10 Things You Must Know About Bull Markets

It's easy to look smart when most stocks are gaining day after day, but how much do you really know about the workings of bull markets?

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

There’s a saying on Wall Street: Don’t confuse brains with a bull market.

After all, when most stocks are gaining day after day, it’s easy to look smart. Indeed, the market has been in bull mode for so much of the last decade-plus, it's hard to remember what challenging investing looks like.

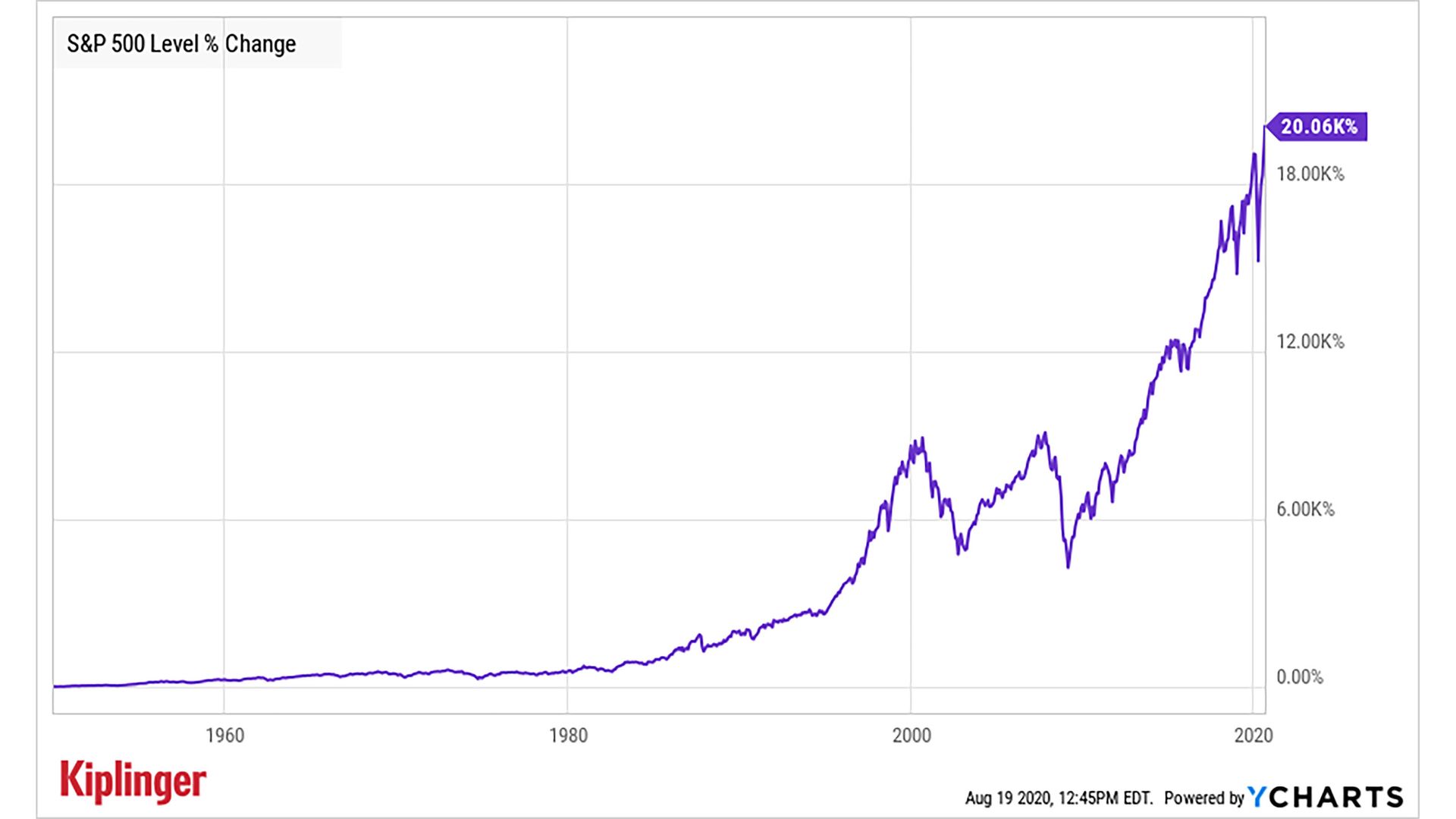

Technical analysts differ on the definition of a bull market, but by one measure the S&P 500 confirmed it's in a bull on Aug. 18, 2020, when it closed above its previous all-time high recorded earlier in the year, on Feb. 19.

The S&P 500's longest bull market in history began in March 2009 and ended abruptly in March 2020, clobbered by coronavirus fears. The ensuing bear market cut fast and deep, but bottomed out in late March. About a month after its nadir, the market returned to bull-market territory and just kept chugging along.

Indeed, from the March 23 bottom to Aug. 18's record high, which confirmed the new bull market, the S&P 500 rose a remarkable 52%.

Justified or not, those of us who have stuck around in stocks are probably feeling pretty brainy these days. Still, there’s plenty more to know about extended runs in stocks. Read on to learn 10 things you must know about bull markets.

Why They Call It a Bull Market

There are several theories. Some say it's because the New York Stock Exchange is built on land that was used by the Dutch in the 17th century to auction off cattle. Another popular explanation is that rising markets were once fueled by fast-talking brokers with exaggerated claims about stocks (thus the phrase, "a line of bull").

As much as the "line of bull" story rings true, the most widely accepted theory is that the actions of bulls and bears, when attacking an opponent, reflect market movements. Bulls thrust upward, while bears swipe downward.

When Stocks Officially Are in a Bull Market

There are many misconceptions about bull markets. No, we're not in a bull market just because the pundits on TV say we are. Neither is it a bull market when a major stock market index – such as the Dow Jones Industrial Average, S&P 500 or Nasdaq Composite – hits a new record high.

Rather, market trackers at S&P Dow Jones Indices define a bull market as a 20% rise in the S&P 500 from its previous low. By that measure – a 20% gain off the low – the current bull market began on April 8, 2020.

Note that by that measure, a bull market comes to an end when the S&P 500 falls 20% from its peak.

But other market analysis and research houses view bull markets differently. For instance, Sam Stovall, chief investment strategist at investment research firm CFRA, told Kiplinger's Personal Finance that he defines a bull market as a gain of at least 20% too – but the market also must go six months without falling beneath the previous low.

Other market participants will say that you can't truly confirm a bull market until you exceed the previous all-time highs. By that measure, the bull market started on March 23, 2020, but wasn't confirmed until Aug. 18, 2020, when the S&P 500 eclipsed its previous high set on Feb. 19, 2020.

Regardless, by many strategists' definitions, we're in a new bull market.

How Long the Average Bull Market Lasts

As much as investors would like the answer to this question to be "forever," bull markets tend to run for just under four years.

The average bull market duration, since 1932, is 3.8 years, according to market research firm InvesTech Research. As noted above, the longest bull market in history ran for 11 years, from 2009 to 2020.

How Common Bull Markets Are

Not including our current uptrend (because some strategists want further confirmation), there have been 26 bull markets since 1928, according to Ned Davis Research, which uses its own set of signals to determine bull and bear markets. We have seen the same number of bear markets over that time frame.

On average, stocks gain 112% during a bull market. That's against an average loss of 36% during a bear market. And, of course, stocks have only gone up over the long term.

The Types of Stocks That Do Best in Bull Markets

It depends.

Typically, over the course of a bull market, different types of stocks will lead the pack. In a young bull market (early in an economic expansion), the cyclical sectors that are most sensitive to interest rates and economic growth do best, including financials, consumer discretionary (companies that provide nonessential goods or services) and industrials.

Later, tech stocks tend to lead mid cycle, and commodity-linked sectors, including energy and materials, often outperform at the end stages of the economic cycle.

But this isn't your typical bull market. As we'll see below, tech stocks are outperforming and financials are lagging. Remember that a diversified portfolio will probably own all or most of these stocks, but the proportions will likely change over time.

The Best-Performing Sector in the Current Bull Market

There's really no agreement on when a bull market "officially" begins. Some say it's when the market rises 20% off the bear-market bottom, while others contend it's not a bull until the market regains its prior peak.

For our purposes – and with the benefit of hindsight – we'll date the current bull run to the market bottom of March 23. The S&P 500 is up a remarkable 52% since then, to which the consumer discretionary sector says, "hold my beer."

The consumer discretionary sector, up 71%, is the top performer in this bull. The sector includes everything from restaurants and retailers to hotel chains and cruise lines to advertising, broadcasting and publishing firms. It has outperformed largely because of how badly it was beaten down in the February-March crash. Tentative moves toward reopening parts of the economy also have boosted sentiment.

The tech sector is essentially tied for second place with the materials sector. They're both up about 64%.

Rounding out the top five, industrials have gained 58%, and energy is up 54% since the March market bottom. For what it's worth, financials are lagging with a 40% gain.

The Stocks Leading the Current Rally

For all the glory the tech giants are getting these days, the best performing stocks in the S&P 500 since March 23, through the Aug. 18 confirmation, are actually two energy sector names.

Oil and gas driller Apache (APA (opens in new tab)) leads the market with a gain of 254% since the bear-market bottom. Oil services company Halliburton (HAL (opens in new tab)), up 214%, came in second.

Rounding out the top five are consumer discretionary stock L Brands (LB (opens in new tab)) (+207%), industrial name Whirlpool (WHR (opens in new tab)) (+183%) and copper miner Freeport-McMoRan (FCX (opens in new tab)) (+167%) from the materials sector.

Bull Markets Can Morph Into Unsustainable Bubbles

All the great bubbles started out as bull markets. From the Dutch tulip bulb mania of 1636-37 to the Nifty Fifty blue-chip stocks that collapsed in 1973 to the dot-com darlings that popped the turn-of-the-century tech bubble, spectacular rises and breathtaking falls prove that irrational euphoria and a herd mentality can catapult any market into oblivion.

To learn about the occasionally catastrophic combination of human nature and financial markets, read Manias, Panics and Crashes: A History of Financial Crises, by Charles P. Kindleberger. The newest edition of the classic book was updated by economist Robert Z. Aliber and released in 2015.

What a Secular Bull Market Is

A secular bull market is an advance usually measured by the decade instead of by the year, occasionally punctuated by shorter bear markets.

Secular bull markets include the run from 1982 through 2000 that saw prices for stocks in the S&P 500 rise more than 1,200%, despite bear markets in 1987 and 1990. The 1949-1966 secular bull withstood a nearly 30% drop in 1962. The average gain for secular bulls approaches 500%.

What Kills a Bull Market

A rising inflation, higher interest rates and recession can all contribute to the death of a bull market. But timing is everything.

The stock market anticipates a recession, typically peaking six to nine months in advance of the onset of one. Making things even trickier, stocks sometimes anticipate recessions that never materialize. Also, stocks tend to perform well in the early days of higher rates and rising inflation; they signal a strengthening economy, after all.

Eventually, however, higher rates choke off growth as inflation erodes the value of investment returns.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Stock Market Today: Markets Up Again as Bank, Energy Stocks Outperform

Stock Market Today: Markets Up Again as Bank, Energy Stocks OutperformThe major indexes closed higher for a second straight day ahead of tomorrow's highly anticipated Fed decision.

By Karee Venema • Published

-

Best Consumer Discretionary Stocks to Buy Now

Best Consumer Discretionary Stocks to Buy NowConsumer discretionary stocks have been challenging places to invest in, but these picks could overcome several sector headwinds.

By Will Ashworth • Published

-

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue NewsReports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.

By Karee Venema • Published

-

What the Markets’ New Tailwinds Could Look Like in 2023

What the Markets’ New Tailwinds Could Look Like in 2023Historically, the markets bounce back nicely after sharp declines, so focusing on historically high-quality companies trading at today’s lower valuations could be a good recovery strategy.

By Don Calcagni, CFP® • Published

-

Stock Market Today: Nasdaq Gains as Treasury Yields Collapse

Stock Market Today: Nasdaq Gains as Treasury Yields CollapseThe tech-heavy index swung higher Monday as investors sought out safety in government bonds.

By Karee Venema • Published

-

Stock Market Today: Silicon Valley Bank Failure Sinks Stocks

Stock Market Today: Silicon Valley Bank Failure Sinks StocksThe largest bank failure since the 2008 financial crisis stole the spotlight from the February jobs report.

By Karee Venema • Published

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

By Dan Burrows • Published

-

Stock Market Today: Stocks Struggle to Start March

Stock Market Today: Stocks Struggle to Start MarchThe major benchmarks finished mostly lower Wednesday after another disappointing inflation reading.

By Karee Venema • Published