Microsoft Buys Activision With One Eye on the Cloud

MSFT’s $68.7 billion deal for ATVI brings the tech giant a library of A+ titles … and another way to leverage its cloud heft.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

Long-suffering shareholders — not to mention canny value investors — were rewarded for their patience in Activision Blizzard (ATVI (opens in new tab), $65.39) Tuesday when Microsoft (MSFT (opens in new tab), $310.20) agreed to pay $68.7 billion, or $95 a share in cash, for the troubled video game publisher.

After all, ATVI, the developer of global hits such as World of Warcraft and the Call of Duty franchise, had an annus horribilis in 2021.

Allegations of sexual harassment, litigation, a torrent of bad press and calls for CEO Bobby Kotick to step down would have been trouble enough. Tough year-over-year comparisons against 2020's pandemic-fueled growth only made matters worse.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

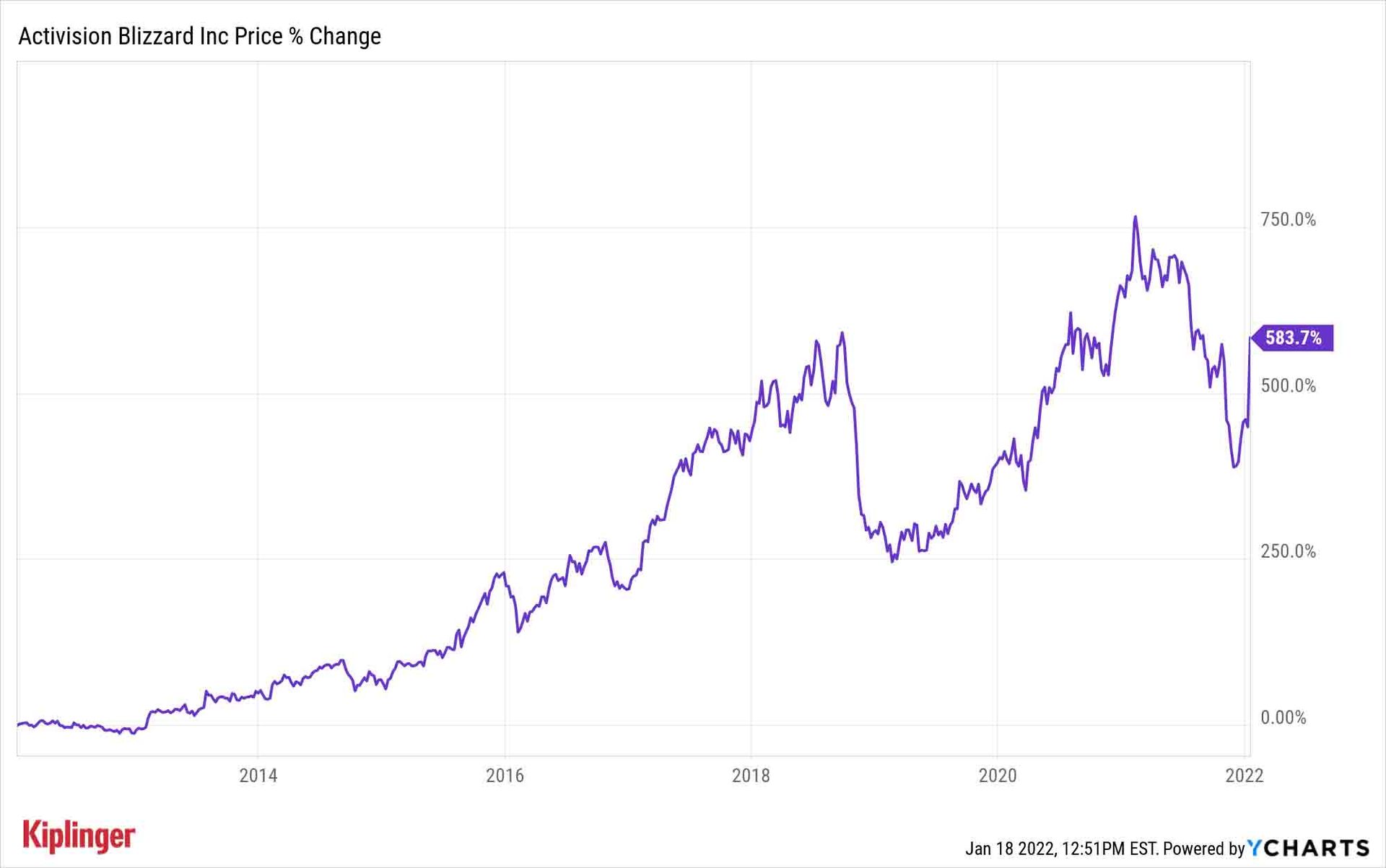

Shares in Activision Blizzard, which closed at an all-time high of $115.82 in February, lost 28% last year. That lagged the tech-heavy Nasdaq Composite by nearly 50 percentage points.

Shares naturally popped on the Microsoft news – a deal in which the software titan is paying a premium of roughly 30% to the video game maker's Friday closing price. ATVI stock was up more than 25% as of midday Tuesday. (U.S. markets were closed Monday in observance of Martin Luther King Jr. Day.)

Some newer ATVI shareholders will close out their investment with losses, but longer-term holders will go out with a smile.

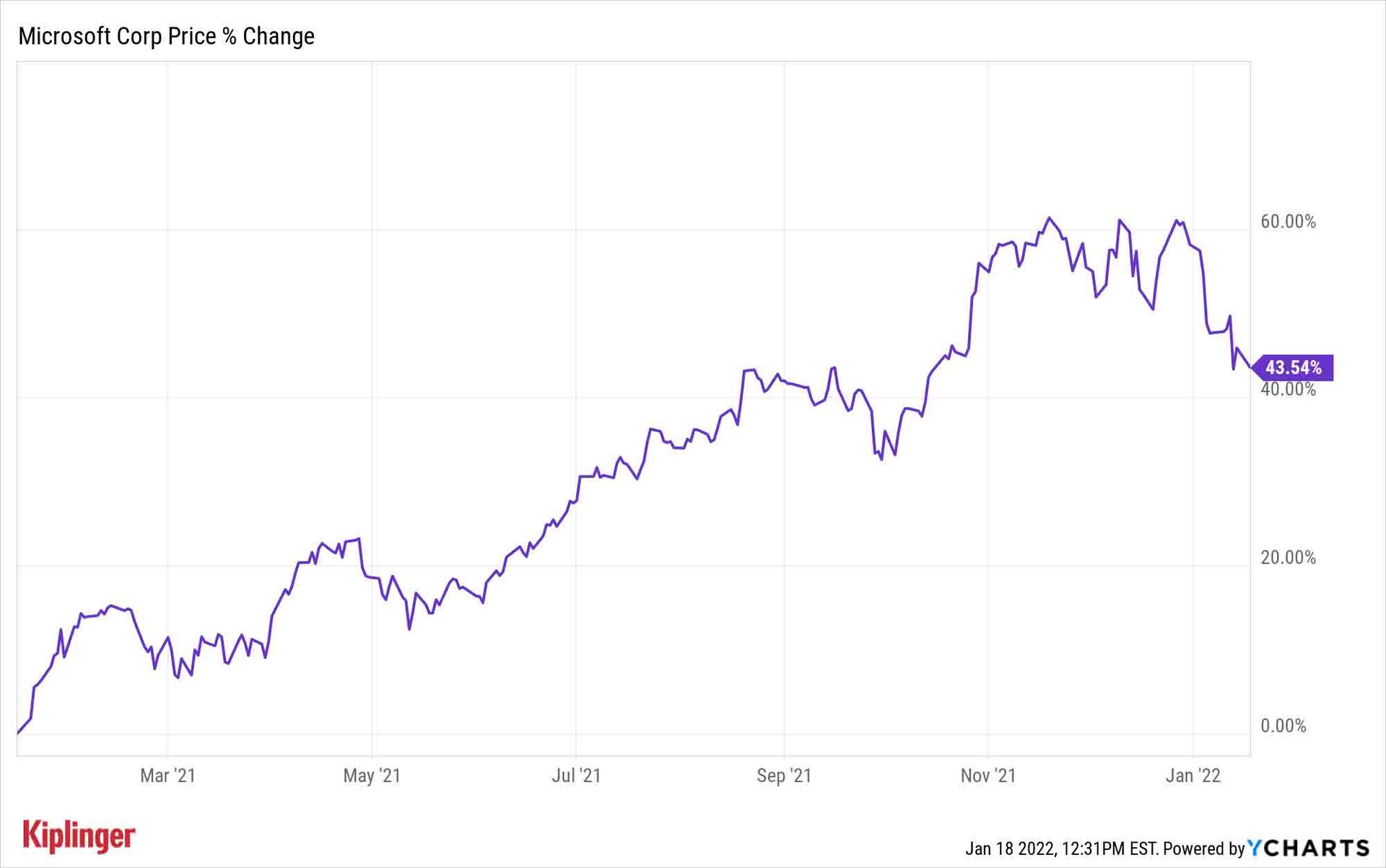

MSFT shares were slightly lower Tuesday, but Microsoft shareholders should like this arrangement for the long run. The acquisition unites Activision’s considerable talents for content production and distribution with MSFT's Xbox console and subscription-based gaming business.

It's the largest deal in dollar terms in Microsoft's history, and comes as the emergent metaverse and other industry trends are forecast to deliver outsized industry growth for years to come.

Why Microsoft Bought Activision Blizzard

The global gaming market is projected to expand to $546.0 billion in 2028 from $229.2 billion last year, or a compound annual growth rate of 13.2%, according to data from market researcher Fortune Business Insights.

Not only does the deal create the world's third-largest video game company, but — perhaps more importantly — it gives MSFT another way to leverage its behemoth of a cloud-based services business.

Indeed, gaming's future as a cloud-based product was one of the reasons behind Cambiar Investors' interest in Activision Blizzard, says Chief Investment Officer Brian Barish.

Cambiar, a Denver-based active value manager with $8.1 billion in assets under management, initiated stakes in ATVI in the fourth quarter. The video game publisher accounts for 2% to 2.5% of the funds that own it; namely, Cambiar Opportunity Fund (CAMOX (opens in new tab)) and Cambiar Aggressive Value Fund (CAMAX (opens in new tab)).

Barish saw value in a stock beaten down by scandal, negative press and difficult year-over-year comparisons — especially one that was trading at just around 13 times free cash flow.

"The conclusion at the time of purchase was there was some component of 'inevitability' that the management suite drama would conclude in some constructive fashion, along with scarcity value for a major video game studio," Barish says.

And make no mistake: That scarcity value is key at a time when major cloud companies such as Amazon.com (AMZN (opens in new tab)), Google parent Alphabet (GOOGL (opens in new tab)) and Microsoft all have designs on the space.

"Eventually we expect video games to become a cloud-based product (as compared to console based), and more content to throw at the customer should expedite this process," Barish adds.

That's the strategic rationale behind Microsoft’s deal for Activision, Barish surmises. "The migration will take a lot of time, however," he cautions.

Bottom Line

It appears investors in ATVI can put the drama surrounding the C-Suite and the stock behind them. MSFT, meanwhile, looks to have made a bold strategic acquisition in a massive and fast-growing industry.

And as for investors in other video game studios? Does the MSFT-ATVI marriage make those assets more valuable?

"Possibly," Barish says.

Dan Burrows is Kiplinger's senior investing writer, having joined the august publication full time in 2016.

A long-time financial journalist, Dan is a veteran of SmartMoney, MarketWatch, CBS MoneyWatch, InvestorPlace and DailyFinance. He has written for The Wall Street Journal, Bloomberg, Consumer Reports, Senior Executive and Boston magazine, and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among other publications. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange and hosted a weekly video segment on equities.

In his current role at Kiplinger, Dan writes about equities, fixed income, currencies, commodities, funds, macroeconomics, demographics, real estate, cost of living indexes and more.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

Stock Market Today: P&G Earnings Headline Quiet Day for Stocks

Stock Market Today: P&G Earnings Headline Quiet Day for StocksWhile the major indexes failed to make big moves today, consumer staples giant Procter & Gamble popped after earnings.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic Data

Stock Market Today: Stocks Struggle After Tesla Earnings, Economic DataSigns that consumer demand is weakening and the economy is slowing weighed on the major indexes Thursday.

By Karee Venema • Published

-

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation Update

Stock Market Today: Stocks Close Mixed After Sizzling U.K. Inflation UpdateInvestors also focused on today's onslaught of earnings reports, including mixed results for streaming giant Netflix.

By Karee Venema • Published

-

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly Reports

Stock Market Today: Stocks Waver Amid a Flurry of Quarterly ReportsMixed earnings and hawkish comments from Fed officials made for something of a seesaw session on Tuesday.

By Dan Burrows • Published

-

Stock Market Today: Stocks Waver Ahead of Busy Earnings Week

Stock Market Today: Stocks Waver Ahead of Busy Earnings WeekWhile the major market indexes made modest moves Monday, Prometheus Biosciences popped on M&A news.

By Karee Venema • Published

-

Stock Market Today: Big Bank Earnings Fail to Lift Stocks

Stock Market Today: Big Bank Earnings Fail to Lift StocksThe major indexes closed lower Friday on hawkish Fed speak and dismal retail sales data.

By Karee Venema • Published

-

Stock Market Today: Stocks Climb After Promising PPI, Jobless Claims

Stock Market Today: Stocks Climb After Promising PPI, Jobless ClaimsThe major market indexes notched a win Thursday as wholesale prices unexpectedly fell and jobless claims hit their highest level in over a year.

By Karee Venema • Published

-

Stock Market Today: Stocks Struggle After CPI, Fed Minutes

Stock Market Today: Stocks Struggle After CPI, Fed MinutesThe major indexes made modest moves after data showed a mixed picture on inflation and the Fed minutes hinted at another rate hike.

By Karee Venema • Published