Gold Investing: What's Next After Recent Gold Price Highs?

If you're hesitant about gold investing simply because prices have run up so much already, here are a few points to consider.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Gold investing has become a hot topic on Wall Street these days. This is because gold prices (GOLD (opens in new tab)) recently hit new multi-month highs and are close to hitting new all-time highs. The yellow metal has been trending sharply higher since late September and is showing no signs of slowing down.

Many investors get intimidated when they see an investment close to new all-time highs. But that's exactly what you want to see in a healthy bull market.

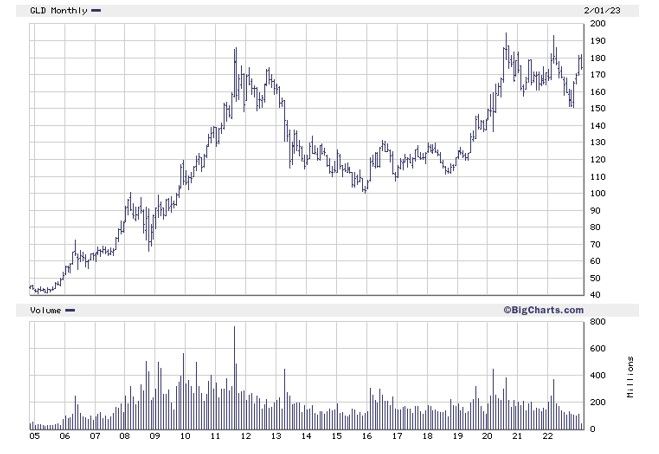

Monthly chart of the SPDR Gold Shares ETF (GLD)

"An object in motion tends to stay in motion," says Adam O'Dell, editor of Green Zone Fortunes (opens in new tab), quoting Sir Isaac Newton. "While you can point to fundamental factors that support gold's rise, it's gold's price momentum itself that has my attention. Momentum buying tends to beget more momentum buying, and today I'm seeing the conditions in place for a significant move higher."

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Most gold is held in central bank vaults or held as jewelry, so the investable market for gold isn't exceptionally large. Take for instance these two gold ETFs: the SPDR Gold Shares (GLD (opens in new tab)) and the iShares Gold Trust (IAU (opens in new tab)). The former is the largest and most liquid gold ETF at $57 billion in assets under management (AUM), while the latter has just $28 billion in AUM. For perspective, the three largest S&P 500 Index ETFs have $1.5 trillion dollars in combined assets, and the market cap of the S&P 500 Index itself is $34 trillion.

So those worried about investing in gold at new highs, take a little heart. Given the relatively small size of the investable gold market, it wouldn't take much in the way of new inflows to send the price of gold sharply higher from here.

But why is gold trending higher, and can it continue?

Gold investing: Why is the gold price trending higher?

Inflation. The Fed flooded the capital markets with virtually unlimited liquidity for nearly two full years during the pandemic, expanding its balance sheet by almost $5 trillion in the process.

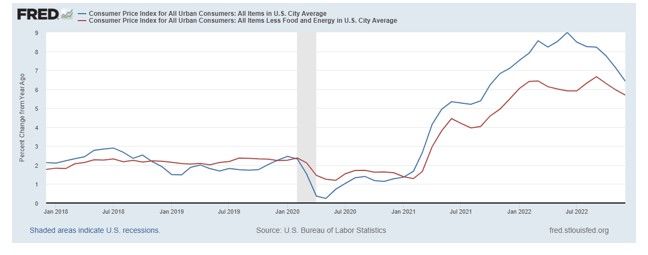

This massive monetary stimulus – along with government assistance and a global supply chain that still isn't fully untangled – helped to push inflation to the highest levels in four decades. Consumer price index (CPI) inflation touched 9% in mid-2022 and remains high at over 6%.

Consumer price inflation since January 2018

Remember, gold is traditionally an inflation hedge. While its price is often volatile, gold has done a good job of maintaining purchasing power over the centuries. And while inflation is down from its highs, it is still a long way from the Fed's target of 2%. All else equal, high inflation bodes well for gold.

But gold's rise is not exclusively an inflation phenomenon. If that were the case, we wouldn't have seen gold prices weaken over the summer, when inflation was the highest. There's another element at play here.

The weak dollar

The U.S. dollar has been one of the world's stronger currencies over the past decade. The turmoil of the pandemic accelerated the dollar's rise, but that was only the beginning. As the Fed scaled back its asset purchases and started aggressively raising rates, the dollar soared to multi-decade highs against many world currencies, including the euro and British pound.

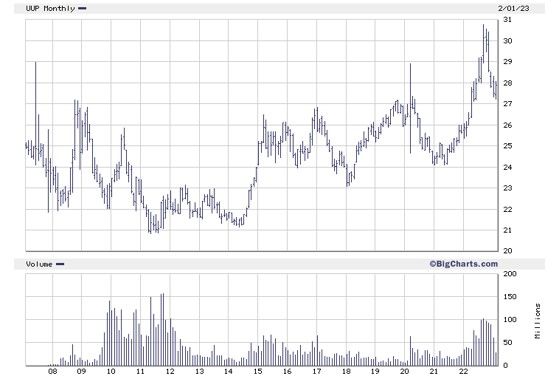

But since September, the dollar's strength has started to fade. The rest of the world's central banks are catching up in terms of monetary tightening, which has eliminated the primary driver of the dollar's torrid rise. You can see this in the performance of the Invesco DB US Dollar Index ETF (UUP (opens in new tab)), which tracks the performance of the dollar against a basket of major world currencies.

Monthly chart of the Invesco DB US Dollar Bullish ETF (UUP)

Gold's rise started the same time that the dollar's strength started to fade. That's no coincidence. Gold is priced in dollars, so dollar weakness is, by definition, gold strength.

The U.S. dollar has a history of trending higher versus other major world currencies for years or even decades at a time, but these periods of strength are generally followed by comparable stretches of dollar weakness. We may be in the early stages of one of those stretches … and that's bullish for gold.

Government dysfunction

Back in January, the United States officially hit its $31.4 trillion debt ceiling. In more normal times, Congress would simply raise the debt ceiling and life would go on. But these are not normal times, and as of the second week of February, we seemed to be no closer to a resolution.

The House of Representatives is demanding spending cuts in exchange for raising the debt ceiling. But the White House is taking the view that Congress already approved the spending that this debt is needed to finance… and President Biden doesn't feel that this is the time or place for this discussion.

If no one blinks, the U.S. will likely default on its debts by early summer.

We've seen this movie before. The Republican-led House of Representatives and the Obama White House had a similar standoff back in late 2011. It was a little scary. And it resulted in the United States losing its AAA credit rating. Standard & Poor's cited political instability as its rationale for the downgrade.

Will the U.S. really default? Probably not. Our leaders are engaged in political theater, and no one really wants to see our nation's finances get shredded. But a crisis like this can also take on a life of its own, and even if we avoid default, we may see confidence in the dollar eroded by these shenanigans.

Under the circumstances, doesn't investing at least a little of your capital in gold make sense?

Related content

- The Best Gold ETFs with Low Costs

- Investing in Gold: 10 Facts You Need to Know

- 5 Gold Stocks Worth Their Weight

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Best Defensive Stocks to Buy Now

Best Defensive Stocks to Buy NowInvestors are concerned about the financial sector and the economy, but these best defensive stocks have risk-averse traits that can help calm those fears.

By Mark R. Hake, CFA • Published

-

Stock Market Today: Markets Up Again as Bank, Energy Stocks Outperform

Stock Market Today: Markets Up Again as Bank, Energy Stocks OutperformThe major indexes closed higher for a second straight day ahead of tomorrow's highly anticipated Fed decision.

By Karee Venema • Published

-

Five Investment Strategies to Focus on in 2023

Five Investment Strategies to Focus on in 2023Planning instead of predicting, reducing allocations of illiquid assets and having a diversified portfolio are good ways for investors to play defense this year.

By Don Calcagni, CFP® • Published

-

Stock Market Today: Stocks Rise Ahead of Fed

Stock Market Today: Stocks Rise Ahead of FedBank headlines dominated another choppy day of trading on Wall Street.

By Karee Venema • Published

-

Stock Market Today: Markets Rise as Bank Stocks Bounce

Stock Market Today: Markets Rise as Bank Stocks BounceInvestors also focused on the February CPI report, which gave a mixed picture on inflation.

By Karee Venema • Published

-

What the Markets’ New Tailwinds Could Look Like in 2023

What the Markets’ New Tailwinds Could Look Like in 2023Historically, the markets bounce back nicely after sharp declines, so focusing on historically high-quality companies trading at today’s lower valuations could be a good recovery strategy.

By Don Calcagni, CFP® • Published

-

Stock Market Today: Nasdaq Gains as Treasury Yields Collapse

Stock Market Today: Nasdaq Gains as Treasury Yields CollapseThe tech-heavy index swung higher Monday as investors sought out safety in government bonds.

By Karee Venema • Published

-

Stock Market Today: Silicon Valley Bank Failure Sinks Stocks

Stock Market Today: Silicon Valley Bank Failure Sinks StocksThe largest bank failure since the 2008 financial crisis stole the spotlight from the February jobs report.

By Karee Venema • Published