Executive summary

Decarbonization, decentralization, and digitization are compelling utilities to evolve faster than ever before. So, how are they responding to this new, three-dimensional challenge?

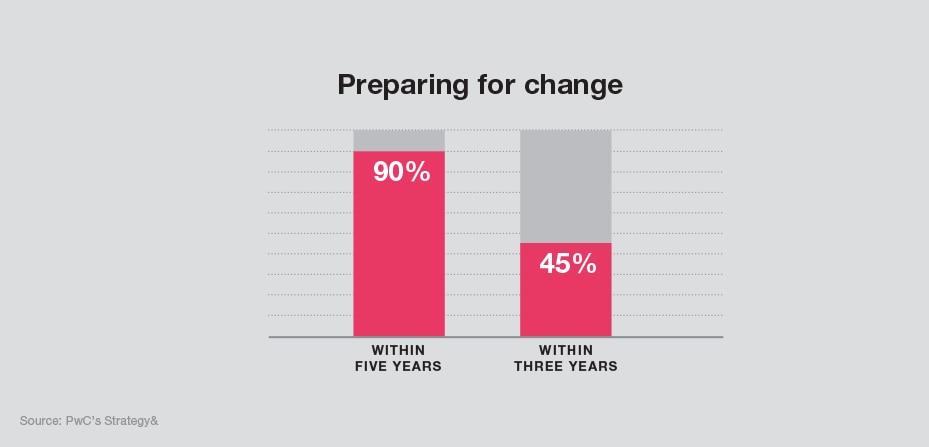

We analyzed the strategic actions of the world’s largest utilities by market capitalization. Our report highlights the different ways these heavyweights are navigating the road ahead and forging a new industry. We zero in on the strategies and capabilities that big utilities will need to succeed in an uncertain future. One finding is clear: Most utilities need to speed up the pace at which they develop and execute strategy.

Global power strategies

Strategy& recently analysed the strategic actions of 40 of the world’s largest utilities companies by market capitalization, exploring the different ways they are navigating the road ahead and forging a new industry. Watch this video to receive a high level summary of the key findings.

In-depth inverviews

Barry V. Perry

CEO of Fortis

St. John’s, Newfoundland and Labrador, Canada

Scott Prochazka

CEO of CenterPoint Energy

Houston, Texas

Brett Redman

CEO of AGL Energy

Sydney, Australia

Francesco Starace

CEO and General Manager of Enel

Rome, Italy

Dr. Johannes Teyssen

CEO of E.ON

Essen, Germany

Where are the strategic bets placed?

Utilities are working hard to create winning strategies amid the most significant transformation in the sector for decades. The majority of their strategic effort is focused on five key areas:

- Reducing exposure to conventional power generation, particularly coal

- Redirecting investment into networks and renewables

- Increasing activity in energy solutions and services

- Developing dedicated innovation facilities

- Restructuring and repositioning their businesses for market opportunities

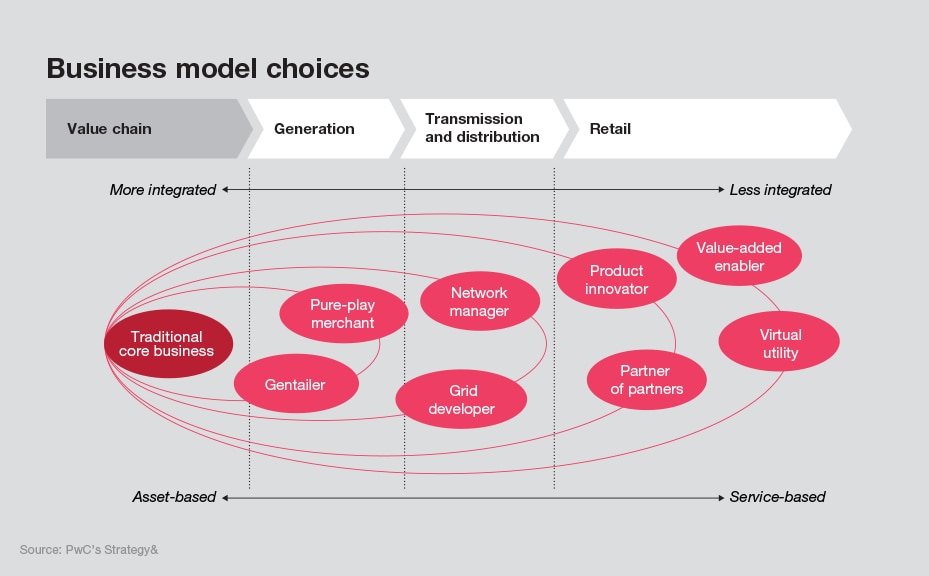

Some utilities are embracing even more radical change. These leaders have begun to reinvent themselves, aggressively pursuing business model innovation and entering new markets for energy solutions and services. They are targeting new value pools in areas as diverse as energy management, electric car charging, and home automation.

Watch out for externalities

Not only are utilities dealing with a world where markets, customers, and strategies have transformed, the GT40 must come to grip with another challenge: The externalities that influence their operations are becoming sharper.

- Interest rates – and therefore the cost of capital – is rising

- Technology is shifting from analog, centralized, and standardized to digital, distributed, and personalized

- Customer needs are starting to outpace what the sector can deliver

- Utilities face a growing number of “unnatural competitors” in the form of highly admired global brands

A path forward: Think like a “non-utility”

Over the next few years, we expect to see a gap emerge between the most enterprising utilities companies and the rest. Leading players are learning from the way nontraditional competitors approach contested or new markets. They are thinking about shorter time horizons, innovative business models, and managing across multiple value chain segments. In other words, they are thinking like a “non-utility.”

These four steps provide a blueprint for utilities to act on now and set themselves up for future success.

Multimedia

Power shifts: Podcast on energy transition

In this podcast we will be discussing the energy transition together with Pedro Azagra, Corporate Development Director of the Iberdrola Group. Interested? Tune in now!

North American utilities - their financial profitability and strategies

Tom Flaherty, Senior VP Strategy&, PwC US is outlining how North American utilities are performing compared to the rest of the world. What challenges do they have to catch up on?

How are GT40 Asia-Pacific utilities performing?

Mark Coughlin, Energy, Utilities & Mining leader in PwC Australia, discusses how the Asia-Pacific utilities are faring among their GT40 counterparts, and the challenges ahead.

European utilities and their performance

Dr. Paul Nillesen, Partner Strategy&, PwC The Netherlands, elucidates how European utilities are performing compared to the rest of the world.

Global power strategies

Strategy& recently analysed the strategic actions of 40 of the world’s largest utilities companies by market capitalization, exploring the different ways they are navigating the road ahead and forging a new industry. Watch this video to receive a high level summary of the key findings.

World's top utilities and how they are doing on strategy

Prof. Dr. Norbert Schwieters, former Global Energy, Utilities and Resources Leader, PwC Germany - answers two questions on how top utilities are acting globally to prepare for the future.

Thinking about strategy and mind-shift in the Utilities sector

Jeroen van Hoof, Global Power & Utilities Leader, PwC Netherlands - explains why global Utilities have to act now in changing their thinking about strategy.

Contact us