10 Things You Should Know About Bonds

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

When it comes to bond investing, there's a lot more to know than the current interest rate on Treasuries.

Bonds have two primary roles: income – whether taxable or tax-free – and portfolio diversification. Much of the time, when stocks or other investments struggle, bonds hold their value.

But these are complex creatures, and there’s a lot more to know than the current interest rate on a Treasury bond or the name of a big bond fund.

Read on to learn some of the key concepts every bond investors should know.

It's All About Interest Rates

Bond prices certainly are linked to interest rates, but inversely. When interest rates overall are on the rise, older, lower-yielding bonds become devalued. Conversely, falling rates raise the value of older issues with higher coupon rates.

So remember this like it's your mantra:

- When interest rates rise, bond prices fall.

- When interest rates fall, bond prices rise.

Rinse, wash, repeat.

What Does "Duration" Mean?

To dispel with some misconceptions, "duration" is not a rough estimate of how long it will take to reach your investing goal. Neither is it the number of years a bond issuer has gone without a negative credit event. And It doesn't refer to the number of years before the borrower has to return your principal.

Rather, it’s a measure of a bond’s interest rate sensitivity.

Duration – roughly related to a bond’s maturity, or the average maturity of the bonds in a fund’s portfolio – tells you approximately how much the price of a bond, or a fund’s net asset value, would fall or rise depending on the direction of interest rates. A duration of 5.5, for example, implies that a fund’s share price would fall roughly 5.5% if market rates rise one percentage point over a 12-month period.

What's the Single Biggest Risk to Bond Returns?

A rising stock market that attracts investment assets at the expense of bonds, or a growing government budget deficit can hurt returns on bonds, but nothing cripples them like the "I" word.

Indeed, nothing is as pernicious to a lender than inflation, which represents a double-whammy for bondholders.

After all, inflation both devalues the real worth of future interest payments and usually results in higher interest rates that detract from a bond’s current market value.

Recession talk makes bond investors nervous for good reason. Corporate bonds are at increased risk of default when the economy is contracting. It turn, that keeps a lid on bond prices.

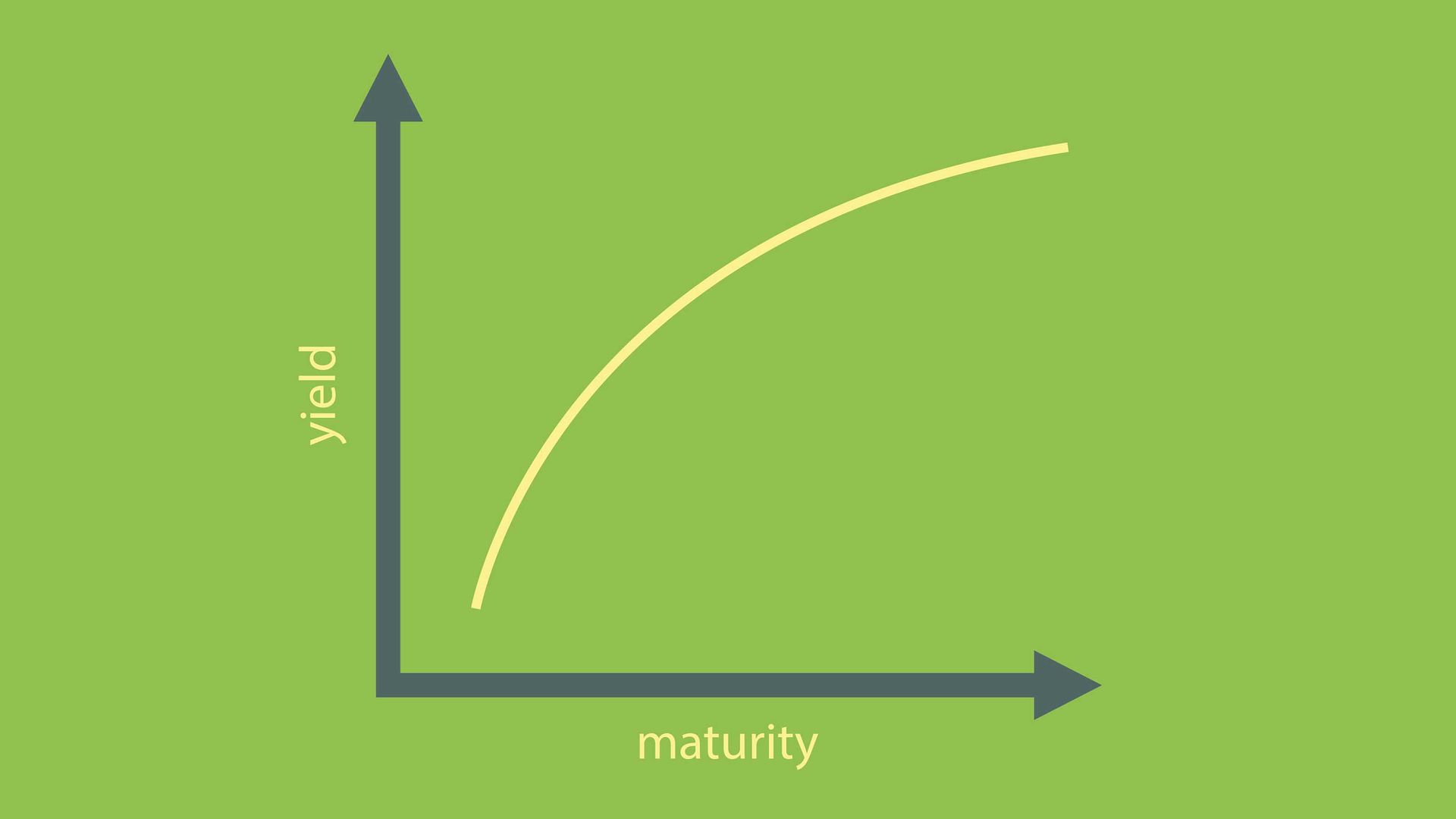

What Is an Inverted Yield Curve?

Nothing gets recession talk started like an inverted yield curve.

A wild and volatile bond market, also known as an upside-down bond market, isn't nearly as worrisome. It's also not good when Treasury securities pay higher interest rates than corporate bonds or mortgages with the same maturity.

But an inverted yield curve is worse. When short-term Treasury notes pay a higher interest rate than long-term government notes and bonds, there be monsters ahead.

Inverted yield curves are usually taken as a warning that the economy is slowing and might go into a recession. Longer-dated maturities typically yield more than shorter ones; when that relationship reverses, it could be because investors foresee lower interest rates as the economy slows along with borrowing demand.

However, there are exceptions, and an inverted yield curve doesn’t always spell disaster.

What Is the Highest Rating a Bond Can Have?

The two most important agencies that rate the creditworthiness of bond issues are Moody's and Standard & Poor's.

The highest credit score for borrowers – be they companies or countries – is AAA. Both agencies use the same designation when it comes to the very best, most reliable debtors.

AAA ratings are precious and hard to earn. The government of Canada gets one. So does pharmaceutical giant Johnson & Johnson also has a AAA rating. Apple, however, even with its massive war chest and firehouse of free cash flow, gets a rating of Aa1 from Moody's. (S&P rates Apple at AAA; AA+, a step lower, is the equivalent of Aa1 at Standard & Poor's.)

Famously, the U.S. lost its top-notch rating from Standard & Poor’s when the rating agency downgraded Uncle Sam to AA+ in August 2011, citing a high level of debt and weakened “effectiveness, stability and predictability of American policymaking” with regard to the debt load.

What Is a Bond's Yield to Maturity?

Don't mistake this for the interest rate on the bond when it is issued, or the interest rate the bond pays between now and the date it is scheduled to mature.

Yield to maturity is the total return, including a gain or loss in the bond’s price, that you can expect if you buy the bond today and keep it until it matures.

Rather, it's a total return calculation.

Although the word “yield” is in the phrase “yield to maturity,” the figure also includes the future gain or loss in the bond’s value to bring it back to par.

Where Do Bondholders Rank in Case of Bankruptcy?

If a company goes out of business and liquidates, bondholders have the first claim on whatever cash becomes available in the bankruptcy.

Anyone who does not own securities but is owed money by the borrower becomes a general creditor. General creditors might include employees, contractors and suppliers. Stockholders are last in line.

Everyone else – including shareholders, bankers with delinquent loans to the business, and the company's suppliers – must get in line behind the bondholders.

What's the Minimum Order My Broker Will Sell Me?

It's a misconception that when you buy bonds from your broker, you must order in multiples of $1,000.

In fact, you can buy $25 “baby bond” units, and often those are better and more liquid than bonds with a face value of $1,000. The $25 units are simple to buy because they are listed just like stocks or ETF units.

When Do Low-Rated, High-Yield Bonds Do Well?

High-yield bonds, also known as junk bonds, can have a legitimate place in a fixed income portfolio.

That's especially true when the economy is so strong that even weak companies are profitable and paying their debts.

Junk bonds are often seen as more related to stocks than to other bonds, and they tend to do better when the economy is growing swiftly and stocks are rising.

What's the Deal with Munis?

Municipal bonds are often known as tax-exempt bonds, but that doesn't mean you always escape income tax on the interest.

Some municipalities issue both tax-free and taxable bonds because some buyers, such as pension funds and foreign investors, would benefit from the higher yield but do not get anything from a tax exemption.

13 Best Vanguard Funds for the Next Bull Market

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

High Yields From High-Rate Lenders

High Yields From High-Rate LendersInvestors seeking out high yields can find them in high-rate lenders, non-bank lenders and a few financial REITs.

By Jeffrey R. Kosnett • Published

-

Time to Consider Foreign Bonds

Time to Consider Foreign BondsIn 2023, foreign bonds deserve a place on the fringes of a total-return-oriented fixed-income portfolio.

By Jeffrey R. Kosnett • Published

-

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks Reeling

Silicon Valley Bank, Signature Bank Failures Send Bank Stocks ReelingFinancial stocks continued to sell off following the collapse of regional lenders SVB and Signature Bank.

By Karee Venema • Last updated

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

By Dan Burrows • Published

-

Stock Market Today: S&P 500 Snaps Weekly Losing Streak

Stock Market Today: S&P 500 Snaps Weekly Losing StreakAI stocks were big winners on Friday after C3.ai posted solid earnings and guidance.

By Karee Venema • Published

-

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO Splits

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO SplitsThe major benchmarks closed higher Monday after notching their worst week of the year on Friday.

By Karee Venema • Published

-

The 9 Best Utility Stocks to Buy Now

The 9 Best Utility Stocks to Buy NowIncome investors like utility stocks for their stability and generous dividends. Here are nine to watch in an uncertain market.

By Jeff Reeves • Published

-

Five Ways to Diversify Your Portfolio During a Recession

Five Ways to Diversify Your Portfolio During a RecessionInvesting successfully during a recession is tough. However, you can protect and grow your portfolio with various diversification strategies.

By Justin Grossbard • Published