TIAA-CREF Real Estate Securities Rides High on a Hot Market

This fund currently favors single family home rentals and data centers.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

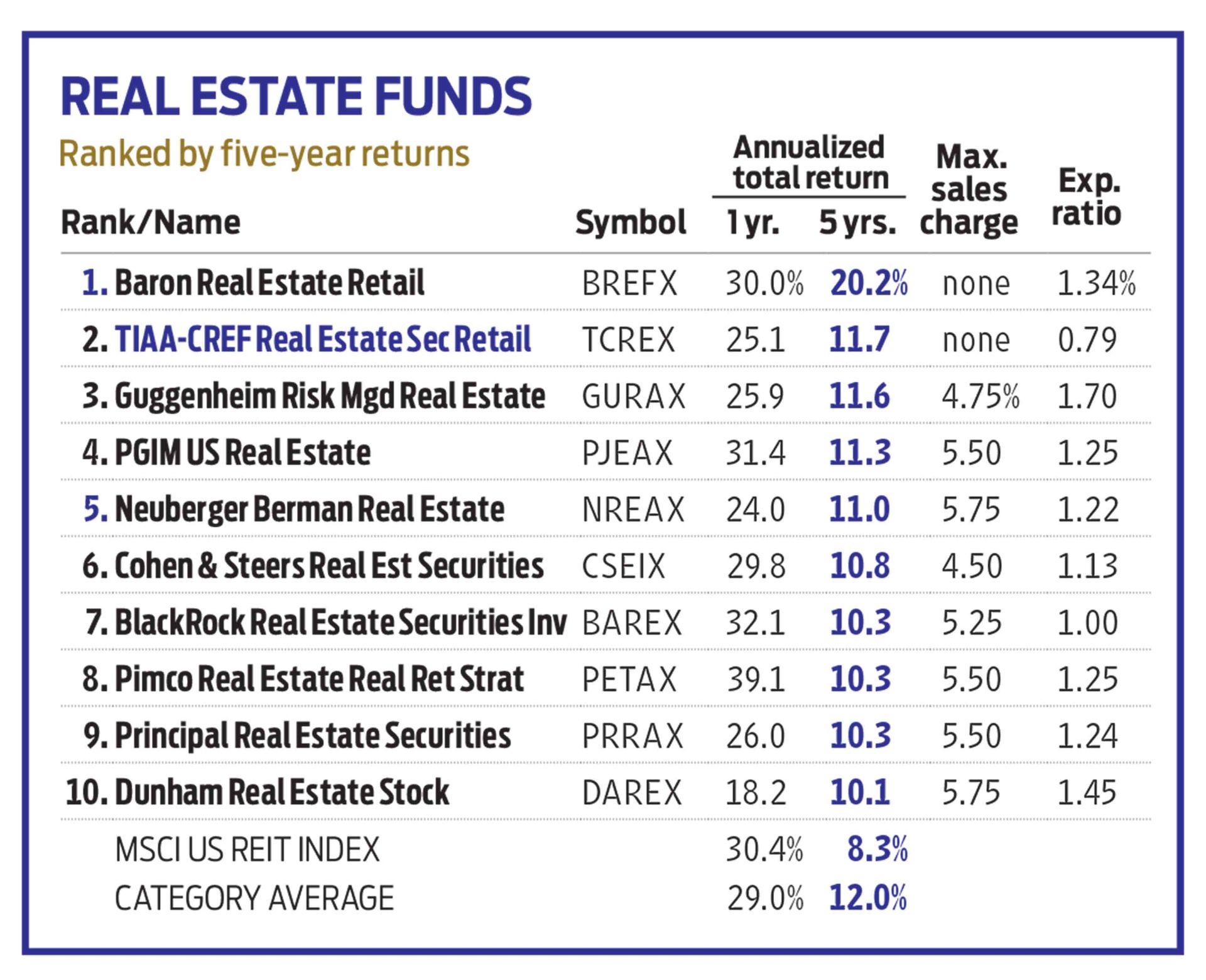

Real estate stocks have been on a roll. Over the past 12 months, the MSCI US REIT index gained 30.4%, which beat the 29.3% return of the S&P 500. REITs trade like stocks, but like bonds, are sensitive to interest rate swings, especially over the short term. That has been a boon to real estate securities as the stock market has soared and interest rates have stayed low. (Rates and bond prices tend to move in opposite directions.)

Will rising rates end the good times for REITs? Over the medium to long term, that’s not likely, say David Copp and Brendan Lee, managers of TIAA-CREF Real Estate Securities (symbol T (opens in new tab)CREX (opens in new tab)). That’s because rates tend to rise when the economy is doing well, says Copp, and “a strong economy is better for real estate than higher rates are bad, because revenue is growing faster than interest expenses are rising.”

Copp and Lee own a diversified portfolio of REITs and real estate securities, including real estate brokers and developers, homebuilders, property-management companies, and financial firms that make or service mortgage loans. “We’re not focused on the highest dividend payers,” says Lee. Instead, the team homes in on investments “that we think will experience the best growth in underlying cash flow and generate the highest price appreciation.” Top holdings include wireless communications infrastructure company American Tower, and Prologis, a logistics-focused real estate firm and member of the new Kiplinger ESG 20 (opens in new tab), which includes our favorite environmentally focused stocks.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Copp and Lee aren’t afraid to buy in weak subsectors if the price is right, as their stake in Simon Property Group, the largest owner of shopping malls, illustrates. Over the past year, retail REITs “were priced like people were never going to shop at malls anymore, and that’s simply not the case,” says Lee. Lately, the managers have favored firms benefiting from the economic reopening, especially apartments and regional malls. As those investments gained in recent months, they took some profits and redeployed the cash into single-family home rentals and data centers.

Over the past three years, the fund’s annualized return of 15.5% beat 90% of its peers.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published

-

Stock Market Today: Big Bank Earnings Fail to Lift Stocks

Stock Market Today: Big Bank Earnings Fail to Lift StocksThe major indexes closed lower Friday on hawkish Fed speak and dismal retail sales data.

By Karee Venema • Published

-

Stock Market Today: Stocks Climb After Promising PPI, Jobless Claims

Stock Market Today: Stocks Climb After Promising PPI, Jobless ClaimsThe major market indexes notched a win Thursday as wholesale prices unexpectedly fell and jobless claims hit their highest level in over a year.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After CPI, Fed Minutes

Stock Market Today: Stocks Struggle After CPI, Fed MinutesThe major indexes made modest moves after data showed a mixed picture on inflation and the Fed minutes hinted at another rate hike.

By Karee Venema • Published