The 5 Best Blue Chip Dividend Stocks to Buy Now

This mini-portfolio of blue chip dividend stocks is well-positioned to generate income and deliver outperformance in tempestuous market times.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

A little more than a year ago we tried an experiment to see how analysts' top-rated blue chip dividend stocks yielding at least 2% would perform in a rapidly deteriorating market.

The idea was that the best blue chip dividend stocks never go out of style, and that they would give income investors both a shot at outperformance and some much-needed peace of mind.

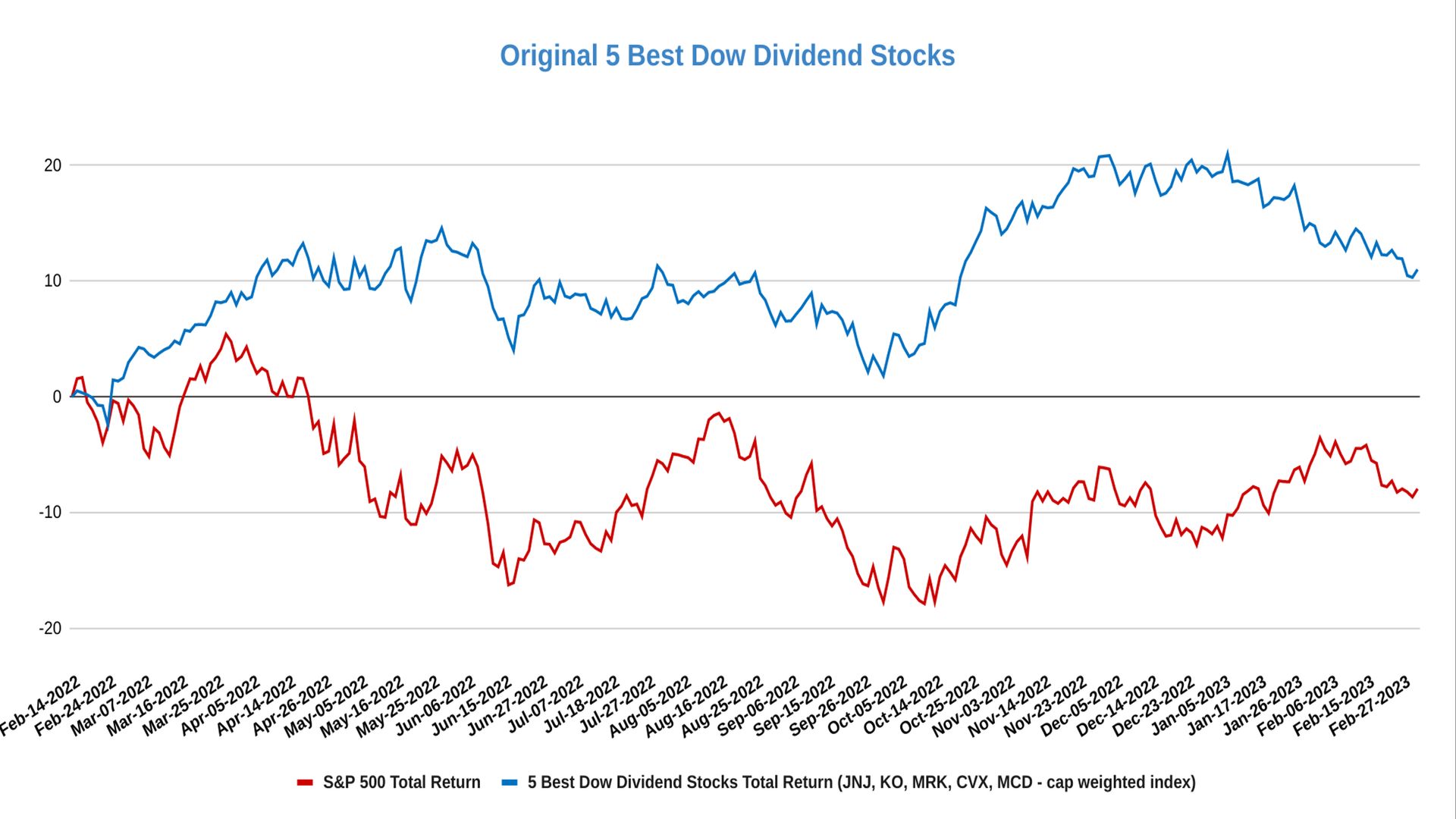

Indeed, they did. As you can see in the chart below, a market-cap weighted index of the five top-rated dividend stocks in the Dow Jones Industrial Average yielding at least 2% as of Feb. 14, 2022 – Chevron (CVX (opens in new tab)), Coca-Cola (KO (opens in new tab)), Johnson & Johnson (JNJ (opens in new tab)), McDonald's (MCD (opens in new tab)) and Merck (MRK (opens in new tab)) – generated a total return (price appreciation plus dividends) of 11% through March 2, 2023.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

By comparison, the S&P 500's total return over the same time frame came to -9.6%.

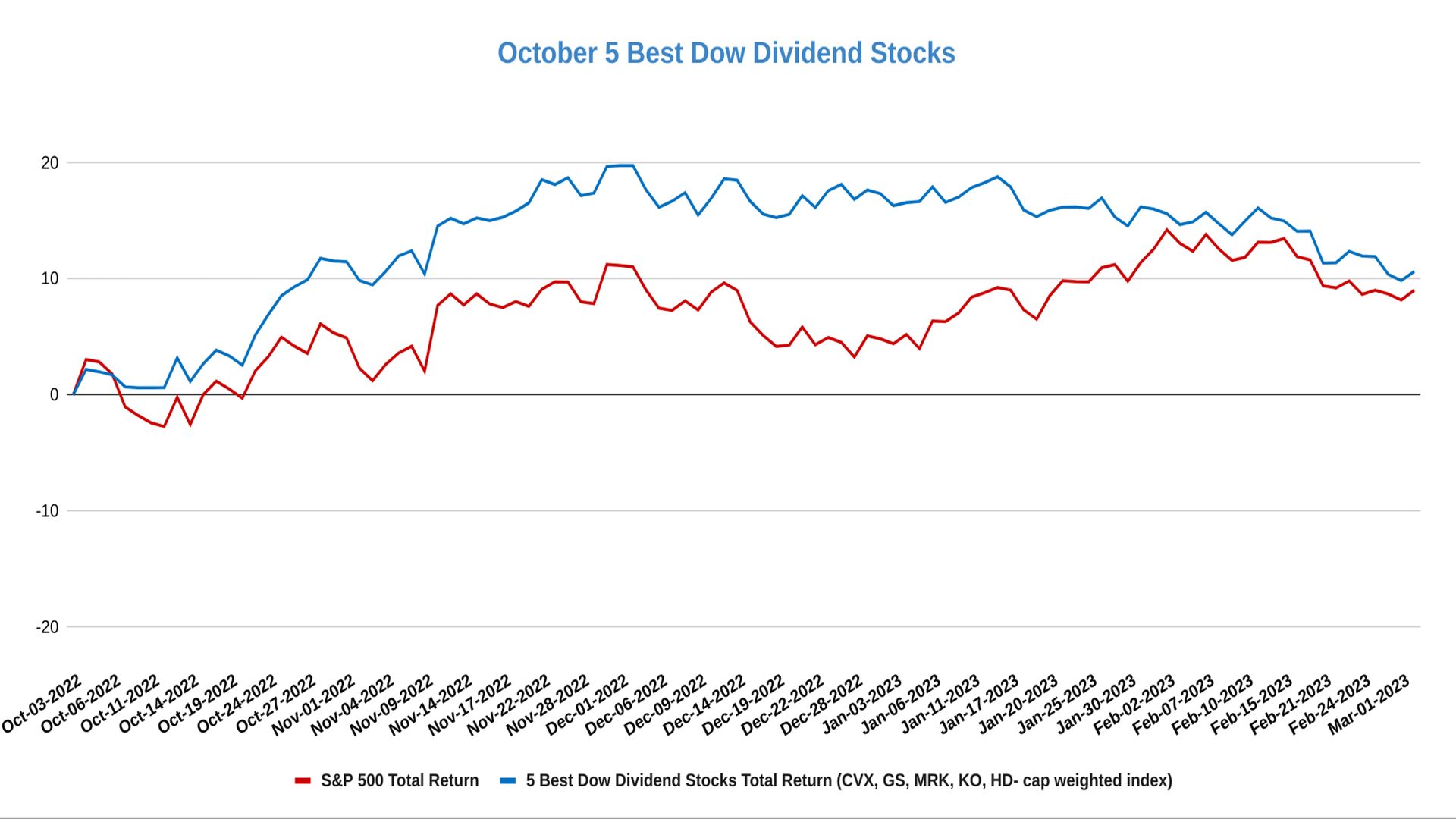

We repeated the experiment in October, but this time looking for analysts' top-rated Dow dividend stocks with yields of at least 2.5%. (Rapidly rising interest rates – and the fact that the dividend yield on the Dow had vaulted to 2.3% from 1.8% a year ago – prompted us to screen for stocks with more attractive yields.)

As you can see in the chart below, this index – comprising Chevron, Goldman Sachs (GS (opens in new tab)), Merck, Coca-Cola and Home Depot (HD (opens in new tab)) – also beat the broader market, albeit by a much narrower margin. From early October through March 2, our second pass at the top-rated blue chip dividend stocks returned 10.7%, vs. 9.1% for the S&P 500. The narrowing of the performance gap can be explained by the market's renewed appetite for risk in early 2023.

The Best Blue Chip Dividend Stocks Right Now

Here's how we found the best blue chip dividend stocks to buy now. Using data from S&P Global Market Intelligence, we screened the Dow Jones Industrial Average for Wall Street analysts' highest-rated blue chip dividend stocks, but this time with dividend yields of at least 1.0%. (We lowered the bar on the income component because of the market's shift back towards growth.)

A quick note on S&P Global Market Intelligence's ratings system: S&P surveys analysts' stock recommendations and scores them on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Any score equal to or below 2.5 means that analysts, on average, rate the stock at Buy. The closer a score gets to 1.0, the stronger the consensus Buy recommendation.

That led us to the following five blue chip dividend stocks, which we list below by strength of analysts' consensus recommendations, from lowest to highest conviction. (Market data and analysts' ratings are as of March 2.)

5. Walmart

- Market value: $378.0 billion

- Dividend yield: 1.6%

- Analysts' consensus recommendation: 1.83 (Buy)

The world's largest retailer gets a consensus recommendation of Buy from Wall Street, and with high conviction, to boot.

Of the 41 analysts covering Walmart (WMT (opens in new tab)) tracked by S&P Global Market Intelligence, 19 rate it at Strong Buy, 10 say Buy and 12 have it at Hold.

Although the discount chain might not wow anyone with its dividend yield, its commitment to payout growth is as solid as they come. This member of the S&P 500 Dividend Aristocrats has increased its disbursement annually for 50 consecutive years and counting.

4. Merck

- Market value: $270.2 billion

- Dividend yield: 2.7%

- Analysts' consensus recommendation: 1.81 (Buy)

Merck (MRK (opens in new tab)) stock is off to a slow start in 2023, but analysts say it's only a matter of time before it gets back to its market-beating ways.

Shares in the pharmaceutical giant are off about 4% for the year-to-date on a price basis, lagging the broader market by more than 9 percentage points. Over the past 52 weeks, however, MRK generated a total return of 44%, vs. -7.7% for the S&P 500.

Bulls contend that MRK's extant blockbuster drugs and a promising pipeline of therapies under development will fuel even more such outperformance for patient investors.

3. Coca-Cola

- Market value: $256.8 billion

- Dividend yield: 3.1%

- Analysts' consensus recommendation: 1.78 (Buy)

When it comes to finding the best stocks for a bear market, few names in the defensive consumer staples sector can match Coca-Cola (KO (opens in new tab)).

KO was hit hard by pandemic lockdowns, which shuttered restaurants, bars, cinemas and other live venues. But those sales are now bounding back. Analysts likewise praise Coca-Cola's ability to offset input cost inflation with pricing power.

KO also happens to be one of Warren Buffett's favorite stocks, accounting for more than 8.5% of the Berkshire Hathaway portfolio. Analysts like it, too, giving it a consensus recommendation of Buy with high conviction.

2. UnitedHealth Group

- Market value: $444.2 billion

- Dividend yield: 1.4%

- Analysts' consensus recommendation: 1.68 (Buy)

Blue chip stocks in defensive sectors such as healthcare tend to hold up better in bear markets, which is why it's no surprise to see UnitedHealth Group (UNH (opens in new tab)) make the cut.

The market's largest health insurer by both market value and revenue garners praise from analysts on a number of fronts. Contributions from its Optum pharmacy benefits manager business are a particular bright spot.

Of the 25 analysts covering UNH tracked by S&P Global Market Intelligence, 13 call it a Strong Buy, seven say Buy and five have it at Hold. That works out to a consensus recommendation of Buy with high conviction.

1. Microsoft

- Market value: $1.89 trillion

- Dividend yield: 1.1%

- Analysts' consensus recommendation: 1.51 (Buy)

Microsoft (MSFT (opens in new tab)) is analysts' top-rated name among all 30 Dow stocks, with a consensus recommendation just shy of Strong Buy.

Shares are up about 5% for the year-to-date and analysts see more outperformance ahead. As much as the market may be fretting about sluggish spending on cloud-based services, analysts' adore MSFT's position and advantages in the fast-growing industry.

Perhaps the most exciting news out of MSFT these days is what it's doing in artificial intelligence. Bulls say the company's investment in ChatGPT could make its moribund Bing search engine a true alternative to Alphabet's (GOOGL (opens in new tab)) Google.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published

-

Stock Market Today: Big Bank Earnings Fail to Lift Stocks

Stock Market Today: Big Bank Earnings Fail to Lift StocksThe major indexes closed lower Friday on hawkish Fed speak and dismal retail sales data.

By Karee Venema • Published

-

Stock Market Today: Stocks Climb After Promising PPI, Jobless Claims

Stock Market Today: Stocks Climb After Promising PPI, Jobless ClaimsThe major market indexes notched a win Thursday as wholesale prices unexpectedly fell and jobless claims hit their highest level in over a year.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After CPI, Fed Minutes

Stock Market Today: Stocks Struggle After CPI, Fed MinutesThe major indexes made modest moves after data showed a mixed picture on inflation and the Fed minutes hinted at another rate hike.

By Karee Venema • Published