Are Capital Gains Taxes Keeping You From Selling Property?

A structured installment sale could help defer or reduce long-term capital gains when you sell real estate.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Homeowners around the country are finding themselves with large amounts of equity in their homes as a result of the recent double-digit increases in real estate values, following more than a decade of growth in many areas. A common reason many are hesitant to sell is the potential capital gains taxes, but a structured installment sale could help with that.

As a financial planner in the San Francisco Bay Area, I frequently hear from clients, friends and associates around the state who are considering unlocking their trapped real estate wealth. Some are empty nesters who want to downsize. Some are done being landlords, while others are considering moving to a more affordable city or state. I also see seniors who — due to age — are looking at selling their home in order to move to an assisted-living community.

This article examines ways to legally reduce your capital gains taxes on the sale of highly appreciated real estate, excluding the more commonly known Internal Revenue Code Section 1031 exchange (opens in new tab) option for investment properties. Instead, we analyze an option that involves the outright sale of appreciated property, known as the structured installment sale.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

How Appreciated Property Sales Are Taxed

In general terms, the difference between what is known as the cost basis and the net sales price is considered your profit and, for tax purposes, your capital gains. To compute your cost basis, add any improvement costs to your purchase price. To arrive at your taxable gain, subtract your cost basis from the purchase price and the tax exclusion. That number equals your capital gain from the sale of your property.

If you have lived in the home for at least two of the last five years, you will have an exclusion, an amount which is not taxable. For an individual, the exclusion amount is $250,000, and for a married couple, it is $500,000 (opens in new tab).

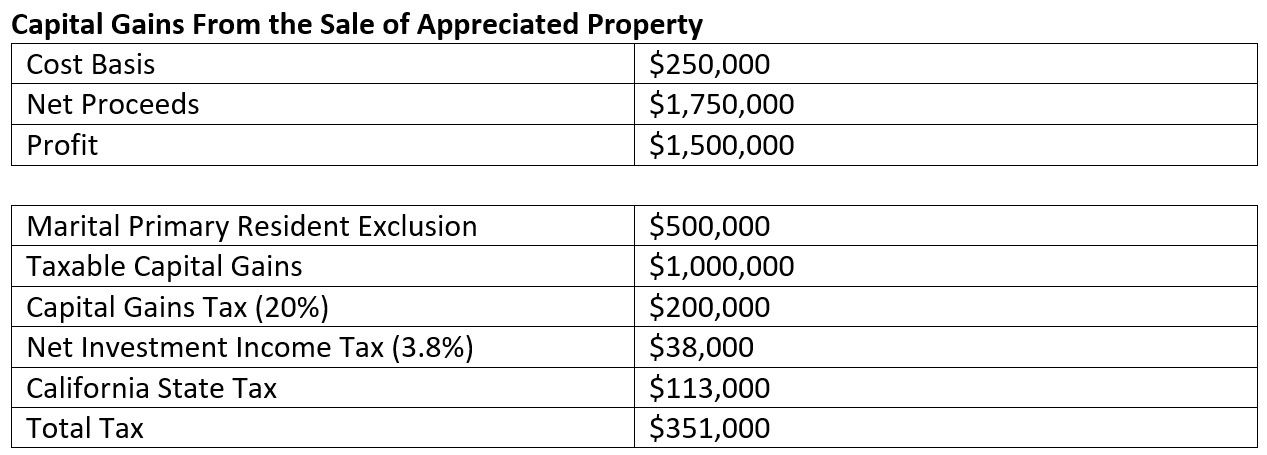

To understand how the sales of highly appreciated real estate are taxed, let’s look at an example. John and Beth purchased their home 25 years ago for $200,000 and spent $50,000 to upgrade their bathroom and kitchen. Their cost basis is $250,000.

Because they live in the San Francisco Bay Area, where real estate has appreciated significantly since they bought their home, the net proceeds from the sale are $1,750,000. Their profit is $1.5 million; however, since this was their primary home, they do not pay taxes on the first $500,000 of the profits due to the capital gains exclusion, leaving them with $1 million in taxable capital gains.

The federal capital gains tax rates range from 0%, 15% to 20% (opens in new tab). The rate you pay depends on your adjusted gross income and filing status. In John and Beth’s case, the capital gains tax will be 20%, or $200,000. An additional federal net investment income tax (NIIT) (opens in new tab) of 3.8% also applies on adjusted gross income in excess of $250,000 for a married couple filing jointly, so John and Beth must pay an additional $38,000.

Since John and Beth are California residents, they are also subject to California state tax (opens in new tab). For Beth and John, the California state tax is an additional $113,000.

The ABCs of Structured Installment Sales

“When the right set of circumstances presents itself, there may be no simpler way to defer, reduce or completely eliminate long-term capital gains when selling real estate, businesses or certain other appreciated assets than a structured installment sale,” according to the CPA Journal in December 2021 (opens in new tab).

A structured installment sale is a vehicle long sanctioned by the Internal Revenue Service Code 453 (opens in new tab). Under this vehicle, sellers of appreciated personal, business or investment property can gain the benefits of an installment sale without the risk of buyer default. Before a structured installment sale can take place, the asset must be deemed eligible for installment sale tax treatment (opens in new tab).

If you’re interested in exploring whether a structured installment sale would be beneficial, it’s a good idea to consult with a financial adviser and a CPA experienced with this type of sale. You’ll also want to find a highly rated insurance company that offers qualified structured installment products to administer the installment payments that provide the tax benefits you’re seeking.

Structured Installment Sale Scenario No. 1

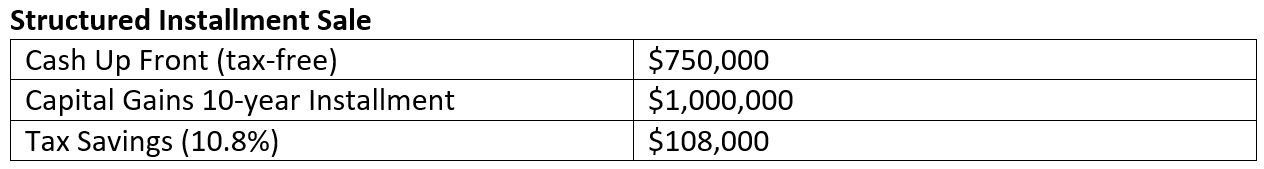

Beth and John work with their CPA and financial planner to implement a structured installment sales plan (opens in new tab) that gives them $750,000 up front, which they will use for their new home. The $750,000 is tax-free due to their cost basis and tax exclusion. They take the $1,000,000 of capital gains as an installment sale over a 10-year period. This strategy allows them to save 10.8% on their taxes (federal, state and NIIT), a total of $108,000. Depending on the actual needs for cash or cash flow and the structure of the installment sale, the tax burden can be reduced even further in many cases.

In addition to the tax savings, the structured installment sale offers a less obvious additional financial benefit. With a traditional sale, the $351,000 John and Beth pay in taxes is gone forever. With the installment sale, you pay taxes only on each year’s taxable installment amount. In other words, the remaining untaxed balance will continue to receive an investment rate of return, until actually paid out over the term of the installment. Using a 4% return example on the $351,000 paid out over 10 years, John and Beth would receive over $100,000 of additional income from the tax dollars they would have otherwise paid when selling the house.

Structured Installment Sale Scenario No. 2

John and Beth retired at 63. They believe they can live on $80,000 annually after using the $750,000 to pay for their new home. They decide to use the annual payments from the structured installment sale as their primary source of income for the next seven years in addition to some interest, dividends and savings. This allows them to defer taking their Social Security benefits until the maximum payout at age 70. They also plan on leaving their retirement accounts alone until their required minimum distribution ages. They now structure the installment sale over a 20-year period, which enables them to stay at a 0% federal estate tax rate for several years, ultimately reducing the total amount of capital gains taxes even further.

Depending on a taxpayer’s total income, the potential tax bill could be further reduced. In some cases, this type of structure may result in some years of no tax obligation within the installment sale period. This is why it is critical to work with an experienced financial adviser and tax professional in structuring this type of sale.

A Final Word

Best practices for a structured installment sale include:

- Preparing for a structured installment sale before you put your appreciated property on the market.

- Setting up a structured installment agreement with a life insurance company specializing in these arrangements.

- Disclosing the structured installment sale in your real estate contract because the buyer must agree.

The potential disadvantages of a structured installment sale include the complexity of the product and the time it takes to set up.

Structured installment sales are a potential way that you can mitigate the taxes paid in the sale of highly appreciated personal, business or investment property. It can also be utilized when selling a traditional business not related to real estate. Before you proceed with such a sale, consult with qualified professionals to decide whether this vehicle is right for you.

Amy Buttell contributed to this article.

This article was provided by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC (opens in new tab) or with FINRA (opens in new tab).

Since 2003, Lars Larsen has been committed to providing a personalized, caring approach with his clients, providing stability, promoting financial well-being and protecting their legacies. Born and raised in Denmark, a highly taxed country with a social safety net, he realized early on the concerns of so many Americans regarding their retirement income. This helped shape the focus and philosophy of Heritage Financial North (opens in new tab).

Advisory Services Offered Through CreativeOne Wealth, LLC a Registered Investment Advisor. Heritage Financial North, Heritage Financial North Insurance Services and CreativeOne Wealth, LLC are not affiliated. CA Insurance License # 0E02803

This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This information is not sponsored or endorsed by the Social Security Administration or any governmental agency.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Why Investors Should Avoid Buying the Banking Sector Dip

Why Investors Should Avoid Buying the Banking Sector DipEven though things appear to have settled after SVB's collapse, that doesn’t mean all is clear. Consider options like healthcare and consumer staples instead.

By Austin Graff, CFA • Published

-

Four Sustainable Investments That Could Have a Positive Impact

Four Sustainable Investments That Could Have a Positive ImpactAs we celebrate Earth Day, consider doing some research aimed at transitioning to a more sustainable and responsible portfolio. These four companies are worth a look.

By Peter Krull, CSRIC® • Published

-

In an Overpayment Scam, Your Bank Could Be a Thief’s Best Friend

In an Overpayment Scam, Your Bank Could Be a Thief’s Best FriendOne man learned the hard way that an overpayment scam can happen to anyone, but the even harder lesson might be that his bank did nothing to protect him.

By H. Dennis Beaver, Esq. • Published

-

Want to Do Board Service? Start the Search Before You Retire

Want to Do Board Service? Start the Search Before You RetireSeasoned executives who want to shift to advisory and thought leader roles should evaluate motivations and skills and build a strong professional network.

By Anne deBruin Sample, CEO • Published

-

Why Investing in Debt-Free DST Properties Makes Sense Today

Why Investing in Debt-Free DST Properties Makes Sense TodayHeadlines about world-class real estate firms being forced to relinquish assets show the dangers of investing in leveraged real estate.

By Dwight Kay • Published

-

Don’t Hand Your Retirement Income Planning Over to AI Just Yet

Don’t Hand Your Retirement Income Planning Over to AI Just YetSome are saying artificial intelligence can replace human financial advisers, but even ChatGPT recognizes the value of experience, judgment and a beating heart.

By Jerry Golden, Investment Adviser Representative • Published