Are Regional Bank Stocks a Buy?

Regional bank stocks might look cheap, but analysts caution against going bargain hunting just yet.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Shares in regional bank stocks have stabilized recently, but analysts say both technical and fundamental factors make it too soon to call a bottom in the sector.

The collapses of Silicon Valley Bank and Signature Bank sparked turmoil throughout the regional bank sector in March, necessitating government intervention. And while the worst of the crisis appears to have passed, the big-picture view suggests that investors would do well to wait before risking their capital on seemingly cheap regional bank stocks.

For one, picking individual stocks is always riskier than making broader, more diversified bets. It's also the case that industry analysts had a consensus recommendation of Buy on Silicon Valley Bank right up until the moment it failed. Even the lone analyst who rated SVB shares at Sell was shocked by the speed of the bank's collapse.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

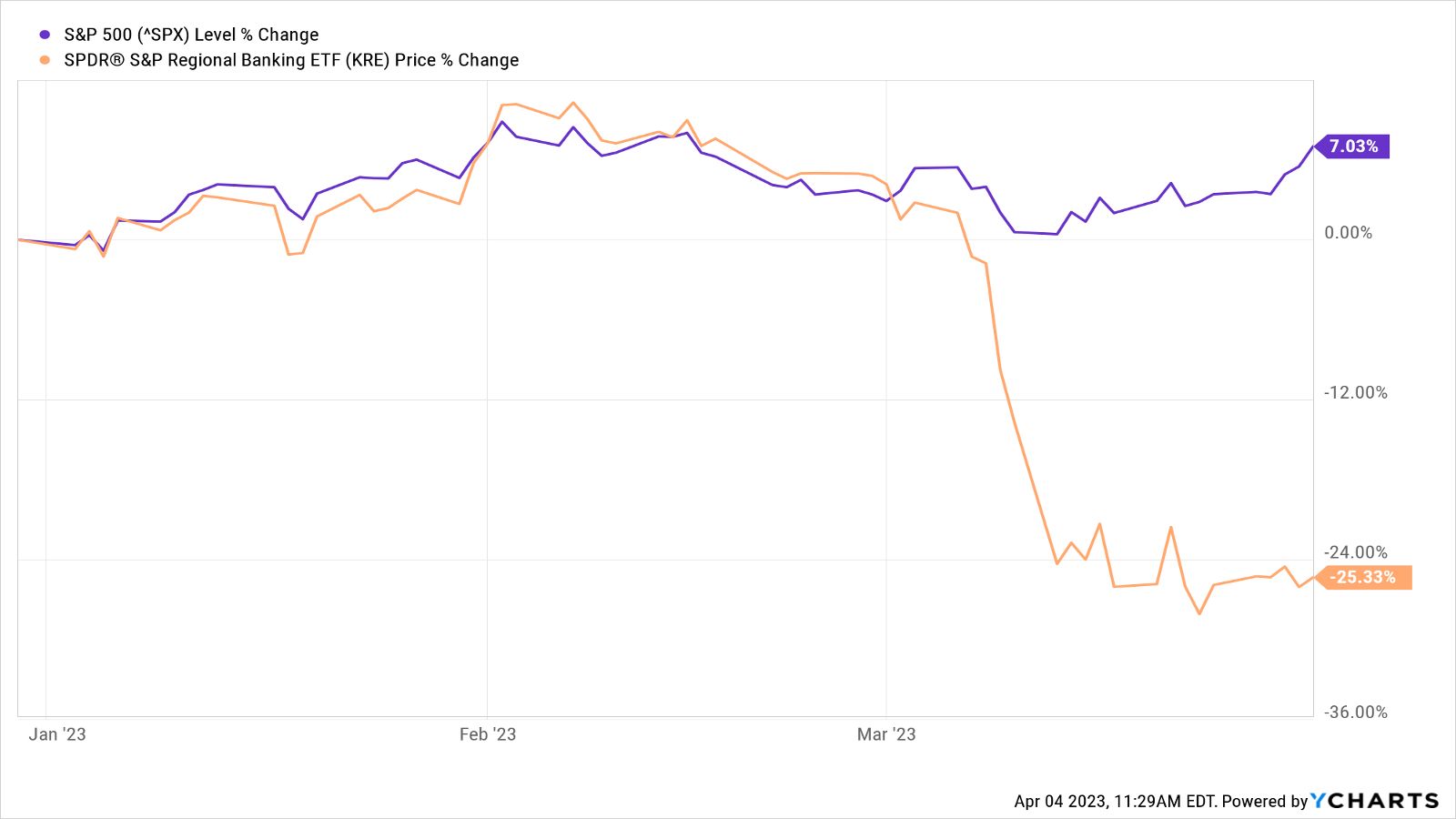

That leaves the SPDR S&P Regional Banking ETF (KRE (opens in new tab)) as the most obvious way to wager on a sector-wide recovery. And by some measures, it does indeed look cheap. After all, the largest and most widely traded regional bank exchange-traded fund lost a quarter of its value during the first three months of the year – a period in which the broader market gained 7% on a price basis.

KRE vs S&P 500 in Q1 2023

And yet while market participants remain rightfully jittery about deposit flight and interest rate risk, since March 20, KRE has traded essentially sideways.

Bulls would argue that the worst is over; that regional bank stocks have been sufficiently discounted to reflect their risks. It might even be time to go bargain hunting in the sector. Bears – and merely more cautious types – are understandably worried that there are other shoes to drop.

It's a tough call for sure. If the idea is to buy low, regional banks as represented by KRE could offer a compelling entry point. Then again, putting cash to work in KRE at current levels might be what's known on Wall Street as trying to catch a falling knife.

So which is it? Based on a technical analysis of KRE, and broader fundamental issues with regional banks, investors should probably look for outperformance elsewhere.

The technical case against regional bank stocks

David Rosenberg, founder and president of Rosenberg Research (opens in new tab), says investors should bide their time on KRE. That's based solely on his reading of the technical indicators.

"In a sense, KRE has held up relatively well in the face of the quagmire experienced by the sector," Rosenberg writes in a note to clients.

Given the pressures of regional bank failures, bank rescues and deposit flight, it's no surprise that regional banks have taken a hit "in both absolute terms and relative to large banks," Rosenberg says. In some ways, they've actually held up fairly well. However, KRE's medium-term momentum has the ETF positioned to remain under pressure into mid-May, Rosenberg maintains.

"This should be enough time to establish support (at lower levels) and build a base," he writes. "KRE will need to go through a basing process in the weeks ahead before it is in position for something more than a short-lived relief rally."

The bottom line is that based on the technicals, it's still too soon to go bargain hunting in regional bank stocks.

The fundamental case against regional bank stocks

More worrisome is what Nicholas Colas and Jessica Rabe, co-founders of DataTrek Research (opens in new tab), have noticed.

Since December 31, 2019, regional banks as represented by KRE are down 25% on a price basis. The broader S&P Bank Index ETF (KBE (opens in new tab)) is off 23.5%.

The S&P 500, however, is up 22.3% on a price basis over the same time period. In other words, regional banks and the wider bank sector have underperformed the broader market by almost 50 percentage points since the beginning of 2020.

That's somewhat alarming, the analysts note.

"Fundamentals alone do not adequately explain the current turmoil in U.S. bank stocks, which leaves us to conclude that the market is primarily concerned about systemic risk," Colas and Rabe write.

The systemic risk comes from three directions, the analysts say:

- The headline risk of additional bank failures or forced mergers

- Commercial real estate loans made by smaller banks are drawing increased attention as office occupancy rates remain at or below 50% and business activity in major U.S. urban centers has not recovered to pre-pandemic levels

- Interest rate uncertainty remains

"None of these problems have easy, quick solutions," the analysts add, almost dryly.

The bottom line on regional bank stocks

If Rosenberg sees a potential entry point for regional bank stocks via KRE in the latter part of May, that could be of interest to tactical investors. But if the fundamental backdrop for regional bank stocks is as opaque as the DataTrek analysts contend, long-term investors might want to steer clear in any case.

Even if KRE's technicals allow for something more than a mere relief rally as we head into the second half of 2023, the fundamental picture, as noted by DataTrek, suggests that KRE's protracted period of underperformance is by no means at an end.

Calls for greater regulation of banks, whether they come to pass or not, are just one overhang on KRE and its components going forward. Recession fears, which are rising by the day, remain another.

Lastly, none other than JPMorgan Chase (JPM (opens in new tab)) CEO Jamie Dimon reminded shareholders in his annual letter in early April that the bank crisis is far from over. Tacticians and traders might find opportunities in KRE and select regional bank stocks in the weeks and months ahead, but buy-and-hold investors should probably tread more carefully.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

IRS Service Improvements Could Bring Faster Tax Refunds

IRS Service Improvements Could Bring Faster Tax RefundsRecent IRS improvements mean taxpayers could see faster tax refunds next year and beyond.

By Katelyn Washington • Published

-

For Best Tax Savings, Year-Round Tax Planning Is Essential

For Best Tax Savings, Year-Round Tax Planning Is EssentialFor optimal, ongoing tax reduction, consider employing these nine strategies throughout the entire year.

By Andy Leung, Private Wealth Adviser • Published

-

Stock Market Today: UPS, First Republic Earnings Drag on Stocks

Stock Market Today: UPS, First Republic Earnings Drag on StocksDismal guidance from logistics giant UPS and dreary deposit data from regional lender First Republic kept a lid on the major indexes Tuesday.

By Karee Venema • Published

-

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have TodayMicrosoft Microsoft stock has lost almost $500 billion in value since its all-time high, but bulls say it's only a matter of time before it reclaims its heights.

By Dan Burrows • Published

-

Stock Market Today: Stocks Wobble Ahead of Big Tech Earnings

Stock Market Today: Stocks Wobble Ahead of Big Tech EarningsThe major indexes made modest moves ahead of earnings from Microsoft, Alphabet and Meta Platforms.

By Karee Venema • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published