The Best Semiconductor Stocks to Buy Now

Semiconductor stocks have struggled for the greater part of the past year, but all the drivers remain in place for success once the macro clouds clear.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

The prospects were high for the best semiconductor stocks heading into 2022, but the industry has been hit by curveballs over the last year that have upended the market.

Take for instance the Biden administration's tech war against China, which restricts the country from buying advanced chips and equipment from the U.S. Further, China's COVID-related lockdowns in key cities where chipmaking factories reside added strain to an already disrupted supply chain. And when those logistics issues began to ease, demand for chips which peaked during the pandemic had also started to decline.

Add to that the prevalent negative economic sentiment due to the Fed hiking interest rates.

Still, the semiconductor landscape is not completely bleak. Many of the same potential drivers for semiconductor stocks that were in place this year are still relevant in 2023: The transformation of the automotive market toward electric vehicles (EVs) and the expansion of 5G.

There's also the continued digitization of industrial economies – which drives the growth in cloud computing, which drives data center spending, which drives the demand for more and more semiconductors. The easing of supply-chain issues could bring focus back to these catalysts next year.

2022 was certainly been one of the most difficult years for semiconductor stocks in recent memory. But for intrepid investors, it may represent what history will show was one of the greatest buying opportunities ever.

With that in mind, here are five of the best semiconductor stocks to buy now. Some of them are simply fundamentally superior with leadership positions in growing end markets. Others offer some grist for stock pickers who like to look below the surface for opportunities.

Data is as of March 6. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Kulicke and Soffa Industries

- Market value: $3.0 billion

- Dividend yield: 1.4%

Kulicke and Soffa Industries (KLIC (opens in new tab), $52.62), which provides semiconductor manufacturing equipment and services, had stellar 2021 results. These comparisons make 2022 look not quite as good.

In its fiscal fourth-quarter report ended Oct. 1, the company reported a 41% and 47% year-over-year decrease in revenue and earnings, respectively. Adding to the pain, fiscal 2022 revenues were flat. The stock has also lost the favor of many analysts, suffering from earnings estimate cuts. This, combined with a bearish landscape, may make for tough sledding in KLIC shares. And the sledding was tough for the stock in 2022, down more than 38% for the year-to-date in October. But it's up about 40% since then.

Kulicke and Soffa faces a concentration risk where relatively few customers can disproportionately impact earnings, and if you sell to semiconductor manufacturers and related companies, there's not that many customers to be had. In 2021 and 2022, KLIC had customers who accounted for approximately 17% of sales in each year.

To broaden its product portfolio and strengthen its capabilities, KLIC acquired high-precision micro dispensing equipment manufacturer, Advanced Jet Automation. The acquisition will allow Kulicke and Soffa to tap into the $2 billion dispensing equipment market and could be a long-term growth driver.

KLIC is a solid choice among semiconductor stocks for income investors too. It is yielding about 1.4%, and the company has averaged annual dividend growth of roughly 30% since 2018, when it was instituted.

KLA

- Market value: $52.6 billion

- Dividend yield: 1.4%

The investment thesis for KLA (KLA (opens in new tab), $379.67) which offers semiconductor manufacturing solutions, is simple: fundamentals and industry outlook. And it's one that remains intact following the company's fiscal second-quarter earnings report.

Revenue and GAAP earnings were up 27% and 46.3% year-over-year, respectively. The reported revenue of $2.98 billion came in above the higher end of KLA's guidance range of $2.65 billion-$2.95 billion.

KLA also expects to sustain its bottom-line growth, with earnings per share (EPS) guidance of $4.52 to $5.46 for the fiscal third quarter. This would represent about 23% year-over-year growth at the top end of the range.

The company sports a decent balance sheet with good liquidity, and operating cash flow exceeded $688 million in the second quarter. Its free cash flow (cash from operations less capital expenditures) arrived at $594.6 million.

Sales growth, guidance for continued EPS improvement and a decent balance sheet is probably what insulated KLAC shares from the overall downdraft in semiconductor stocks. Shares are up 14% in the past 12 months (more if you include the 1.4% dividend), versus the iShares Semiconductor ETF (SOXX (opens in new tab)), which is down almost 8%.

This is not an entirely logical constellation, however. Semiconductor supply companies face a big concentration as there are a limited number of customers big enough to service the foundries and related companies. So, when one or all of these customers face troubles, it can spell trouble for KLA too. Though Taiwan Semiconductor (TSM (opens in new tab)) and Advanced Micro Devices (AMD (opens in new tab)) are still growing, for example, Nvidia's (NVDA (opens in new tab)) sales contracted in the most recent quarter. This trend bears watching.

Notwithstanding, a sure sign of management confidence – or hubris – is KLA's use of cash, the largest expenditure of which were for the company's stock buybacks and payments of dividends to shareholders, at 82% of free cash flow. All in, KLA returned a total of $1.33 billion to shareholders in the 12 months ending September 2022. For a company with a market cap of around $53 billion, this is a big number.

And behind financial strength and earnings momentum is increasing demand for semiconductors worldwide in the form of a one-two punch. In addition to governments mobilizing to increase production as a means of weaning their economies from reliance on South Korean and Taiwanese chip giants Samsung and Taiwan Semiconductor, the digitization of daily life is putting chips in everything from doorbells to automotive systems.

All of this makes KLAC one of the best semiconductor stocks going forward.

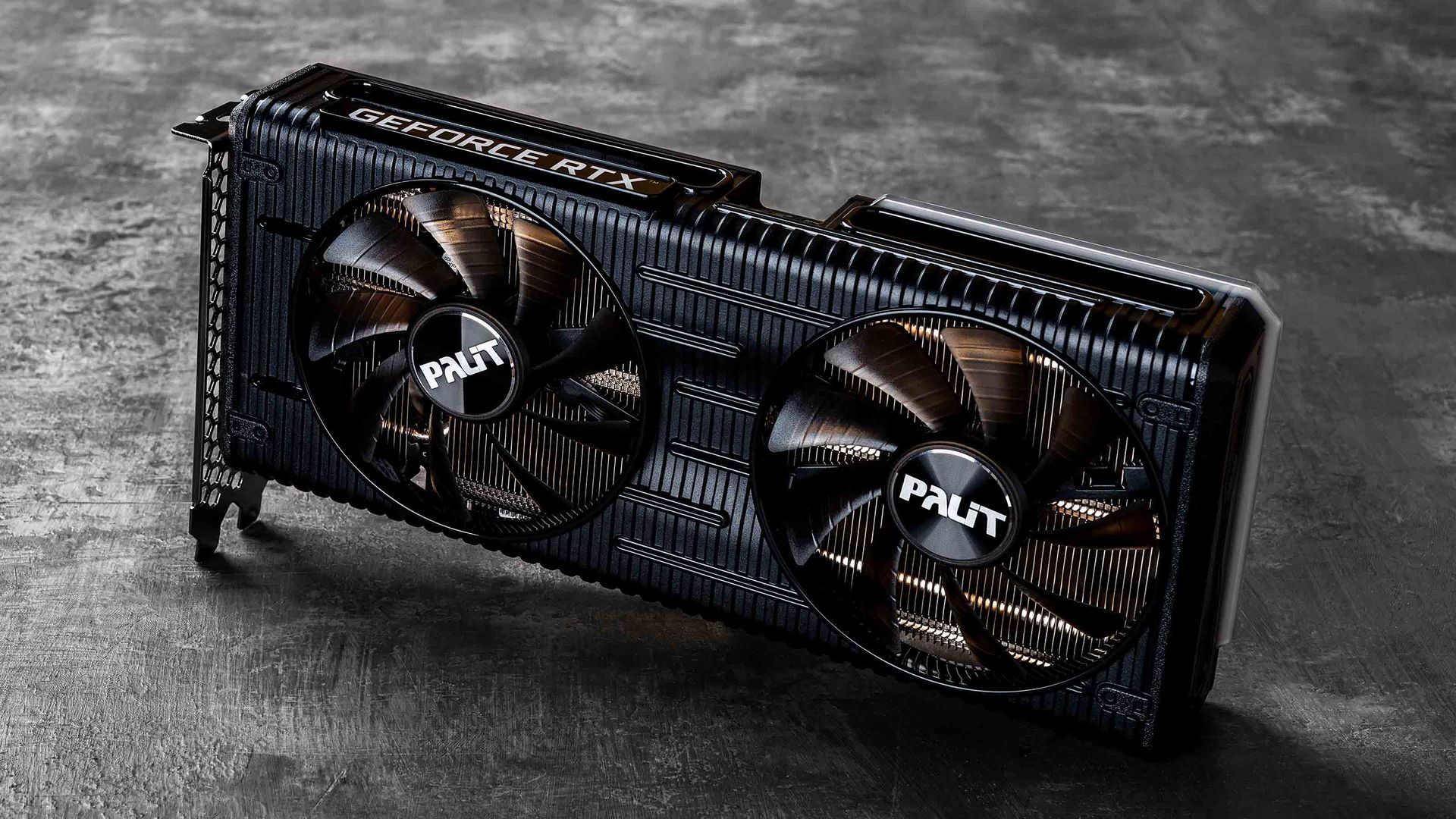

Nvidia

- Market value: $389.5 billion

- Dividend yield: 0.1%

Nvidia's (NVDA (opens in new tab), $156.28) share price has been on a roller-coaster ride over the past 12 months. The stock was down more than 61% for the year-to-date in October 2022, after the U.S. government initiated new restrictions on chip exports to China. NVDA has found its footing since then and is starting to gain momentum. Nvidia shares are up more than 60% so far in 2023.

For its fiscal 2023 fourth-quarter report, Nvidia barely beat analysts' revenue expectations, though its earnings per share beat estimates. Its revenue was down 21% year-over-year, and up 2% from the previous quarter.

The company's gaming division also announced a 46% year-on-year decline in sales in its Q4 report. Its data center division remains strong, however, with revenue of $3.62 billion, up 11% from the year-ago figure – a silver lining for investors since data center represents 60% of NVDA's fourth-quarter revenue by end market. Gaming, on the other hand, represents only 30%.

And while many chip companies have been hammered by the U.S. export controls that affected demand from Chinese companies, Nvidia found a way to circumvent this rule. The firm introduced a new graphics processing chip, the A800, that can be exported to China under the new U.S. export restrictions on AI (artificial intelligence) chipsets.

The A800 has the same processing power of its flagship A100 chip, but has a narrower interconnect bandwidth to receive data from other chips, which is critical for AI applications. Specifically, while the A100 can send data at 600 gigabytes per second, the A800 can only transmit data at 400 gigabytes per second.

Nvidia has solid fundamentals and arguably remains the best AI stock among semis, but it isn't out of the woods yet. Its rising inventory levels, now at $5.2 billion – double the year-ago figure due to weakening demand for its graphics processing units – can present a problem in the future. Funds tied up in unsold units could affect its earnings and cash flow.

However, Jensen Huang, founder and CEO of NVIDIA, said that the inventory correction is "largely" behind the company, and that it will likely end in the first half of the new fiscal year. For investors who believe in chipmakers, NVDA is one of the best semiconductors stocks there is.

Marvell Technology

- Market value: $31.5 billion

- Dividend yield: 0.7%

Everything seems to still be moving in the right direction at Marvell Technology (MRVL (opens in new tab), $42.27), except for the share price which is off about 33% in the past 12 months. Off the charts, though, the company – which makes semiconductors for data storage, communications and consumer markets – is still displaying a relatively strong momentum.

Marvell reported in-line results in the fourth quarter of fiscal 2023. The company had revenue of $1.4 billion, up 6% year-over-year. For the year, MRVL reported record revenue of $5.92 billion.

MRVL is not impervious to the headwinds facing the semi industry such as weakening demand in the consumer sector, but it was able to maintain growth in other end markets. This was particularly true in the enterprise networking and automotive/industrial, where the revenue rose 39% and 25%, respectively, year-over-year.

When looking at Marvell, or for that matter, most tech stocks, the earnings per share is not always the best measurement for success. A look at Marvell's statement of cash flows shows that stock-based compensation, depreciation and amortization of intangible assets totaled nearly $500 million for the most recently reported quarter, a figure which dwarfs a reported net loss of $15 million.

Also notable also is the company's commitment to research and development, spending nearly $450 million in the last quarter. Clearly, MRVL is looking to the future, though what the future looks like, beyond continued, if albeit lumpy expansion, remains difficult to discern.

SiTime

- Market value: $2.8 billion

- Dividend yield: N/A

SiTime (SITM (opens in new tab), $129.98) makes silicon-based timing products for use in electronic equipment, from mobile phones to graphics and identity cards. Timing is critical to the functioning of digital processing, and the more environments silicon-based – as opposed to quartz – timing devices can be used, the more areas advanced processing can be deployed. Timing, as they say, is everything.

The company estimates there are one to two timing chips per device today, creating a market for 40 billion units. But this will grow to 125 billion units in 2030 as silicon-based timing applications proliferate and as consumers and industries own more connected devices.

SITM demonstrated significant momentum during 2021, with revenue doubling from $36 million in the first quarter of the year to $76 million in the fourth quarter. Although revenue growth has been relatively flat this year, SiTime was able to maintain its revenue above $70 million in three of the four quarters of 2022 (Q4 revenue came in at $60.8 million).

Annually, SiTime is holding up. For all of 2022, revenues were up 29.6% over 2021, laudable in today's semiconductor market.

When assuring investors, SITM notes design wins, its leadership position, and quote activity, which are important. But better pricing and more repeat business, both of which SiTime is positioned to realize, may be what moves the needle on sales and earnings.

SITM is a small-cap stock, and small companies can get buffeted by circumstances well beyond their control. And while this may well be the case with SiTime, for believers in semis, the timing market, and SiTime's place in it, SITM is one of the best semiconductor stocks out there.

-

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

From SECURE Act to SECURE 2.0: Is Your Estate Plan Safe?

From SECURE Act to SECURE 2.0: Is Your Estate Plan Safe?The ever-evolving legislative landscape provides both challenges and opportunities when it comes to making plans for your retirement and your estate. A key focus: tax planning.

By Lindsay N. Graves, Esq. • Published

-

Stock Market Today: Weak Economic Data Weighs on Stocks

Stock Market Today: Weak Economic Data Weighs on StocksHealthcare stocks were some of the biggest gainers on Wall Street Wednesday, while tech shares lagged.

By Karee Venema • Published

-

Stock Market Today: Tech, Bank Stocks Lead Markets Higher

Stock Market Today: Tech, Bank Stocks Lead Markets HigherRetailers were big gainers, too, thanks to strong earnings from Lululemon Athletica.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Higher in Volatile Session

Stock Market Today: Stocks Close Higher in Volatile SessionThe major indexes spent most of Thursday in rally mode, but selling pressure emerged in afternoon trading.

By Karee Venema • Published

-

Stock Market Today: Silicon Valley Bank Failure Sinks Stocks

Stock Market Today: Silicon Valley Bank Failure Sinks StocksThe largest bank failure since the 2008 financial crisis stole the spotlight from the February jobs report.

By Karee Venema • Published

-

Stock Market Today: Stocks Sink Ahead of February Jobs Report

Stock Market Today: Stocks Sink Ahead of February Jobs ReportThe major benchmarks finished solidly lower Thursday as bank stocks sold off.

By Karee Venema • Published

-

Stock Market Today: Stocks Choppy After Strong Jobs Data

Stock Market Today: Stocks Choppy After Strong Jobs DataBoth the ADP private payrolls report and the January job openings update came in stronger than expected.

By Karee Venema • Published

-

Stock Market Today: S&P 500 Snaps Weekly Losing Streak

Stock Market Today: S&P 500 Snaps Weekly Losing StreakAI stocks were big winners on Friday after C3.ai posted solid earnings and guidance.

By Karee Venema • Published

-

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO Splits

Stock Market Today: Stocks Bounce Back; UNP Rallies After CEO SplitsThe major benchmarks closed higher Monday after notching their worst week of the year on Friday.

By Karee Venema • Published