A Kiplinger-ATHENE Poll: Retirees Are Worried About Money

Concerns about recession, inflation and health care costs weigh on retirees and near retirees.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

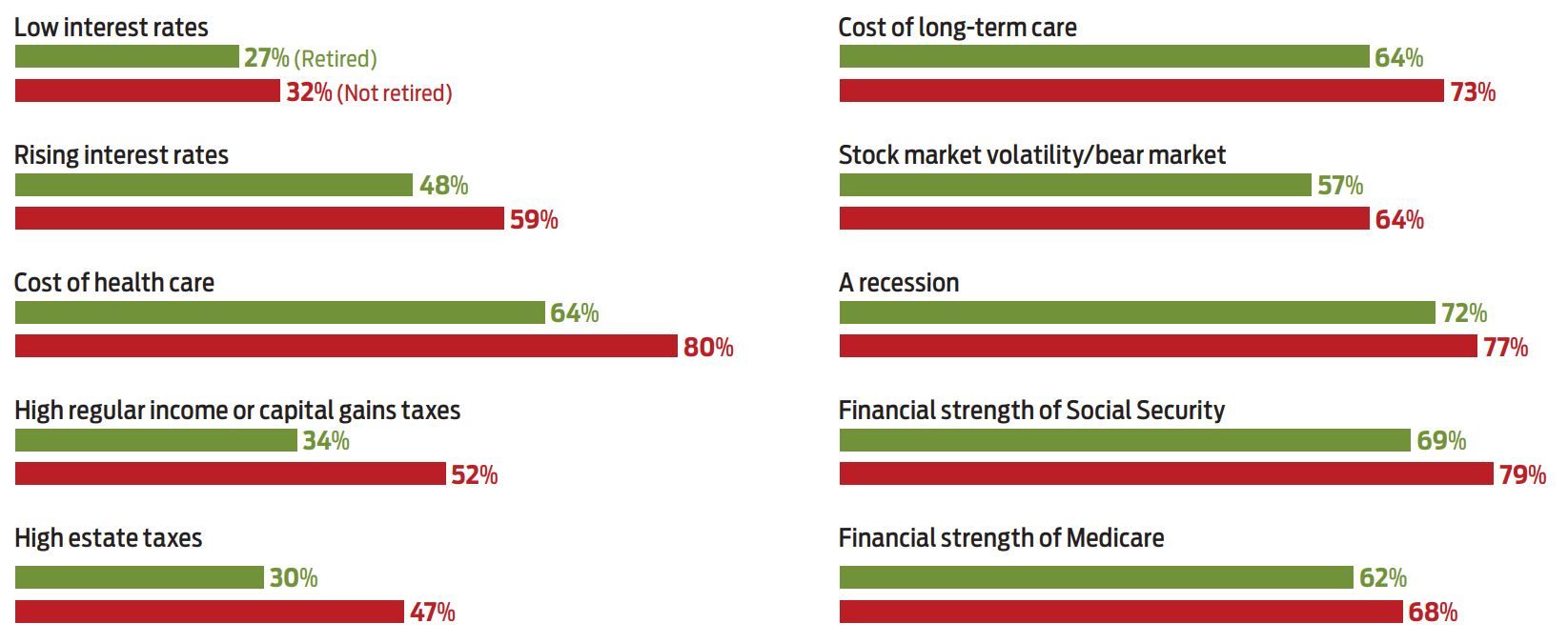

A bear market accompanied by market volatility has led to shifting perceptions of what constitutes a secure retirement, according to a new national poll by Kiplinger and retirement services company Athene. Top concerns of retirees and near-retirees include a possible recession, the financial security of Social Security, the cost of health care and inflation.

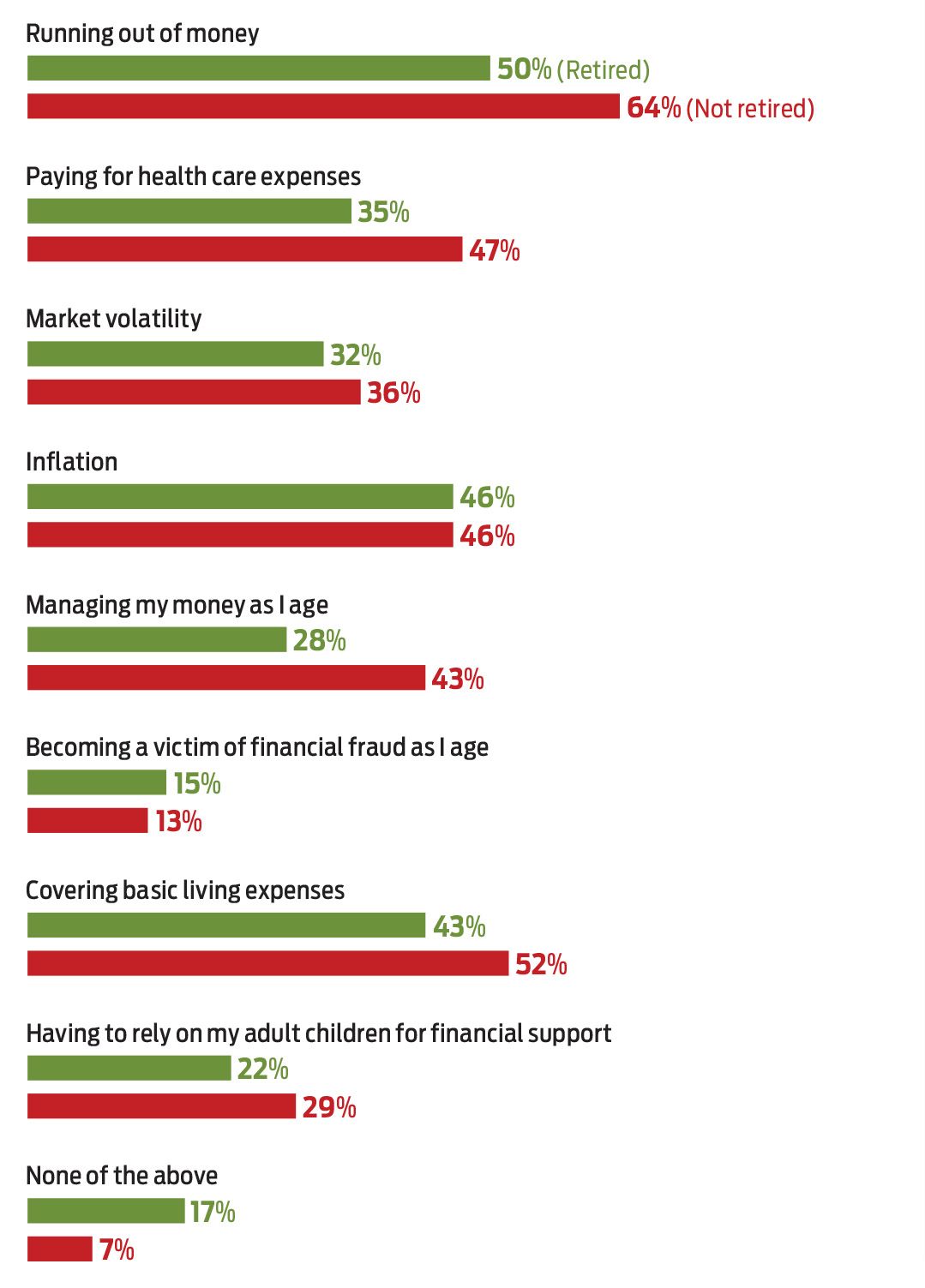

A majority of respondents say that having more guaranteed income in retirement would ease their concerns about running out of money. Even so, an overwhelming majority of current retirees report high levels of satisfaction and happiness. And retirees are generally confident about their financial future, with 70% reporting they expect to have enough income to live comfortably, and 66% saying they are confident they will not run out of money in retirement. However, preretirees are less sanguine. Less than 55% of respondents not yet retired expressed confidence that they will not run out of money at some point.

The poll targeted retirees and pre-retirees with a net worth of at least $100,000; the respondents’ median household net worth (excluding primary residence) was $369,979 for retirees and $322,506 for pre-retirees. The relatively high net worth is one likely reason financial confidence in this survey is higher than reflected in other retirement-confidence surveys.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Retirees are a bit more positive about stock market volatility than preretirees. Nearly half (49%) of retirees are concerned that stock market volatility could cause serious economic hardship in retirement (versus 64% of preretirees). Some 68% of retirees say they are doing nothing (and waiting) in response to volatility this year (versus 60% of preretirees).

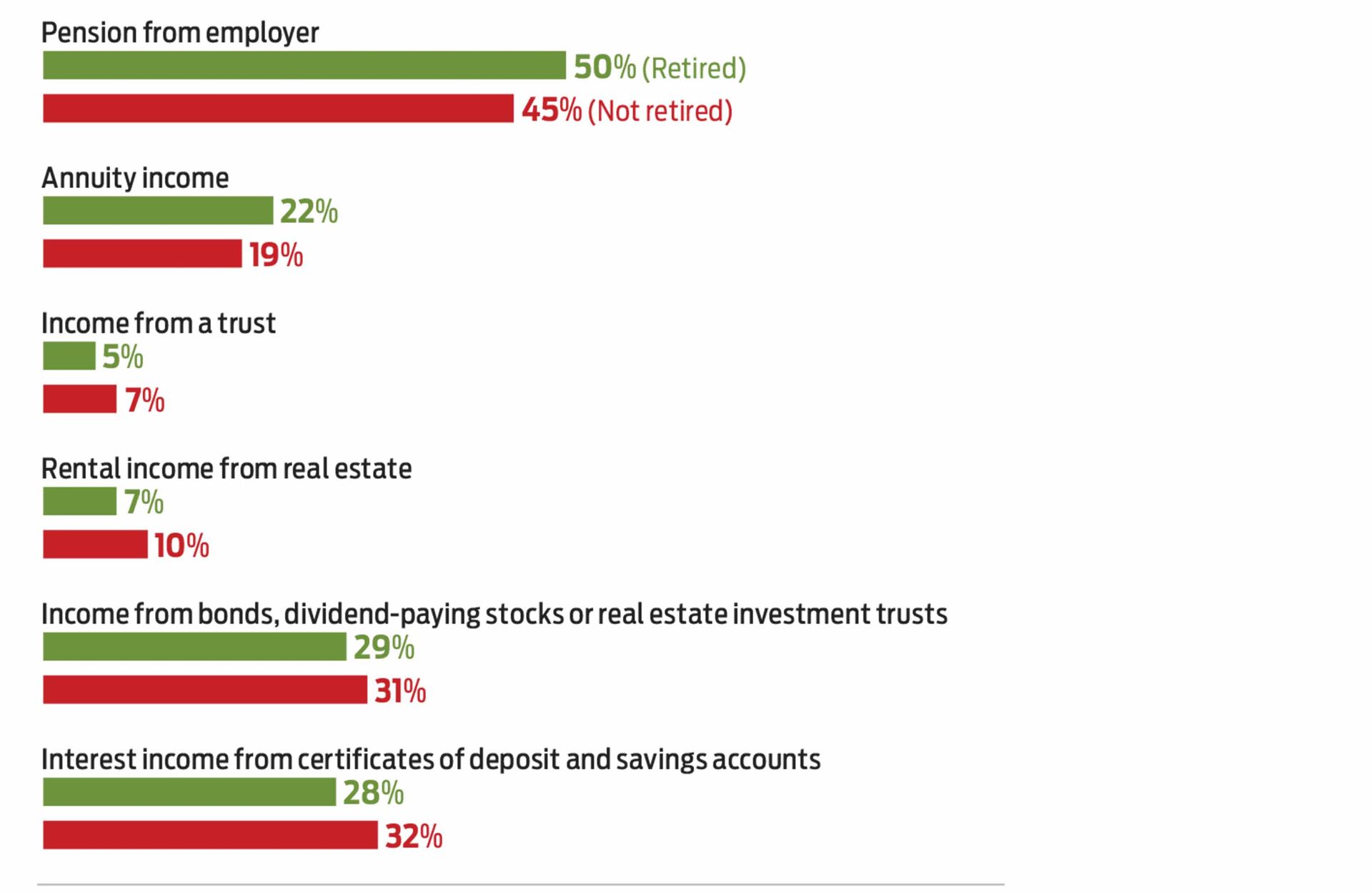

Among retired respondents, 83% have already claimed Social Security benefits, with a mean claiming age of 63. For 43% of these respondents, Social Security provides 50% or more of their annual retirement income. Top sources of stable income for current retirees (beyond Social Security) include an employer pension; income from bonds, dividend-paying stocks and REITs; CDs and savings accounts; and annuities. More highlights from the poll:

Are you worried about the following economic issues in retirement?

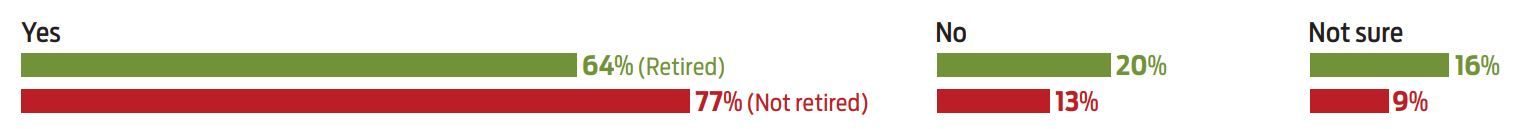

Are you concerned that inflation could cause serious economic hardship for you in retirement?

How confident are you that you will not run out of money in retirement?*

Which of the following things would you worry less about if more of your retirement income were guaranteed?

Which of the following strategies most closely matches how you currently withdraw or plan to withdraw money from your retirement savings each year?*

Which of the following sources of income do you receive or expect to receive at some point?†

Methodology

We surveyed 818 Americans ages 50 and older (about evenly split between retirees and preretirees). Respondents had a net worth of at least $100,000, and the median household net worth (excluding primary residence) was $369,979 for retirees and $322,506 for preretirees. About half of the respondents were men and half women. The poll was conducted by Qualtrics from June 21 to June 24, 2022. The margin of error is 3.4% with a 95% confidence level.

*Figures do not add up to 100% due to rounding.

†Respondents were asked to select all that apply.

-

-

Chase Launches $1K Bonus Offer For Sapphire Card

Chase Launches $1K Bonus Offer For Sapphire CardThe Chase Sapphire Preferred® Card recently launched a jaw-dropping deal for new customers.

By Ellen Kennedy • Published

-

Stock Market Today: Nasdaq Outperforms on Microsoft Earnings

Stock Market Today: Nasdaq Outperforms on Microsoft EarningsThe Nasdaq led in a mixed session for stocks Wednesday as Big Tech earnings impressed.

By Karee Venema • Published

-

New RMD Rules: Starting Age, Penalties, Roth 401(k)s, and More

New RMD Rules: Starting Age, Penalties, Roth 401(k)s, and MoreMaking Your Money Last The SECURE 2.0 Act makes major changes to the required minimum distribution rules.

By Rocky Mengle • Published

-

As the Market Falls, New Retirees Need a Plan

As the Market Falls, New Retirees Need a Planretirement If you’re in the early stages of your retirement, you’re likely in a rough spot watching your portfolio shrink. We have some strategies to make the best of things.

By David Rodeck • Published

-

Retirees: Your Next Companion May Be a Robot

Retirees: Your Next Companion May Be a Robothappy retirement Robots may help fill the gap left by a shortage of humans to help older adults live independently.

By Alina Tugend • Published

-

Using Your 401(k) to Delay Getting Social Security and Increase Payments

Using Your 401(k) to Delay Getting Social Security and Increase Paymentsretirement Your 401(k) can be a bridge from retirement to higher monthly income.

By Elaine Silvestrini • Published

-

6 RMD Changes We Could See This Year

6 RMD Changes We Could See This YearMaking Your Money Last Congress is considering two bills that would make major changes to required minimum distributions. Could your RMDs be affected?

By Rocky Mengle • Last updated

-

How Do I Stop Robocalls From Scamming Me?

How Do I Stop Robocalls From Scamming Me?retirement The scammers have automated their efforts to separate you from your money. We have ways to make it stop.

By Elaine Silvestrini • Published

-

Grandparent Scams Get Victims in Their Hearts

Grandparent Scams Get Victims in Their HeartsScams If you get a call from someone who claims to be your grandchild in trouble and needing money right away, be wary. Don’t send any money or give any information until you verify the story.

By Elaine Silvestrini • Published

-

Tech Support Fraud Targets Seniors

Tech Support Fraud Targets Seniorsretirement Get a message offering help with a computer problem you didn’t think you had? It’s probably a scammer looking for your money and personal information

By Elaine Silvestrini • Published