the bank run. This type of coordination between depositors exacerbates bank run risk, but historically was much more difficult before Twitter and other large-scale social media networks grew into prominence.

The working paper's lead author J. Anthony Cookson told Kiplinger, "One aspect of our study is that we find that impact of social media is mostly confined to the banks with deposit risks. In an age of high and coordinated communication, the usual risks are riskier."

The researchers contend that many more banks could be susceptible to the same phenomenon, depending on their level of deposit risk, unrealized losses and online visibility.

In an age of high and coordinated communication, the usual risks are riskier.

Professor J. Anthony Cookson

Bottom line for banks, regulators and consumers

The researchers' findings on SVB's collapse once again demonstrate how the financial system is increasingly vulnerable to social media-driven volatility. We've seen similar episodes of Twitter and Reddit posts driving extreme swings in cryptocurrencies and stocks like GameStop, Bed Bath & Beyond and AMC.

Banks and regulators alike may be well served to monitor online sentiment to head off depositor panic during a crisis, either real or manufactured. Cookson told Kiplinger, "It can be helpful as an early warning to listen to Twitter conversation about your firm, whether you're a bank or not." Future panics may be mitigated with an early warning system to enable immediate action before hysteria and fear bubble over.

Banks might also be prudent to reduce their deposit risk by diversifying away from one single sector; SVB's heavy concentration in the startup space made it more vulnerable to coordination among panicked depositors. Banks could also consider adding downside protection in the form of derivatives whenever they make large, long-term bets, as suggested by NBER (opens in new tab).

For most banking customers, this issue is a moot point. The Federal Deposit Insurance Corporation (FDIC) insures bank deposits up to $250,000 per depositor account. Even depositors with balances above that limit affected by the SVB collapse were made whole, through a special FDIC emergency program funded by fees paid by every U.S. bank.

Still, consumers can further increase the safety of their deposits by spreading their savings across multiple accounts, so each account balance ideally fits under the $250,000 FDIC threshold.

Related Content

Ben Demers manages digital content and engagement at Kiplinger, informing readers through a range of personal finance articles, e-newsletters, social media, syndicated content, and videos. He is passionate about helping people lead their best lives through sound financial behavior, particularly saving money at home and avoiding scams and identity theft. Ben graduated with an M.P.S. from Georgetown University and a B.A. from Vassar College. He joined Kiplinger in May 2017.

-

-

How Bitcoin Mining Works and If It's Worth It

How Bitcoin Mining Works and If It's Worth ItBitcoin mining can be extremely lucrative, but it also comes with big risks. Here’s what you need to know.

By Guy Anker • Published

-

How to Find the Cheapest Home Insurance Policy

How to Find the Cheapest Home Insurance PolicyHomeowners insurance can help cover your home in the event of a burglary, fire or natural disaster and the following tips can help you score the cheapest policies.

By Erin Bendig • Published