Bed Bath & Beyond (BBBY): Will Earnings Spark This Meme Stock?

Our preview of the upcoming week's earnings reports includes Bed Bath & Beyond (BBBY), Micron (MU) and Walgreens (WBA)

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Will Bed Bath & Beyond (BBBY (opens in new tab), $30.25) be the belle of the meme-stock ball yet again?

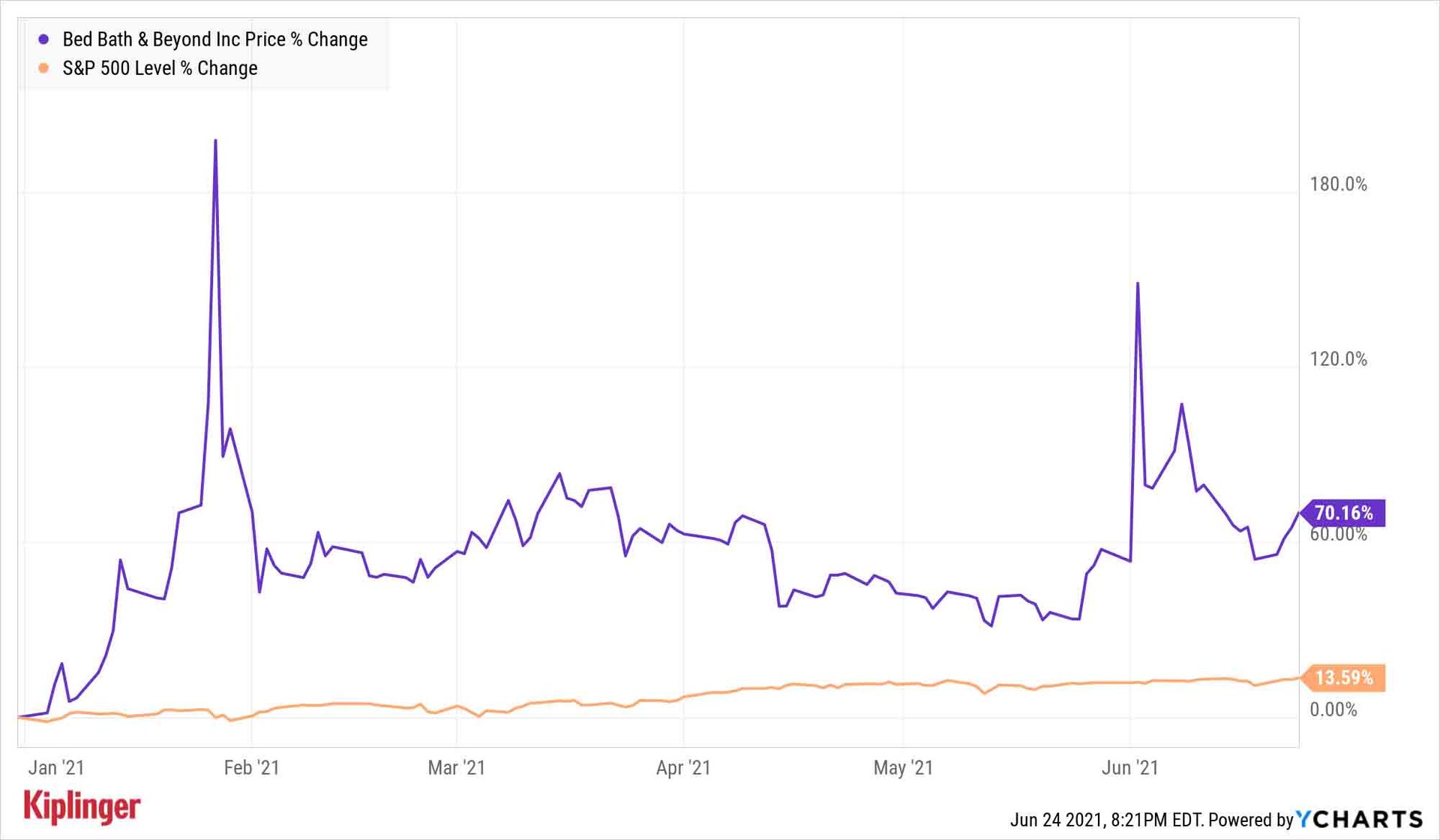

The troubled retailer takes the spotlight on the earnings calendar on June 30, and it does so by having one of its best first halves in recent memory ... at least on a share-price basis. BBBY stock is up 70% so far in 2021, though it has been a wild ride that has seen the stock double at a couple of points this year, and even triple.

Why the red-hot action in BBBY shares?

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In part, simply a better operational environment. An explosion in homebuying has meant good things for the home-furnishings retailer. And several new initiatives have given hope to investors that the struggling chain might possibly be on the verge of a real turnaround.

CFRA analyst Kenneth Leon recently upgraded shares to Hold from Sell, saying, "Our rating upgrade is based on our confidence management can execute major brand transformation that will accelerate the digital experience, ration stores by closing low demographic locations, remodel most stores, and bring on new stores all in the new store layout and website that showcases eight new brand product categories recently introduced."

But BBBY has also been caught up in the recent trend of day traders piling into heavily shorted stocks with the (often successful) goal of triggering short squeezes that send shares soaring.

Not everyone is hyped about BBBY, however.

UBS's Michael Lasser (Sell) notes the possibility that irons in the fire such as its branding campaign and private-label products could breathe life into Bed Bath. And he also thinks BBBY should make progress on things such as its supply chain and store remodels.

However, "While these initiatives should help over the LT, we believe the retailer will face stiff headwinds from consumers shifting wallet share away from home furnishings," Lasser says. "This will likely materialize as consumers head back to the office (data from Kastle shows that only 31.5% of workers have returned to the office)."

"When demand slows, discounting & promos will likely increase, offsetting some of the idiosyncratic potential that BBBY has," adds Lasser.

As far as Bed Bath's upcoming report: The pros are looking for a 34.9% year-over-year jump in revenue to $1.87 billion. That will fuel a swing from a loss of $1.96 per share in the year-ago quarter to an 8-cent-a-share profit.

Earnings Spotlight: Micron Technology

Micron Technology (MU (opens in new tab), $80.58) is a prime example of how easy year-over-year comparisons are already baked into share prices.

The chipmaker will report fiscal third-quarter earnings after the June 30 close. The pros, on average, are looking for $7.2 billion in revenues (+35.5% YoY) and earnings of $1.70 per share, or more than double the year-ago figure.

However, shares have rocketed 62% over the past year already, despite slowing-down over the past couple of months. At the same time, MU stock is underperforming the market, with just a 7% gain for the year-to-date -- and that's after investors digested a positive earnings pre-announcement just a few weeks ago.

"We don't expect many surprises with F3Q (May) results," says Deutsche Bank's Sidney Ho, who rates the stock at Buy. "We still think F4Q (Aug) guidance will point to solid sequential revenue and EPS growth on continued pricing strength, but we do note more mixed data points recently related to end market strength and pricing trends."

However, the analyst adds that in the near term, "investor sentiment on MU has turned more conservative, and hence we believe an in-line F4Q guide with DB estimates should be enough to lead MU's shares higher."

Earnings Spotlight: Walgreens Boots Alliance

Walgreens Boots Alliance (WBA (opens in new tab), $52.10), like many other stocks, enjoyed a robust rally to start the year but has since flattened out over the past couple months. To wit, WBA shares are up 30% so far in 2021 but are virtually breakeven since late March.

Will Walgreens' Thursday morning quarterly report inject some life back into shares?

Analysts appear to be all over the place on the subject. On average, they're looking for a 2.5% decline in revenues to $33.76 billion, but a 64.8% jump in profits to $1.17 per share. However, Argus Research analyst Christopher Graja points out that "there are a wide range of estimates from $0.80 to $1.35 for fiscal 3Q, which includes the months of March, April, and May." And his own estimate of $1.07 per share is below the consensus.

Even then, Graja, who has a Hold rating on shares, sees some reason for optimism.

"We like the company's emphasis on healthcare with the ramp-up of VillageMD primary care clinics and the sale of most of the former Wholesale division," he says. "We also think that Rosalind Brewer is a perfect pick as the company's new CEO."

Kyle Woodley is the Editor-in-Chief of Young and The Invested (opens in new tab), a site dedicated to improving the personal finances and financial literacy of parents and children. He also writes the weekly The Weekend Tea (opens in new tab) newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley (opens in new tab).

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published

-

Stock Market Today: Big Bank Earnings Fail to Lift Stocks

Stock Market Today: Big Bank Earnings Fail to Lift StocksThe major indexes closed lower Friday on hawkish Fed speak and dismal retail sales data.

By Karee Venema • Published

-

Stock Market Today: Stocks Climb After Promising PPI, Jobless Claims

Stock Market Today: Stocks Climb After Promising PPI, Jobless ClaimsThe major market indexes notched a win Thursday as wholesale prices unexpectedly fell and jobless claims hit their highest level in over a year.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After CPI, Fed Minutes

Stock Market Today: Stocks Struggle After CPI, Fed MinutesThe major indexes made modest moves after data showed a mixed picture on inflation and the Fed minutes hinted at another rate hike.

By Karee Venema • Published