Kiplinger ESG 20: Our Favorite Picks for ESG Investors

Doing good and making money are no contradiction with these 15 stocks and five funds that ride the trend of socially conscious investing.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Introducing the Kiplinger ESG 20, the list of our favorite stocks and funds that excel at meeting environmental, social and corporate governance challenges.

Buying stocks or funds that are planet- and people-friendly is becoming as important a goal among investors as saving for retirement. In response to crises tied to climate change and the global pandemic, as well as to pressing social issues such as income inequality and the push for racial justice, more investors are embracing the ESG investing movement in a bid to drive change and make the world a better place.

People who want to align their investments with their values seek businesses that not only focus on increasing profits for shareholders but also take steps to protect the planet, boost the well-being of their employees, keep customers satisfied and safe, and assist communities in need. Money invested just in ESG index and exchange-traded funds could jump nearly sixfold this decade, to $1.2 trillion, projects BlackRock, the world’s largest money management firm.

You don’t have to sacrifice returns to jump on the ESG train. The S&P Composite 1500 ESG index, a broad measure of ESG-focused stocks covering U.S. companies of all sizes, returned 36.4% over the past year—barely a hair less than the 36.6% return of the S&P Composite 1500, its non-ESG cousin. Over the past three years, the ESG index has returned an annualized 18.6%, besting its counterpart’s 17.2% average yearly gain.

Because it’s harder to quantify non-financial ESG factors, such as a company’s carbon emissions or its record on board diversity, than it is to tally annual revenues or calculate a price-to-earnings (P/E) ratio, identifying promising investments through a sustainability lens can be as tough as pinpointing where a Category 5 hurricane will make landfall. An explosion of ESG ratings, rankings and reports adds more complexity than clarity, given that criteria are continually evolving, reporting isn’t standardized and U.S. regulation is nascent.

Our list is broken down by category: You'll find 15 stocks in the Environmental, Social or Governance groups, along with five funds that cover any or all of the bases. Few firms exceed on every ESG metric, but we tried to select all-around good corporate citizens. Says Cheryl Smith, comanager of Green Century Balanced fund: “No company is perfect.”

Methodology: We reviewed ratings on individual stocks and funds published by leading ESG rating firms such as MSCI, Sustainalytics and Institutional Shareholder Services, among others. We then interviewed fund managers, ESG investing experts, Wall Street analysts and company representatives. Finally, we did our own research to identify sustainable investments that possess a winning combination of strong ESG credentials along with solid business fundamentals and growth potential. Returns and other data are as of Dec. 19. Tabular data is from Morningstar Direct.

Environmental Steward: First Solar

Increasingly, climate risk poses investment risks. But climate change also presents opportunities for innovative, sustainably minded companies designing products that solve or mitigate environmental ills such as air and water pollution, depletion of natural resources or outdated power grids. Companies in this group are judged on the impact they make on the environment and how well they manage that impact.

- Industry: Solar

- Market value: $9.9 billion

- Forward price-to-earnings (P/E) ratio: 37.2

- Annualized total return, 1 year: 0.9%

- Annualized total return, 3 years: 30.4%

Renewable energy sourced from the sun using solar panels is an ally of the clean energy revolution. First Solar (FSLR (opens in new tab), $93) is a leading maker of photovoltaic solar panels, which convert sunlight into electricity with no carbon emissions. “If you’re looking at stocks from an ESG perspective, focus on ones like First Solar, with technological solutions that are helping to stabilize the world,” says Garvin Jabusch, manager of Shelton Green Alpha fund.

Demand for solar-driven power is rising. First Solar’s sales in the first half of 2021 were up 22% compared with the same period in 2020. And President Biden has put forth a plan that calls for solar energy to power nearly half the electric grid by 2050, up from 3% now. The Solar Energy Industries Association projects that over the next 10 years, U.S. solar capacity will grow to be three times greater than it is now.

The stock, which lagged the S&P 500 in 2021, is in a good position to rebound.

Environmental Steward: Microsoft

- Industry: Software - Infrastructure

- Market value: $2.4 trillion

- Forward P/E: 35.5

- Annualized total return, 1 year: 48.6%

- Annualized total return, 3 years: 47.5%

The second-biggest U.S. stock by market value is unarguably green. Over the past decade, Microsoft’s (MSFT (opens in new tab), $324) ambitions have shifted from its Office software to its cloud-based data centers to making sure that the environment has a sustainable future.

While many companies are still racing to get to carbon neutral (a goal the tech giant achieved in 2012), Microsoft last year set a new, ambitious goal of being a carbon-negative company, which would mean removing more carbon dioxide from the atmosphere each year than it emits.

Environmental Steward: Prologis

- Industry: REIT - Industrial

- Market value: $119.2 billion

- Forward P/E: 87.0

- Annualized total return, 1 year: 62.8%

- Annualized total return, 3 years: 39.8%

Building, buying and leasing green buildings, warehouses and fulfillment centers is a red-hot business for Prologis (PLD (opens in new tab), $161), a logistics-focused real estate investment trust (REIT).

Prologis builds energy-saving logistics facilities with sustainable features such as rooftop solar panels, LED lights and low-emission heating and cooling systems—facilities that are now in demand from giant retailers that store inventory there, such as Amazon.com and Walmart.

All that energy efficiency confers a green cast on tenants, too. “It helps all of Prologis’s customers advance their sustainability goals,” says Scott Renze, senior investment analyst at American Century Investments.

Prologis also benefits from the key locations of its facilities, close to population centers—which means a shorter, quicker and less energy-intensive delivery distance for tenants to cover. “We are committed to doing right by the places where we live and work,” says Ed Nekritz, Prologis’s head of ESG and chief legal officer.

Research firm CFRA rates the stock a Strong Buy. Morgan Stanley analysts say there's "undervalued sector growth" in PLD, which they rate at Overweight (equivalent of Buy) and give a $175 price target, suggesting a gain of 17% from recent levels.

Environmental Steward: Vestas Wind Systems

- Industry: Specialty industrial machinery

- Market value: $29.5 billion

- Forward P/E: 45.7

- Annualized total return, 1 year: -32.3%

- Annualized total return, 3 years: 23.6%

Wind is a way to a greener grid, and the turbines that Vestas Wind Systems (VWDRY (opens in new tab), $10) makes turn wind energy into electricity.

During their lifespans, the company’s wind turbines, which are installed onshore and offshore, emit less than 1% of the carbon emissions of conventional energy sources, according to Vestas’s 2020 Sustainability Report. The firm cuts down on its own carbon emissions by using 100% renewable energy at its plants and by recycling most turbine components—the goal is to become carbon neutral by 2030.

Vestas had a record wind turbine order backlog valued at $25 billion at the end of June. The company is also bulking up its services business, which generates revenue from servicing turbines made by other companies, and it’s working to expand its offshore business, which accounted for 16% of revenues in the first half of 2021.

The stock backtracked throughout 2021. But as the economy transitions to wind power, “you want to own the leaders like Vestas,” says Shelton Green Alpha’s Jabusch.

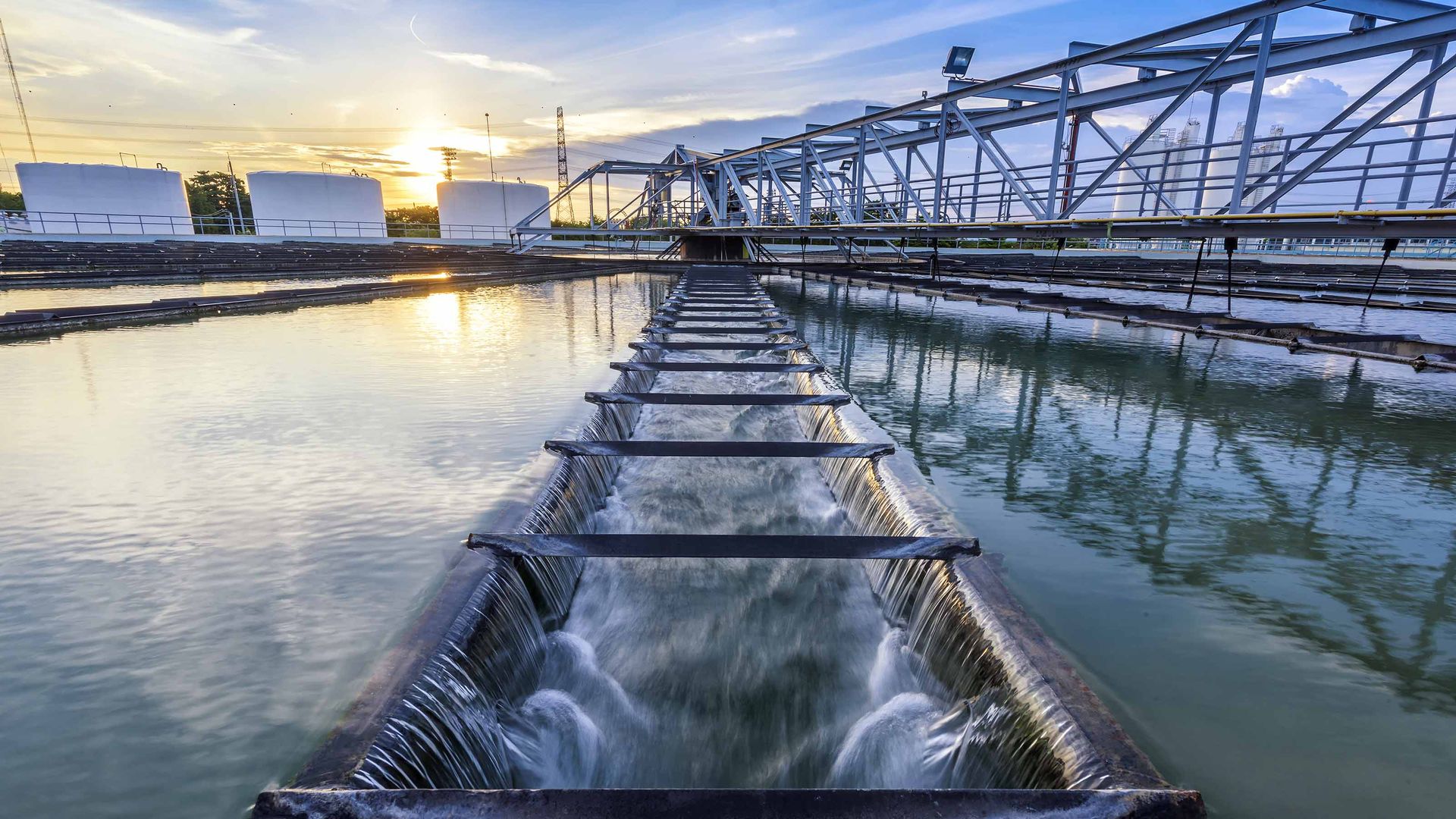

Environmental Steward: Xylem

- Industry: Specialty industrial machinery

- Market value: $20.9 billion

- Forward P/E: 38.2

- Annualized total return, 1 year: 17.2%

- Annualized total return, 3 years: 22.8%

Only 1% of the world’s water is usable, and two-thirds of the planet’s population may face shortages by 2025, according to the nonprofit World Wildlife Fund. Xylem (XYL (opens in new tab), $116), a water technology company, is focused on quenching the globe’s thirst for clean H2O in the face of droughts, population growth and aging infrastructure. “Now more than ever, it’s our job to be part of the solution,” says Claudia Toussaint, Xylem’s chief sustainability officer.

Xylem’s “smart” products address a flood of water challenges. Digital sensors detect pipe leaks, which helps to reduce the amount of wasted water. Water-treatment technologies turn dirty water into usable water. Artificial intelligence-driven technology prevents polluted sewer water from overflowing during storms. In 2020, Xylem helped its customers reuse enough water to fill 2 million Olympic swimming pools. By 2025, Xylem hopes to use 100% renewable energy at its major facilities and to help clients reduce wasted water by an amount equivalent to the annual water usage of 55 million people.

“Xylem is the poster child for sustainability,” says Andy Braun, senior portfolio manager at Impax Asset Management.

The stock is not cheap. Shares coughed up 12% across the past three months and still trade at 38 times expected earnings. Still, Argus Research says Xylem is more attractive than its peers given its financial strength and growth outlook, and the firm rates XYL a Buy.

Social Standout: Kellogg

A company’s social influence begins with its workforce, then stretches out to the rest of the world. Are employees happy? Do workers and supply-chain laborers work in safe and healthy environments? Happy employees are 13% more productive, according to one Oxford University study, and high productivity typically leads to high profitability. Are the company’s products or services safe? Do they provide a positive impact on the community? Here are five standout ESG companies that lead the way on different social issues.

- Industry: Packaged foods

- Market value: $22.0 billion

- Forward P/E: 15.6

- Annualized total return, 1 year: 6.9%

- Annualized total return, 3 years: 6.4%

Kellogg (K (opens in new tab), $64) may produce sugar-packed cereals such as Frosted Flakes and Fruit Loops. But the packaged-foods giant also makes healthier fare, including Kashi and All-Bran. And over the past three years, it has been trying to feed the world in a more nutritious way.

Kellogg has been adding more nutrients—vitamins A and D, iron and fiber—to its products and reducing sugar, sodium and saturated fat content. Among its many cereal products, 59% are now fortified with vitamins and minerals; 40% contain vitamin D. It’s all part of the company’s commitment to improving the lives of 3 billion people by 2030. To get there, Kellogg plans to support the livelihood of 500,000 farmers and expand breakfast programs to reach 2 million children. Since 2015, Kellogg has fed 3.2 million children and donated 2.4 billion servings of food to people in need.

Kellogg shares are inexpensive relative to those of peer companies as well as the broad market. At $64, the stock trades at less than 16 times expected year-ahead earnings. Another plus: The stock boasts a 3.6% dividend yield.

Social Standout: Nvidia

- Industry: Semiconductors

- Market value: $695.0 billion

- Forward P/E: 54.1

- Annualized total return, 1 year: 108.5%

- Annualized total return, 3 years: 98.0%

Nvidia (NVDA (opens in new tab), $278), whose graphics chips make video games look more lifelike, earns high marks for being a great place to work: 97% of employees say they are proud to tell others they work at Nvidia.

The firm’s artificial-intelligence tools and imaging chips are also helping to accelerate medical research so the world can be a healthier place. In 2017, three scientists won the Nobel Prize using Nvidia chips to create 3-D views of viruses. That capability proved pivotal to developing COVID-19 vaccines. Today, doctors use AI tools to, among other things, align multiple chest X-ray images to help diagnose the severity of a patient’s lung disease.

The shares are expensive, trading 54 56 times estimates for year-ahead earnings, so buy when the price dips. Nvidia still has many fans on Wall Street. Of 44 analysts who follow the stock, 35 recommend it.

Social Standout: Salesforce.com

- Industry: Software - Application

- Market value: $249.1 billion

- Forward P/E: 55.0

- Annualized total return, 1 year: 12.0%

- Annualized total return, 3 years: 14.6%

Salesforce.com (CRM (opens in new tab), $252) wins on giving back to the community. This subset of social measures can be tricky to assess, says MSCI ESG research director Julia Giguere-Morello. The giving, whether in the form of products or dollars, needs to be targeted and long term.

That’s easy for Salesforce.com. Every year, it donates 1% of the value of its stock to charity and 1% of its products to community nonprofits; employees spend 1% of their work hours volunteering. After 20-plus years, all that giving adds up. To date, Salesforce has outfitted 51,000 nonprofits and schools with its software; employees have volunteered 5.7 million hours; and the firm’s foundation has donated $430 million to local communities.

Meanwhile, business is humming. Salesforce dominates the cloud-based software market, yet BofA Global Securities analyst Brad Sills says the company is “well positioned” to capture even more of the market. Analysts expect 17% average annual earnings growth over the next three years. But the stock is pricey, so stretch your purchases over time, or buy on down days.

Social Standout: Target

- Industry: Discount stores

- Market value: $107.0 billion

- Forward P/E: 17.0

- Annualized total return, 1 year: 32.3%

- Annualized total return, 3 years: 53.3%

Target (TGT (opens in new tab), $223) is a leader in the retail industry on overall ESG measures. But its social scores stand out, especially for good labor-management policies along its supply chain. The company regularly monitors its supply chain for labor violations. If it catches a child labor violation, for example, it works with the Center for Child Rights and Corporate Social Responsibility to address it. And Target provides long-term support, so children don’t return to work.

The company makes an impact on basic human rights, too. In line with U.N. human rights principles, which aim to ensure access to drinkable water for supply-chain workers, Target recently partnered with the nonprofit Water.org so that families in India, Bangladesh and Indonesia could have access to clean water at home.

The company isn’t perfect. Years ago, Target faced criticism related to over-policing of inner-city communities. But in response to racial injustice in 2020, Target promised to hire 20% more Black employees by 2025 and to help them advance at the company.

At $223 a share, the stock price sits closer to its 52-week high than its low. But based on expected earnings, the shares are a bargain relative to peers. CFRA analyst Garrett Nelson rates the stock a Buy, given his favorable outlook for consumer spending.

Social Standout: W.W. Grainger

- Industry: Industrial distribution

- Market value: $25.4 billion

- Forward P/E: 22.3

- Annualized total return, 1 year: 22.8%

- Annualized total return, 3 years: 21.6%

Think of W.W. Grainger (GWW (opens in new tab), $493) as an Amazon.com of industrial supplies. Grainger sells everything from motors to plumbing tools to medical diagnostic equipment to safety goggles—online, via catalogs and in 400 branches. The firm likes to say it “helps businesses do business,” says Billy Hwan, Parnassus Endeavor fund manager.

Grainger is an ESG star, too, with a rare triple-A rating from MSCI. It’s working to lower its greenhouse emissions, and it wins high marks for workplace diversity. It also shines on employee health and safety, a major social measure. Safety has long been a focus. Since 2010, Grainger’s rate of lost time at work because of injury has fallen by 50% and is more than 70% below the national average rate of lost time at work for the wholesale industry, according to the company.

Grainger stock trades at 22 times estimated year-ahead earnings; its peers trade at a forward P/E of 31. Analysts project 13% annual earnings growth over the next three years—better than the 10% average growth rate for its peers.

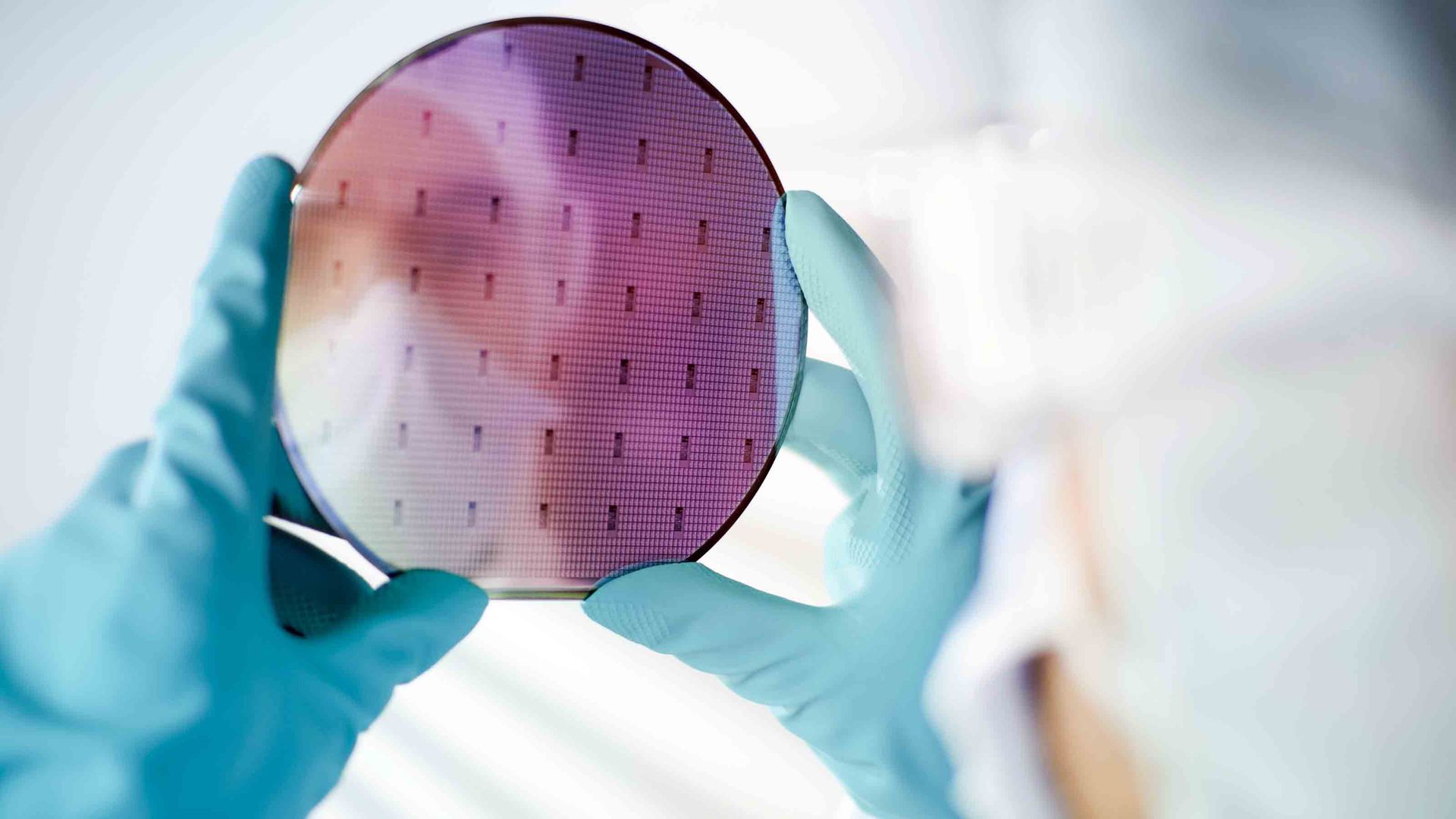

Governance Leader: Applied Materials

Corporate governance applies to all companies and matters to all shareholders. Good governance is a mix of ethics, diversity and transparency. It is exemplified by a diverse (and independent) board of directors and inclusive executive ranks; clean accounting; sensible executive compensation (a payout that is tied to long-term company results or meeting ESG goals, for example); and straightforward, timely communication with shareholders. These five companies have best-in-class governance.

- Industry: Semiconductor equipment

- Market value: $132.0 billion

- Forward P/E: 17.9

- Annualized total return, 1 year: 68.1%

- Annualized total return, 3 years: 65.8%

When evaluating stocks through a governance lens, American Century’s Reiland looks for companies that split the CEO and chairman jobs, insist on diverse and independent boards, say no to entrenched boards that treat seats like lifetime positions, and frown on director “overboarding,” a term that describes board members who hold similar posts at too many other companies. Applied Materials (AMAT (opens in new tab), $146), the maker of manufacturing equipment used to build computer chips, checks all the boxes, Reiland says.

That means the tech firm is less vulnerable to corruption and ethics infractions that could dent its reputation and stock price. Last year, it ramped up accountability by naming a director of ESG. And this year it expanded pay incentives for the CEO and executives to include progress toward ESG goals.

Despite a 68.1% gain in the past year, the stock trades at just less than 18 times estimated earnings for the year ahead. Analysts at investment firm Stifel say the growing appetite for smart devices will drive demand for computer chips. They see the shares trading at $180 in the next 12 months, representing a 23% gain from the stock’s recent price.

Governance Leader: Best Buy

- Industry: Specialty retail

- Market value: $24.1 billion

- Forward P/E: 11.0

- Annualized total return, 1 year: 0.5%

- Annualized total return, 3 years: 27.0%

Diversity is as big a part of Best Buy’s (BBY (opens in new tab), $100) DNA as its gadget-fixing Geek Squad. A female CEO, Corie Barry, commands the corner office, and women occupy five of the consumer electronics retailer’s 11 board seats.

“You need diversity of thought, and having a female CEO sets the tone,” says Hellen Mbugua, a vice president and ESG senior research analyst at Calvert Research and Management.

Studies show that a more diverse workforce boosts the bottom line. Jefferies analyst Jonathan Matuszewski says the company’s diversity initiatives should play well with a new customer base that skews younger and female, as well as with socially conscious millennials. “We see higher wallet share ahead,” he says.

For now, business is benefiting from greater demand for tech gadgets due to societal shifts accelerated by the pandemic, such as remote work and increased video streaming.

Governance Leader: CBRE Group

- Industry: Real estate services

- Market value: $34.1 billion

- Forward P/E: 28.9

- Annualized total return, 1 year: 58.0%

- Annualized total return, 3 years: 37.1%

In a service business in which reputation is everything, corporate governance can be the difference between success and failure. That’s why a top executive at CBRE Group (CBRE (opens in new tab), $102), a global commercial real estate services firm, fears an ethics scandal even more than risks related to climate change.

“Our business is our word. It’s about trust,” says Larry Midler, CBRE’s executive vice president, general counsel and chief risk officer. “If that trust is broken, you don’t just get sent to the penalty box. It’s really game over.”

To stay in the game, CBRE makes sure its governance practices are major league. That’s why its CEO is not chairman of the board, board members are independent and replaced on a set timetable, and committees overseeing executive pay and audits are also independent. In 2021, CBRE created a new position: chief responsibility officer. Prioritizing ESG matters, Midler says, helps the company recruit top talent.

CBRE’s business is rebounding as real estate begins to normalize. Revenue increased 20% in the second quarter compared with the same period last year.

Governance Leader: Clorox

- Industry: Household products

- Market value: $21.4 billion

- Forward P/E: 32.7

- Annualized total return, 1 year: -11.7%

- Annualized total return, 3 years: 6.1%

Clorox (CLX (opens in new tab), $174), whose Disinfecting Wipes became go-to products in the early days of the pandemic, is also known for tidy corporate governance. Led by CEO Linda Rendle and an independent and diverse board (42% of its members are women and four members are people of color), the household product giant has “deeply embedded ESG throughout its business strategy and governance,” says Parnassus Mid Cap fund comanager Lori Keith.

Last year, Clorox split the CEO and chairman roles and tied the compensation of its CEO, chief financial officer and other top execs to progress toward sustainability goals. Rigorous stock-ownership guidelines for insiders help align their goals with the interests of shareholders.

“The stock-ownership requirements ensure that the CEO, executive officers and board have skin in the game,” Keith says.

The stock has tumbled 12% in the past year due to worries about supply-chain constraints and rising production costs. But Clorox, yielding 2.7%, could revive as the company rolls out price increases and as investors worried about the longevity of the bull market place a greater premium on defensive shares.

Governance Leader: Trane Technologies

- Industry: Specialty machinery

- Market value: $46.1 billion

- Forward P/E: 27.9

- Annualized total return, 1 year: 39.5%

- Annualized total return, 3 years: 34.8%

Trane Technologies (TT (opens in new tab), $194) is known for making energy-efficient heating and cooling systems for commercial buildings and residential homes. It’s also “the biggest ESG no-brainer out there,” says portfolio manager Andy Braun, at Impax Asset Management. Trane earns top sustainability grades from the major ESG rating agencies, including an “A” grade for governance from Institutional Shareholder Services.

The company also has a do-good streak. During the pandemic, its Thermo King unit tweaked refrigerated containers normally used to ship tuna to make sure they were at low enough temperatures to safely transport COVID-19 vaccines.

Bonnie Saynay, global head of ESG research at ISS’s ESG unit, says a centerpiece of Trane’s corporate governance is a board-level committee that tracks Trane’s performance against its sustainability goals. One big goal is Trane’s “Gigaton Challenge,” which aims to cut customers’ carbon footprint by 1 billion metric tons by 2030.

ESG Fund: Brown Advisory Sustainable Bond Fund

Choice is not a problem with ESG funds; there are dozens. But funds that claim to incorporate ESG principles into their investment process do so in various ways and to different degrees. Some might seek to make a measurable impact on a specific sustainability challenge; others might focus on one ESG pillar or another, integrate ESG criteria into a broader investment strategy, or even actively engage with companies to improve their ESG profiles. These funds offer one or more of those tilts.

- Category: Intermediate core-plus bond

- Expense ratio: 0.51%

- Annualized total return, 1 year: 0.2%

- Annualized total return, 3 years: 6.0%

Thomas Graff and Amy Hauter combine ESG and fundamental analysis to invest in government, corporate and mortgage-backed securities, among others. Each bond issue finances projects that make a positive impact in one of three areas: health and well-being, economic development and social inclusion, or the environment. “We want to understand how the bond plays a role in the overall sustainable goals of that issuer,” says Hauter.

With COVID and racial injustice top of mind in 2020, Brown Advisory Sustainable Bond Fund (BASBX (opens in new tab)) picked up bonds that address those issues. A World Bank sustainability bond funded training and support for front-line health care workers and paid for medical equipment. A Bank of America bond financed mortgages with low interest rates and down payment requirements for first-time Black and Hispanic buyers and provided capital for minority-owned businesses.

Over the past three years, the fund’s 6.0% annualized return beat the Bloomberg U.S. Aggregate Bond index, which returned 5.1%.

ESG Fund: FlexShares Stoxx Global ESG Select Index ETF

- Category: World large-stock blend

- Expense ratio: 0.42%

- Annualized total return, 1 year: 21.1%

- Annualized total return, 3 years: 20.9%

FlexShares Stoxx Global ESG Select Index ETF (ESGG (opens in new tab)) invests in large companies all over the world that score high on ESG measures. The portfolio tracks a carefully constructed index. It shuns companies that don’t adhere to the 10 U.N. Global Compact principles, which include setting emissions-reduction targets, prohibiting child labor and having an independent board. Weapons companies and coal-mining firms are out, too.

Stocks are then ranked by overall ESG scores, and the ones that make it into the index are weighted in the portfolio by ESG score rather than by market value. Just over 60% of the fund is invested in the U.S.; foreign stocks make up the rest.

Over the past five years, the fund’s 20.9% annualized return beat 95% of its category peers (world large-stock funds with both growth and value characteristics). Apple (AAPL (opens in new tab)), Microsoft and Amazon.com (AMZN (opens in new tab)) top the portfolio.

ESG Fund: Green Century Balanced Fund

- Category: Allocation - 50% to 70% equity

- Expense ratio: 1.46%

- Annualized total return, 1 year: 15.4%

- Annualized total return, 3 years: 16.9%

A good all-in-one option, Green Century Balanced (GCBLX (opens in new tab)) holds 65% of assets in stocks of companies that meet rigorous sustainability and environmental standards and 35% in bonds that finance efforts to combat climate change.

The environment is a primary focus, but social and governance measures matter, too. “It’s hard to disentangle the E, S and G,” says Smith, Green Century’s comanager for more than 15 years. Before the fund invests, “we really dig into the details to make sure a company is not only excellent on environmental factors but also meets our standards on S,” she says. The fund doesn’t own Amazon.com, for example, despite its reputation for environmental awareness. “It doesn’t meet our standards yet,” says Smith. “We are concerned about labor conditions for its workforce.”

Over the past 10 years, the fund’s 10.9% annualized return beat 85% of its peers (funds with 50% to 70% of assets in stocks). Apple and Microsoft are top stock holdings; Boston Properties (BXP (opens in new tab)) and Starbucks (SBUX (opens in new tab)) bonds are top debt holdings.

ESG Fund: Pax Global Environmental Markets Fund

- Category: World large-stock blend

- Expense ratio: 1.20%

- Annualized total return, 1 year: 39.8%

- Annualized total return, 3 years: 19.1%

ESG fans looking to invest overseas may like Pax Global Environmental Markets (PGRNX (opens in new tab)), which holds 43% of its assets in foreign shares. The fund invests in firms that tackle one of four environmental challenges: energy, water infrastructure, sustainable food or waste management. Top holding Linde (LIN (opens in new tab)), an industrial gas supplier, helps its customers reduce their environmental impact, for example. Trash collector Waste Management (WM (opens in new tab)) is developing ways to turn leftover food and yard trimmings into resources that can power electricity.

“When we think about sustainability,” says comanager David Winborne, “we think about what these companies are doing that brings improvement or efficiencies.” The next step digs deeper into how they carry out their green operations. “There has to be an alignment with the ‘what’ and the ‘how’ for us to invest,” Winborne says.

The process has delivered strong returns so far. Global Environmental Markets boasts a 15.4% five-year annualized return that stays well ahead of the MSCI All Country World index.

ESG Fund: Putnam Sustainable Future ETF

- Category: Large growth

- Expense ratio: 0.64%

- Annualized total return, 1 year: N/A

- Annualized total return, 3 years: N/A

This active ETF has a short track record—it launched in May—but Putnam Sustainable Future ETF (PFUT (opens in new tab)) is modeled after a mutual fund with a long one. Managers Katherine Collins and Stephanie Dobson run the mutual fund and the less-expensive ETF with the same strategy. Together, they build a fully diversified portfolio of 75-odd companies that offer solutions to key sustainability challenges.

Aluminum-can maker Ball (BLL (opens in new tab)), for example, is leading the charge in the growing circular economy, a model that emphasizes cycles of reuse, recycling and reduction instead of the old linear model of consumption and disposal. And McCormick & Company (MKC (opens in new tab)), a leader in herbs and spices, created the first framework in the herb and spice industry to measure and track sustainability efforts across suppliers.

Collins and Dobson have managed the mutual fund since March 2018. Since then, it has outpaced the S&P 500 by a few percentage points.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

-

Stock Market Today: Nasdaq Outperforms on Microsoft Earnings

Stock Market Today: Nasdaq Outperforms on Microsoft EarningsThe Nasdaq led in a mixed session for stocks Wednesday as Big Tech earnings impressed.

By Karee Venema • Published

-

Did Tweets Help Crash Silicon Valley Bank? Paper Shows New Risks

Did Tweets Help Crash Silicon Valley Bank? Paper Shows New RisksA new study on Silicon Valley Bank's demise links depositor flight and stock crash with Twitter mentions.

By Ben Demers • Published

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

By Jeffrey R. Kosnett • Published

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.

By Jeffrey R. Kosnett • Published

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

By Dan Burrows • Published

-

The 9 Best Utility Stocks to Buy Now

The 9 Best Utility Stocks to Buy NowIncome investors like utility stocks for their stability and generous dividends. Here are nine to watch in an uncertain market.

By Jeff Reeves • Published

-

Best AI Stocks to Buy: Smart Artificial Intelligence Investments

Best AI Stocks to Buy: Smart Artificial Intelligence Investmentstech stocks AI stocks have been bloodied up in recent months, but the technology's relentlessly growing importance should see the sun shine on them again.

By Tom Taulli • Published

-

9 Best Stocks for Rising Interest Rates

9 Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and it's likely not done yet. Here are nine of the best stocks for rising interest rates.

By Jeff Reeves • Published

-

The 6 Safest Vanguard Funds to Own in a Bear Market

The 6 Safest Vanguard Funds to Own in a Bear Marketrecession Batten the hatches for continued market tumult without eating high fees with these six Vanguard ETFs and mutual funds.

By Kyle Woodley • Published

-

9 Best Commodity ETFs to Buy Now

9 Best Commodity ETFs to Buy NowETFs These commodity ETFs offer investors exposure to the diverse asset class, which is a helpful hedge against inflation.

By Jeff Reeves • Last updated