The 9 Best Monthly Dividend Stocks to Buy Right Now

Your bills come monthly. Why not your dividend checks? These are some of the best monthly dividend stocks for 2023 income planning.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Monthly dividend stocks are a game-changer for income investors.

For all the changes we've experienced in recent years, some things remain regrettably the same. We all have bills to pay, and those bills generally come monthly. Whether it's your mortgage, your car payment or even your regular phone and utility bills, you're generally expected to pay every month.

While we're in our working years, that's not necessarily a problem, as paychecks generally come every two weeks. And even for those in retirement, Social Security and (if you're lucky enough to have one) pension payments also come on a regular monthly schedule. But unfortunately, it doesn't work that way in our investment portfolios.

And that's where monthly dividend stocks come into play.

Dividend stocks generally pay quarterly, and most bonds pay semiannually, or twice per year. This has a way of making portfolio income lumpy, as dividend and interest payments often come in clusters.

Well, monthly dividend stocks can help smooth out that income stream and better align your inflows with your outflows.

"We'd never recommend buying a stock purely because it has a monthly dividend," says Rachel Klinger, president of McCann Wealth Strategies, an investment adviser based in State College, Pennsylvania. "But monthly dividend stocks can be a nice addition to a portfolio and can add a little regularity to an investor's income stream."

Today, we're going to look at 9 of the best monthly dividend stocks to buy for 2023. You'll see some similarities across the selections. That's because monthly dividend stocks tend to be concentrated in a small handful of sectors such as real estate investment trusts (REITs) and business development companies (BDCs). These sectors tend to be more income-focused than growth-focused and sport yields that are vastly higher than the market average.

But in a market where the yield on the S&P 500 is currently 1.7%, that's certainly welcome.

The list isn't particularly diversified, so it doesn't make a complete portfolio. In other words, you don't want to overload on monthly dividend stocks. But they do allow exposure to a handful of niche sectors that add some income stability, so take a look and see if any of these monthly payers align with your investment style.

Data is as of Dec. 5. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Realty Income

- Market value: $39.0 billion

- Dividend yield: 4.7%

Perhaps no stock in history has been more associated with monthly dividends than conservative triple-net retail REIT Realty Income (O (opens in new tab), $62.24). The company went so far as to trademark the "The Monthly Dividend Company" as its official nickname.

Realty Income is a stock, of course, and its share price can be just as volatile as any other equity. But it's still as close to a bond as you're going to get in the stock market in terms of the safety and reliability of its payout. It has stable recurring rental cash flows from its empire of more than 11,700 properties spread across over 1,100 different tenants in nearly 80 separate industries throughout all 50 states, as well as Puerto Rico, the U.K. and Spain.

O focuses on high-traffic retail properties that are generally recession-proof and, perhaps more importantly, "Amazon.com-proof." Perhaps no business is completely free of risk of competition from Amazon.com (AMZN (opens in new tab)) and other e-commerce titans, but Realty Income comes close.

Its largest tenants include 7-Eleven, Dollar General (DG (opens in new tab)), and Lowe's (LOW (opens in new tab)), among others. More than a quarter of the portfolio is in grocery stores, dollar stores and convenience stores, all of which tend to be pretty recession-proof or in some cases actually benefit from trading down in a recession. That’s good because, with the yield curve inverted as it was for much of 2022, a recession in 2023 is a real possibility.

At current prices, Realty Income yields 4.7%. That's not a monster windfall, but it's much more than both the broader market, as well as 10-year Treasuries, with the latter yielding 3.5%.

It's not the raw yield we're looking for here, but rather income consistency and growth. As of this writing, Realty Income has made 629 consecutive monthly dividend payments and has raised its dividend for 100 consecutive quarters – making it a proud member of the S&P 500 Dividend Aristocrats.

Since going public in 1994, Realty Income has grown its dividend at a compound annual growth rate of 4.4%. While that's below the rate of inflation today, it's well ahead of inflation over the duration of that period. And regardless of whether the Fed manages to get inflation under control any time soon, Realty Income's history suggests it should be able to keep its dividend growth rate ahead of inflation.

Stag Industrial

- Market value: $5.9 billion

- Dividend yield: 4.4%

Realty Income is pretty darn close to "Amazon.com-proof," but fellow monthly dividend payer Stag Industrial (STAG (opens in new tab), $32.34) proactively benefits from the rise of internet commerce.

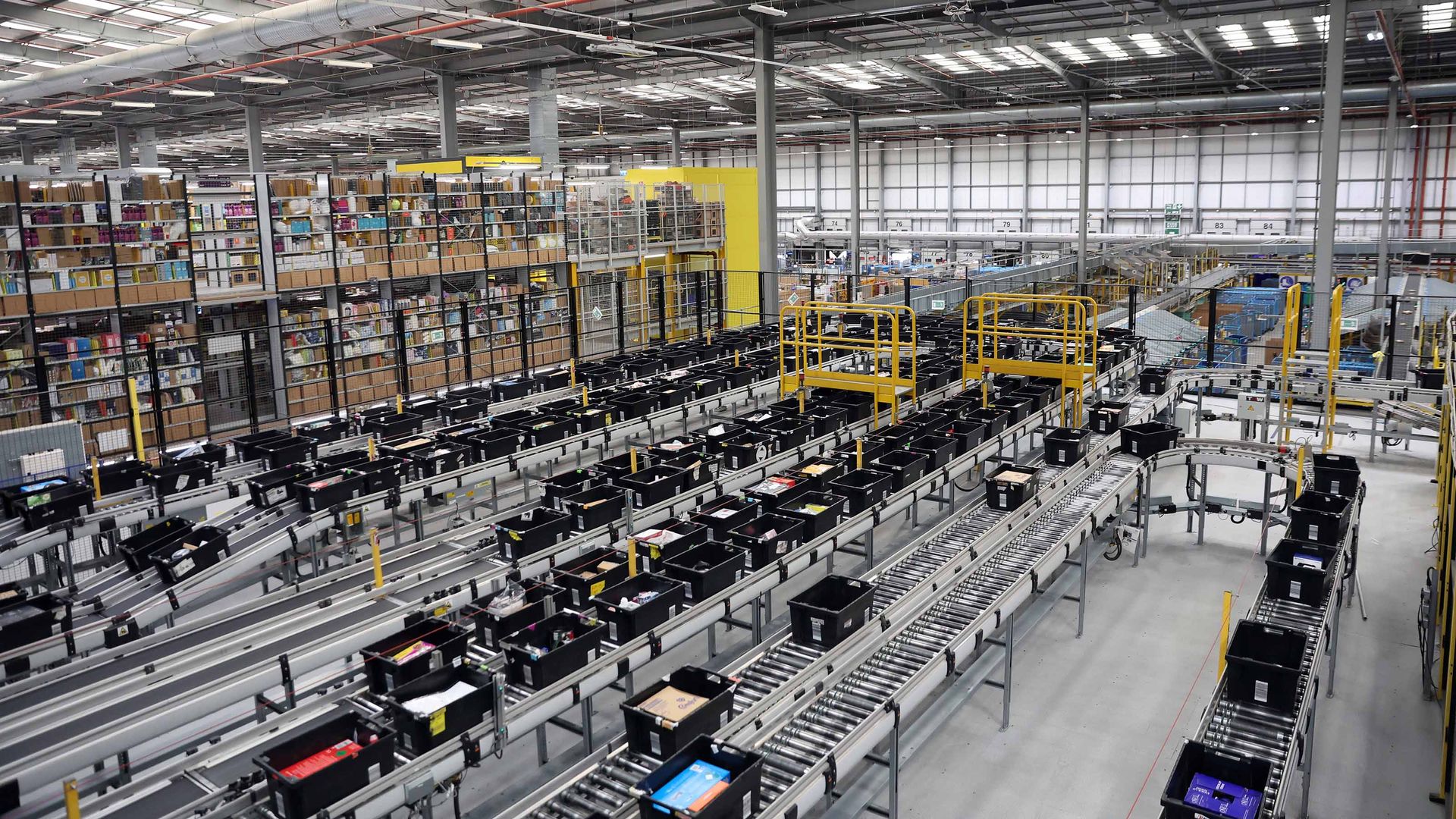

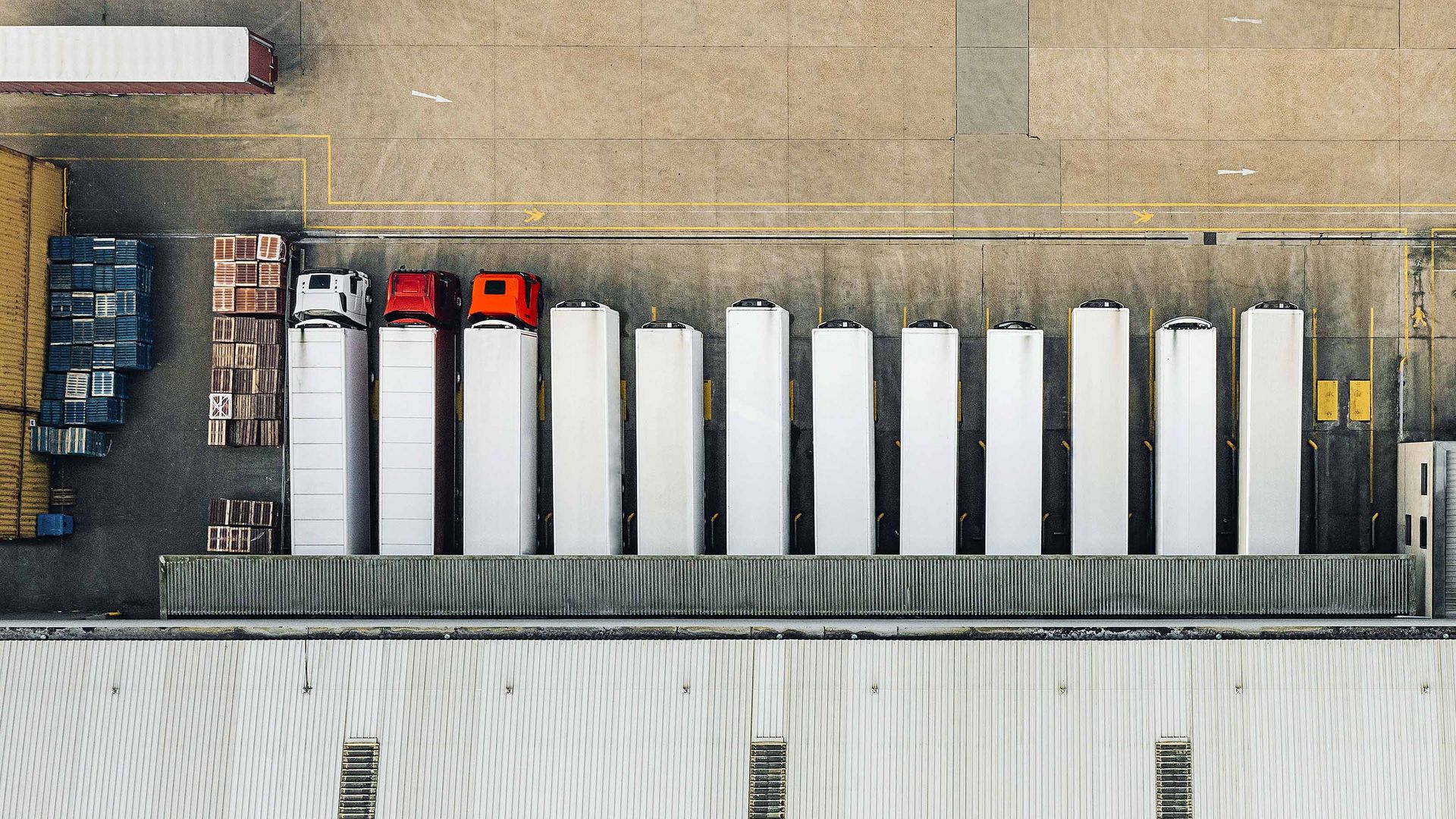

STAG invests in logistics and light industrial properties. You know those gritty warehouse properties you might see near the airport with 18-wheelers constantly coming and going? That's exactly the kind of property that Stag Industrial buys and holds.

It's a foregone conclusion that e-commerce is growing by leaps and bounds, and STAG is positioned to profit from it. Roughly 40% of Stag Industrial's portfolio handles e-commerce fulfillment or other activity. In fact, Amazon.com is STAG's largest tenant.

E-commerce spiked during the pandemic for obvious reasons. And while stores have reopened over the past two years, the effects of that initial spike have dissipated somewhat. Still, the trend toward e-commerce is clear – and likely to stick around. We're making a larger percentage of our purchases online, and that trend only goes one direction.

However, there's still plenty of room for growth. As crazy as this might sound, fewer than 15% of retail sales are made online, according to the U.S. Census Bureau. Furthermore, the logistical space is highly fragmented, and Stag's management estimates the value of their market to be around $1 trillion. In other words, it's unlikely STAG will be running out of opportunities any time soon.

Stag Industrial isn't sexy. But it's one of the best monthly dividend stocks to buy for 2023, with plenty of growth in front of it. And its 4%-plus yield is competitive in this market.

Gladstone Commercial

- Market value: $755.4 million

- Dividend yield: 8.1%

For another gritty industrial play, consider the shares of Gladstone Commercial (GOOD (opens in new tab), $18.74). Gladstone Commercial, like STAG, has a large portfolio of logistical and light industrial properties. Approximately 54% of its rental revenues come from industrial properties, with another 42% coming from office real estate. The remaining 4% is split between retail properties (3%) and medical offices (1%).

Such a diversified portfolio has had little difficulty navigating the crazy volatility of the past few years. As of Sept. 30, 2022, the REIT had a portfolio of 137 properties spread across 27 states and leased to 112 distinct tenants. GOOD has grown its portfolio 15% per year in a consistent, disciplined manner since 2012. Its occupancy stands at 97.0% and has never dipped below 95.0%. Its largest tenant makes up only 4% of its portfolio, and nearly half of its tenants are publicly traded companies.

That's not a bad run.

Gladstone Commercial has also been one of the most consistent monthly dividend stocks, paying one uninterrupted since January 2005. What's more, GOOD currently yields a juicy 8%.

EPR Properties

- Market value: $3.1 billion

- Dividend yield: 8.1%

2022 was a year of adjustments. It was painful in the stock market, as we had to contend with a normalization of monetary policy by the Fed and the elimination of a lot of pandemic-era aid. But it also brought a lot of normality back to our lives. And as we get ready to enter 2023, that should be positive for EPR Properties (EP (opens in new tab)R, $40.69). EPR owns a diverse and eclectic portfolio of movie theaters, amusement parks, ski parks, "eat and play" properties like Topgolf, and a host of others.

EPR specializes in experiences over things, which should be a major tailwind in 2023. We gorged ourselves on "stuff" during the pandemic. But what we've often done without are experiences with friends, family and coworkers. And the more we reintroduce these things into our lives, the more EPR's tenants stand to benefit.

The company was a consistent dividend payer and raiser pre-pandemic. But with its tenants facing an existential crisis, EPR eliminated its dividend in 2020. That cut was short-lived, however, and the REIT reinstated its monthly dividend in July 2021, and then raised it in March 2022. The shares now yield an attractive 8.1%.

EPR is not without its risks. We may be entering a recession, and when times get tough, discretionary spending often takes a hit. Inflation doesn't help on that front either, nor does the tight labor market, which makes it difficult to find help. And EPR has a large allocation to movie theater properties, and movies have been slow to bounce back to pre-COVID levels.

Still, if you’re willing to take a modest amount of risk, EPR is a nice potential turnaround play with an attractive yield and the potential for significant dividend growth in the years ahead.

LTC Properties

- Market value: $1.6 billion

- Dividend yield: 5.7%

For one final "traditional" REIT, consider the shares of LTC Properties (LTC (opens in new tab), $38.56).

LTC is a REIT with a portfolio roughly split equally between senior living properties and skilled nursing facilities. Obviously, the REIT's tenants had a hard time during the pandemic, as the heightened risks dampened enthusiasm for senior living and nursing homes. And the national labor shortage has only added fuel to the fire. It may be a while before the industry returns to full pre-pandemic health. But the long-term demographic trends here are just about unstoppable, and LTC is an attractive turnaround play in 2023.

Senior living properties face less pressure from the labor shortage and lingering virus fears in that the tenants are generally younger and live independently without medical care. They also offer an attractive, active lifestyle for many seniors, and that hasn't fundamentally changed. With the bulk of the Baby Boomers now retired empty nesters, the investment case for senior living properties essentially makes itself.

Skilled nursing may take a little longer to fully recover. Home care might be a viable option for many seniors who need assistance but either can't afford or who are reluctant to live in a nursing home. But ultimately, there comes a point where there are few alternatives to the care of a nursing home.

Importantly, the longer-term demographic trends here are supportive of growth in LTC. The peak of the Baby Boomer generation is in its early to mid-60s today – far too young to need long-term care. But over the course of the next two decades, demand will continue to build as more and more boomers age into the need for these services.

And at 5.7%, LTC is one of the higher-yielding monthly dividend stocks on this list.

AGNC Investment

- Market value: $5.6 billion

- Dividend yield: 14.8%

AGNC Investment (AGNC (opens in new tab), $9.82) is a REIT, strictly speaking, but it's very different from the likes of Realty Income, STAG or any of the others covered on this list of monthly dividend stocks. Rather than own properties, AGNC owns a portfolio of mortgage securities. This gives it the same tax benefits of a REIT – no federal income taxes so long as the company distributes at least 90% of its net income as dividends – but a very different return profile.

Mortgage REITs (mREITs) are designed to be income vehicles, with capital gains not really much of a priority. As such, they tend to be monster yielders. Case in point: AGNC yields 14.8%.

Say "AGNC" out loud. It sounds a lot like "agency," right?

There's a reason for that. AGNC invests exclusively in agency mortgage-backed securities, meaning bonds and other securities issued by Fannie Mae, Freddie Mac, Ginnie Mae or the Federal Home Loan Banks. This makes it one of the safest plays in this space.

The sudden spike in interest rates in 2022 wreaked havoc on a lot of income investments, particularly mortgage REITs like AGNC. But the stock appears to have bottomed out in October and has been trending higher ever since.

Unlike equity REITs, which are backed by real properties, mortgage REITs really are at the mercy of market yields. If the yield curve remains inverted for much longer, AGNC might be at risk of a dividend cut. Dividend cuts are common in this space. Still, with a yield of almost 15%, AGNC could trim back its payout and still sport a very competitive yield.

Dynex Capital

- Market value: $597.58 million

- Dividend yield: 11.9%

Along the same lines, let's look at Dynex Capital (DX (opens in new tab), $12.89). Like AGNC, Dynex is a mortgage REIT. Approximately 94% of its portfolio is invested in agency residential mortgage-backed securities (MBSes) – bonds made out of the mortgages of ordinary Americans – but it also has exposure to commercial mortgage-backed securities (CMBSes) and a small allocation to non-agency securities.

It's important to remember that the past several years have been a roller coaster for the mortgage REIT sector. In the upheavals of the pandemic, many mortgage REITs took catastrophic losses and some failed altogether.

Dynex is one of the survivors. And frankly, any mortgage REIT that could survive the chaos in the bond markets of recent years is one that can likely survive the apocalypse.

Dynex trades at a 11% discount to book value and sports a juicy yield of nearly 12%. We could see some more volatility in the space as the Federal Reserve continues to push rates higher, but for now, this looks like one of the best monthly dividend stocks to buy if you're looking for seriously high yield.

Main Street Capital

- Market value: $2.9 billion

- Dividend yield: 7.1%

Business development companies (BDCs) are where the proverbial Main Street means the proverbial Wall Street. BDCs provide debt and equity capital mostly to middle-market companies. These are entities that have gotten a little big to get financing from bank loans and retained earnings, but aren't quite big enough yet to warrant an initial public offering (IPO).

BDCs exist to bridge that gap.

The appropriately named Main Street Capital (MAIN (opens in new tab), $37.49) is a best-in-class BDC based in Houston, Texas. Like some of the stocks on this list, Main Street is something of a turnaround play. The last two years were not particularly easy for MAIN's portfolio companies, as many smaller firms were less able to navigate the lockdowns than their larger peers. But the company persevered, and today it is stronger than ever.

Main Street has a conservative monthly dividend model in that it pays a relatively modest monthly dividend, but then uses any excess earnings to issue special dividends twice per year. This keeps MAIN out of trouble and prevents it from suffering the embarrassment of a dividend cut in years where earnings might be temporarily depressed.

As far as monthly dividend stocks go, Main Street's regular payout works out to a respectable 7.1%, and this does not include the special dividends. Main Street raised its monthly dividend earlier this year and managed to throw in an additional 17 cents per share in special dividends. A recession might slow down additional growth and special dividends for a few quarters, but don’t expect it to slow Main Street down for long!

Prospect Capital

- Market value: $3.0 billion

- Dividend yield: 9.3%

For another high-yielding, monthly paying BDC, consider the shares of Prospect Capital (PSEC (opens in new tab), $7.43).

Like most BDCs, Prospect Capital provides debt and equity financing to middle-market companies. PSEC has been publicly traded since 2004, so it has proven to be a survivor in what has been a wildly volatile two decades.

Prospect Capital is objectively cheap, as it trades at just 77% of book value. Book value itself can be somewhat subjective, of course, but the 23% gives us a good degree of wiggle room. It's safe to say the company, even under conservative assumptions, is selling for less than the value of its underlying portfolio. It also yields a very healthy 9%-plus.

As a general rule, insider buying is a good sign. When the management team is using its own money to buy shares, that shows a commitment to the company and an alignment of interests. Well, over the course of the past two years, the management team bought more than 31 million PSEC shares combined. These weren't stock options or executive stock grants. These are shares that the insiders bought themselves in their brokerage accounts. Today, CEO John Barry owns a whopping 69 million shares.

That's commitment.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

-

IRS Service Improvements Could Bring Faster Tax Refunds

IRS Service Improvements Could Bring Faster Tax RefundsRecent IRS improvements mean taxpayers could see faster tax refunds next year and beyond.

By Katelyn Washington • Published

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

22 Best Retirement Stocks for an Income-Rich 2022

22 Best Retirement Stocks for an Income-Rich 2022dividend stocks Ideally, your retirement stocks will help you generate a sizable and reliable income stream. These 22 dividend payers make the grade.

By Brian Bollinger • Published

-

10 High-Quality Stocks With Dividend Yields of 4% or More

10 High-Quality Stocks With Dividend Yields of 4% or Moredividend stocks There's no shortage of stocks with dividends these days, but not all of them are worth chasing. Here's a list of top-rated, high-yielding names to consider.

By Dan Burrows • Published

-

A Comeback for Dividends

A Comeback for DividendsInvesting for Income The biggest hikes in the Kiplinger Dividend 15 were 10% increases from Home Depot and Procter & Gamble.

By Adam Shell • Published

-

20 Best Stocks to Buy for the Joe Biden Presidency

20 Best Stocks to Buy for the Joe Biden Presidencystocks to buy We examine 20 of the best stocks to buy to take advantage of President Joe Biden's existing and expected policy initiatives.

By Charles Lewis Sizemore, CFA • Published

-

25 Dividend Stocks the Analysts Love Most for 2021

25 Dividend Stocks the Analysts Love Most for 2021Kiplinger's Investing Outlook Income investors looking for more than just a little yield: These are the top dividend stocks for 2021, according to the pros.

By Dan Burrows • Published

-

7 Safe High-Yield Dividend Stocks Delivering 4% or More

7 Safe High-Yield Dividend Stocks Delivering 4% or Moredividend stocks These seven high-yield dividend stocks have sturdy foundations, according to the DIVCON dividend-health rating system and Wall Street experts.

By Dan Burrows • Published

-

20 Dividend Stocks to Fund 20 Years of Retirement

20 Dividend Stocks to Fund 20 Years of Retirementdividend stocks Each of these high-quality dividend stocks boast attractive yields, and you can expect them to grow their payouts even more. That's a powerful 1-2 combo for retirement income.

By Brian Bollinger • Published

-

The Kiplinger Dividend 15: Our Favorite Dividend-Paying Stocks

The Kiplinger Dividend 15: Our Favorite Dividend-Paying Stocksdividend stocks All of our favorite dividend stocks hiked payouts over the past year, and yields, on average, trounced the yield of the S&P 500.

By Adam Shell • Published