GameStop: How WSB Beat Hedge Funds at Their Own Game

Short squeezes and stock mania are nothing new. But the Reddit community WallStreetBets (WSB) has put its own spin on an old formula via GME and other unloved stocks.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

The epically insane rise and fall and rise of shares in GameStop (GME (opens in new tab)) might look alarming to some folks, but long-term investors can rest easy. Online mobs from the subreddit r/wallstreetbets (WSB) are not coming for the stocks in their portfolios of blue-chip dividend payers.

But those mobs have claimed some wild gains, a "smart money" pelt or two, and for the moment, Wall Street's attention.

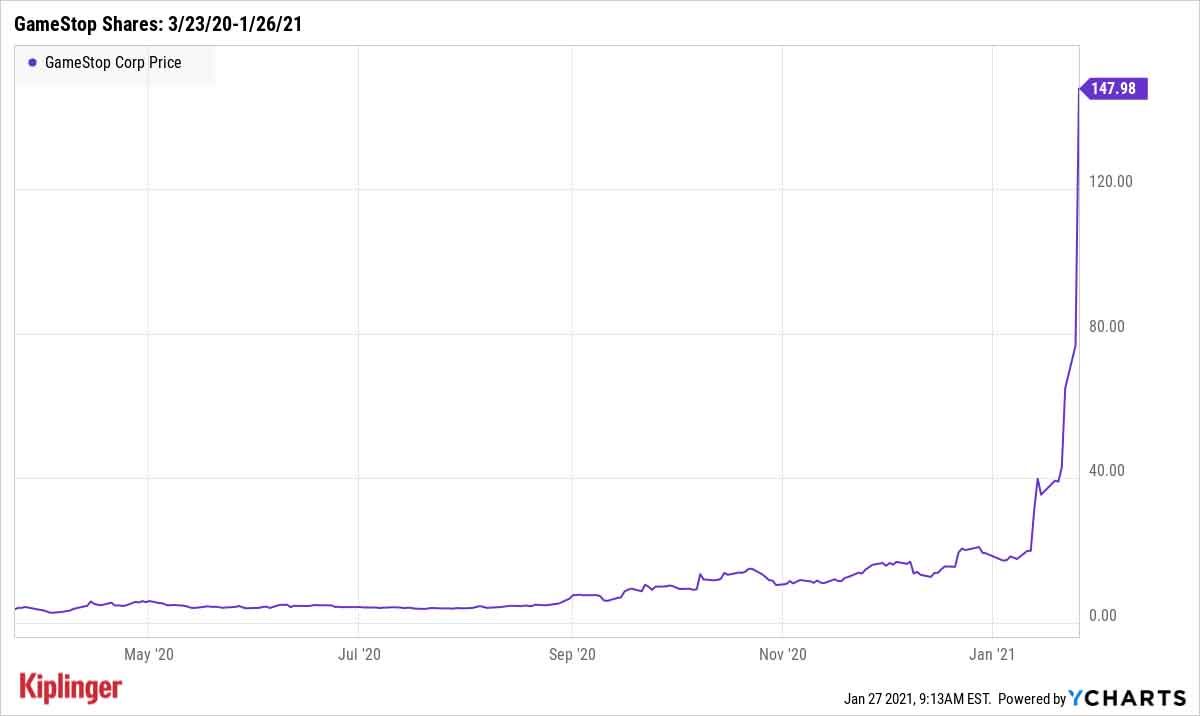

It's a story that centers around GameStop, a brick-and-mortar retailer of video games and consoles that has seen its shares go for as little as $2.57 per share in April to as much as $483 at one point in Jan. 28 trading. At those levels, GME has gained roughly 18,700% since the spring.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Heck, at those levels, GME shares have jumped almost 1,600% in the past month alone.

This GME rocket ride has been attributed to a somewhat convoluted combination of elements. But most notable among them is an aggressive group of traders from the WallStreetBets community on the Reddit social media platform.

A Retailer and Some WSB Redditors

First, there's GameStop itself.

The video game retailer hasn't made a profit in two years, and it has been in steady decline for even longer. As a physical retailer in a world where gamers buy and download games online, its prospects were dim enough. Then came the pandemic, which caused foot traffic at mall-based stores to collapse.

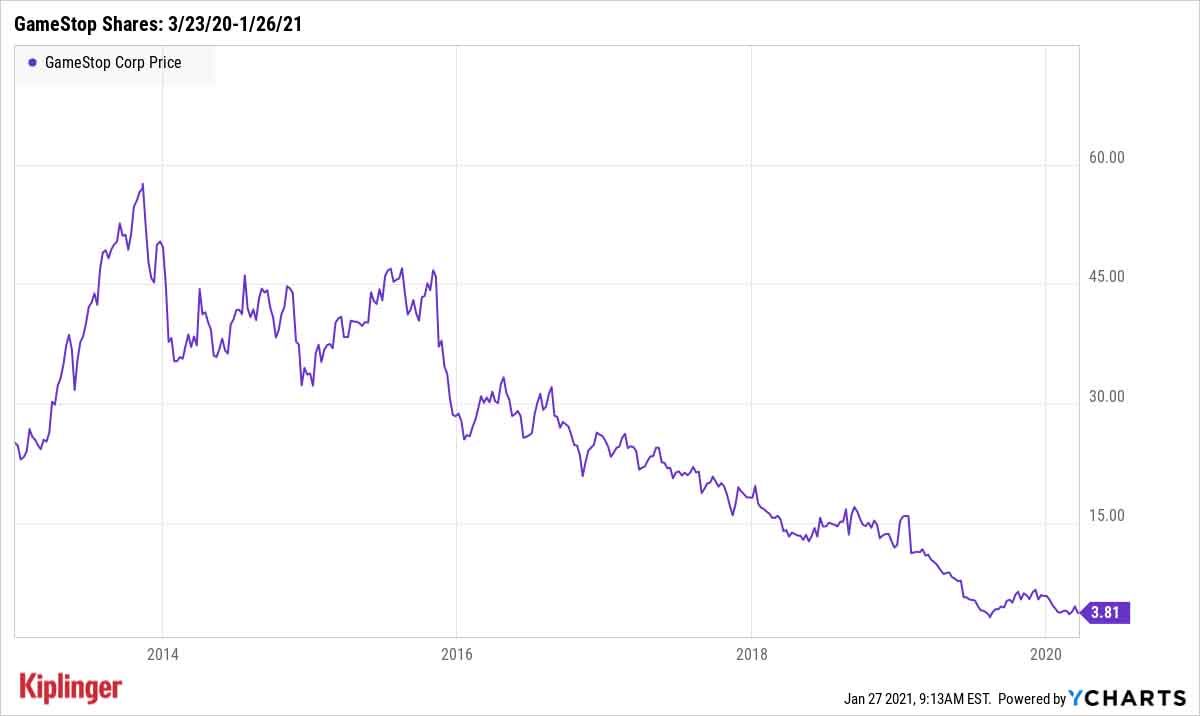

Between November 2013 and the March 2020's stock-market bottom, GME shares had lost 93% of their value.

GameStop looked like it was starting to circle the drain, and so it became an obvious target for short sellers who profit when a company's share price declines. In fact, it was so tempting a target that short interest in GME still exceeds its number of shares outstanding.

Heavily shorted GameStop also came to the attention of the hordes of mostly young, mostly male day traders who congregate at WallStreetBets. The online community of 6 million members likes to take wild gambles with their money. Jaime Rogozinski, who founded the WallStreetBets subreddit but has not been affiliated with it since last year, explained to Wired that WSB treats stock trading like a video game.

As with the message boards of the 1990s tech boom, WSB is a place to swap trade ideas, juvenile jokes, threats and insults. To get a sense of its self-concept, WSB bills itself as "4chan with a Bloomberg terminal."

Once WallStreetBets alighted on GameStop, it was more like a pit bull with a pork chop.

For the record, this isn't the first time WSB has singled out a stock for crazy hype. Lumber Liquidators (LL (opens in new tab)) and Plug Power (PLUG (opens in new tab)) have had price spikes in the past thanks to organized online buying. At this very moment, WallStreetBets is working to ignite short squeezes in AMC Entertainment (AMC (opens in new tab)), BlackBerry (BB (opens in new tab)) and Nokia (NOK (opens in new tab)), among others.

But nothing, so far, has taken off like GameStop.

"It was a meme stock that really blew up," a WallStreetBets moderator told Wired. "The massive short contributed more toward the meme stock." (A meme stock is essentially a cult stock.)

WallStreetBets Wages War on the "Smart Money"

It's fair to assume that plenty of GME buyers are just looking to make a fast buck. What's striking in this case, however, is how many of them are trying to send a message. A number of WSB traders are openly motivated by a desire to profit at the expense of "The Man": the rich hedge funds and other institutional investors on the other side of the trade. Separating hedge funds from their money – the 99% against the 1% – by sticking up for shorted stocks such as GameStop is a stated goal.

In others words, for some traders, Robinhood isn't just a cute brand name for a trading app – it's an ethos. Others are no doubt just bored from being cooped up inside because of the pandemic. Either way, frictionless trading enabled by new technology and fee-less trades helps the WallStreetBets community stick it to "the shorts."

Here's how the mechanics work:

- A short seller borrows shares from a broker.

- The short seller then sells those shares.

- They then wait for the stock's price to fall.

- They buy the stock back to return to the lender – ideally, at a lower price than they sold.

Note well that short selling is incompatible with the principles of long-term investing, which by definition doesn't rapidly churn positions and take on excessive risk.

Make no mistake, short selling is loaded with risk. It exposes a trader to theoretically infinite losses.

If you're long on a stock, the most you can lose is 100% of your investment. Regardless of what you paid for it, a stock's price can't fall below zero.

But when you short a stock and it rises, there is no limit to how high it can go. When traders make short sales, their brokers demand a margin payment, which is taken from their accounts to offset potential losses. As the stock's price rises, the short seller's losses grow, and the broker requires ever more margin payments.

In the case of a short squeeze, short sellers are forced to panic-buy a stock so they can return it to their lenders before margin calls make them go broke. The buying pressure forces the stock price up even farther, leading to even more panic-buying from short sellers trying to cover their trades.

WSB realized that if they bought en masse, they could deal a blow to the "smart money" shorting GameStop stock. The subreddit's short-squeeze strategy has claimed at least one pelt so far. Melvin Capital, one of GME's most prominent shorts, was forced to take a $2.75 billion bailout from a couple of other hedge funds. Well known short seller Andrew Left said Jan. 27 that his Citron Research had covered the majority of its short position at a 100% loss, but it still maintains a small position.

However, while WallStreetBets has claimed both money and victories, very little of this has so far led to meaningful support for the actual underlying company, GameStop.

"GameStop has become a cult stock because of Ryan Cohen's success with Chewy," Wedbush Securities analyst Michael Pachter wrote in a note to clients. Cohen, co-founder and former CEO of pet e-commerce site Chewy (CHWY (opens in new tab)), has amassed a large stake in GameStop over the past six months via his RC Ventures firm and recently gained three seats on GME's board of directors.

"I cannot discount Mr. Cohen's past successes and don't know what he has in mind going forward, but I need to see their strategy before I give them credit for materially higher earnings power," Pachter says.

That raises the very real prospects for a painful lurch back to reality for new GME shareholders once the squeeze is exhausted and WSB's attention drifts elsewhere. Even this morning, AMC appears to be the new rage d'jour.

Meanwhile, BofA Securities on Jan. 27 raised its price target on GameStop from $1.60 per share to $10.

GME closed Jan. 26 trading at $147.98.

WSB: A New Twist on an Old Theme

Whether they come from irreverent posts on Reddit, the message boards and unsolicited faxes of the '90s, or the proverbial shoeshine boy, there have always been dubious hot stock tips.

"There is nothing new in Wall Street," Jesse Livermore said almost a century ago. "There can't be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again."

Take it from Livermore, one of the godfathers of day trading. He was once considered the greatest trader in the world, making and losing several fortunes over the course of his career. At one point, he was one of the richest men on the planet.

They didn't have trading apps and Reddit back in Livermore's day, but he would recognize immediately the herd behavior, irrationality and greed fueling today's melodrama in GME stock.

That's why long-term investors turn their backs on such shenanigans. They know there's a level of safety with larger, healthier companies. It's important to note that GameStop had a market value of less than $200 million in early April, and has a relatively small 69.8 million shares outstanding. Even now GME accounts for just $22.7 billion of the stock market's total value.

It's one thing to pump a tiny microcap stock supported by a limited number of shares. It's quite another for WSB to try to move, say, Apple (AAPL (opens in new tab)), which is worth more than $2 trillion and has 16.8 billion shares outstanding.

Although it's easy for investors to remain insulated from this trading madness, it is disconcerting nonetheless. As New York Times tech columnist Kevin Roose tweeted on Monday: "We've been through a lot this year, but nothing emotionally prepared me for the prepubescent kid who announced in Valorant team chat that he made $15,000 today trading Gamestop on his brother's Robinhood account." (Valorant is a multiplayer online game.)

Serious investors who rely on fundamentals, valuations and diversification to allocate capital wisely have nothing new to learn from this episode.

But they do have plenty to watch from the sidelines.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Are You Guilty of Financial Infidelity?

Are You Guilty of Financial Infidelity?Nearly one in four Americans are keeping money-related secrets from their partners.

By Emma Patch • Published

-

IRS Service Improvements Could Bring Faster Tax Refunds

IRS Service Improvements Could Bring Faster Tax RefundsRecent IRS improvements mean taxpayers could see faster tax refunds next year and beyond.

By Katelyn Washington • Published

-

Stock Market Today: UPS, First Republic Earnings Drag on Stocks

Stock Market Today: UPS, First Republic Earnings Drag on StocksDismal guidance from logistics giant UPS and dreary deposit data from regional lender First Republic kept a lid on the major indexes Tuesday.

By Karee Venema • Published

-

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have TodayMicrosoft Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

By Dan Burrows • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published