Best Cheap Stocks to Buy Now (Under $10)

If you're willing to take on the risk of owning cheap stocks, these nine picks are all priced under $10.

- (opens in new tab)

- (opens in new tab)

- (opens in new tab)

- Newsletter sign up Newsletter

First things first: Cheap stocks are not necessarily better stocks.

But with the S&P 500 Index suffering its biggest annual loss since 2008 last year, many investors have seen their portfolios decline in value. And one opportunity that comes from a less favorable environment on Wall Street is the presence of more cheap stocks.

Some investors choose to avoid stocks under $10 – and for good reason. These names are risky and volatile, and are often facing weak fundamentals. But others love cheap stocks for their affordability factor and their ability to reap big gains in a short period of time (though, this also means investors can suffer big losses in a hurry).

If you are interested in cheap stocks, it's vital to do your research beyond just looking at the latest print for prices. You need to take a hard look at risk metrics, recent performance and future outlook in order to invest responsibly.

With that in mind, here are nine cheap stocks under $10 to consider. The following picks all have something to offer: Some are stable low-priced stocks with healthy dividends, while others are tech companies with growth potential in a digital age. And some are simply bargains after recent declines.

But remember, cheap stocks move quickly, so if you decide to invest in them at all, do so in small amounts that you can afford to lose.

Data is as of March 10. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

ADT

- Market value: $6.7 billion

- Dividend yield: 1.8%

ADT (ADT (opens in new tab), $7.34) debuted as a public company in 2012 as a spinout from industrial conglomerate Tyco to gain capital efficiencies and focus on its unique business model. But over the last decade or so, there hasn't been particularly huge growth for the security stock – particularly in the age of connected devices and doorbell cams, which many feel are adequate replacements for traditional home security systems.

But ADT has evolved, too, partnering with Alphabet's (GOOGL (opens in new tab)) Google Nest technology instead of trying to outdo its high-tech competitors. In fact, the ADT/Google deal announced in 2020 was backed by a $450 million ownership stake that equates to just under 7% of the company.

ADT might not knock your socks off with surging revenue, but it has what it takes to deliver steady growth over time. Plus, amid a rough market environment, ADT has outperformed the S&P 500 over the last 12 months – falling 3.6% compared to a 9.7% decline for the S&P 500.

That's in part because the company turned around from a 25 cents per share loss in fiscal 2021 to a 24 cents per share profit in fiscal 2022. Furthermore, ADT's full-year report showed annual revenue growth of 21%, as well as a fourth consecutive quarter of record-high customer retention and recurring monthly revenue balances. This fundamental strength is why ADT is on this list of the best cheap stocks to buy now.

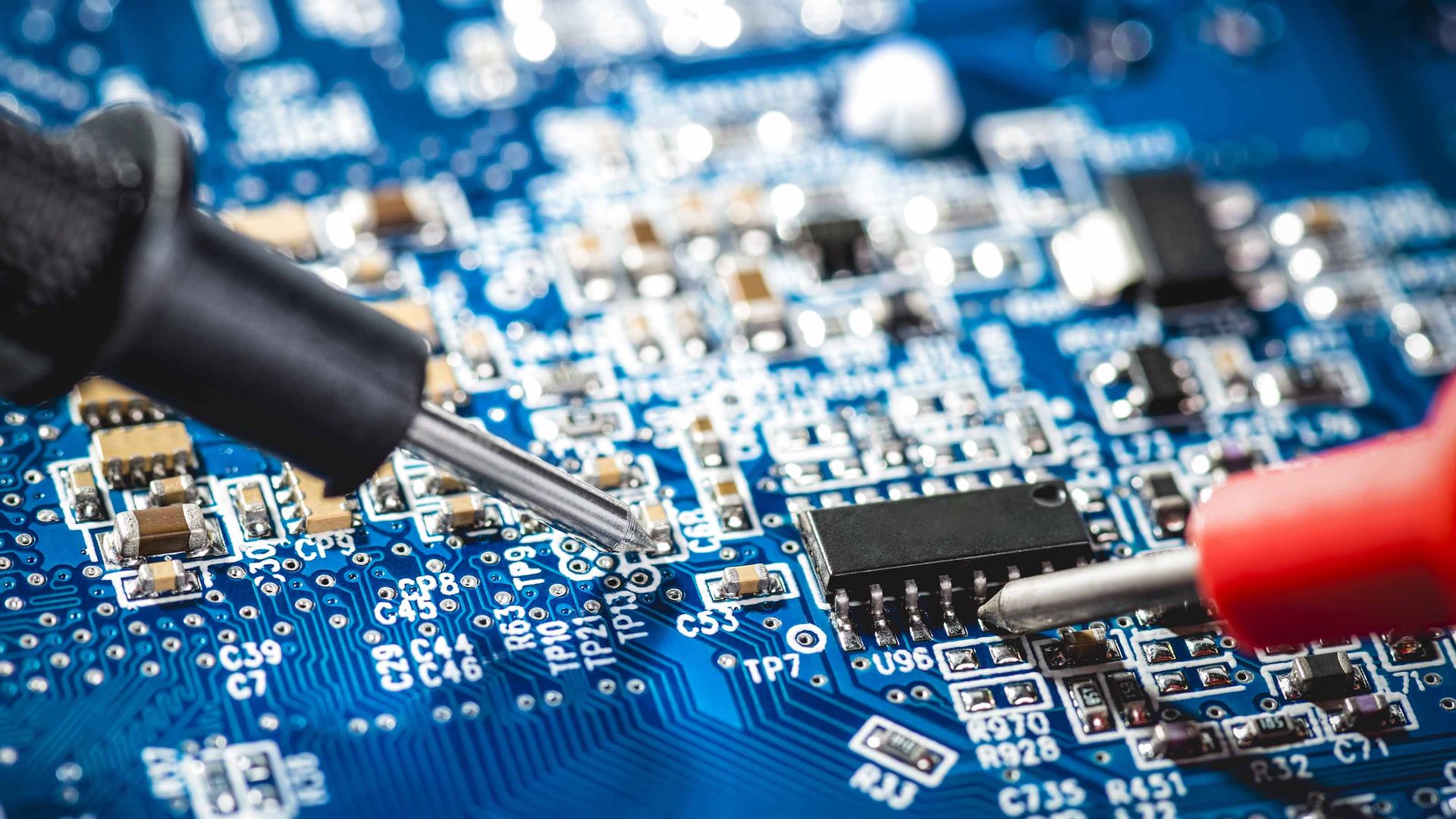

ASE Technology Holding Co.

- Market value: $15.5 billion

- Dividend yield: N/A

Semiconductor stocks took it on the chin a few years back amid supply-chain disruptions. Headwinds remain after a 2022 U.S. Department of Commerce ruling restricted exports to China and could spark a long-term trade war on chips. However, it's important to understand that recent troubles are coming after significant long-term growth for the semiconductor industry.

Consider the popular iShares Semiconductor ETF (SOXX (opens in new tab)), which holds the biggest names in the sector. While the fund is down about 20% from its 52-week high, it's more than doubled over the last five years – nearly three times the performance of the S&P 500 in the same period.

Taiwan-based ASE Technology Holding Co. (ASX (opens in new tab), $7.22) is not a big-name, branded chipmaker like an Intel (INTC (opens in new tab)) or a Broadcom (AVGO (opens in new tab)) that might be the first names that spring to mind for investors. But recently, ASE has outperformed its peers, as well as the broader S&P 500, with shares that are roughly flat over the last 12 months. That's because ASE is involved in services like packaging and testing circuits and doesn't design specialty semiconductors on its own the way these bigger names do.

It's a lower-margin business, but that means ASE doesn't have to sweat the research side or the marketing of patented semiconductors and therefore offers more stability. Many of the cheap stocks out there in the tech sector can be risky, so ASE's unique business model makes it stand out.

Equitrans Midstream

- Market value: $2.5 billion

- Dividend yield: 9.9%

Equitrans Midstream (ETRN (opens in new tab), $5.73) is an energy infrastructure stock valued at just around $2.5 billion at present. Its natural gas pipeline and storage assets are located mainly in the Appalachian Basin, but it also has a modest water and wastewater utility operation that provides potable water to parts of Ohio.

While some of the names on this list carry an elevated risk profile, ETRN is one of the most stable and recession-proof stocks you'll find in the lineup.

LNG infrastructure operations are far more stable than exploring for fossil fuels and dealing with the volatility of market pricing. Instead, ETRN is a toll-taker that just passes the fuel along – and takes a small fee along the way. That allows for a reliable operation that supports a generous and consistent dividend payment to shareholders.

In fact, the dividend is a hefty 9.9% based on its 15 cents per share quarterly payout and current pricing. Even if shares continue to move sideways, that big-time payday could make Equitrans one of the best cheap stocks for income investors to consider.

New York Community Bancorp

- Market value: $5.0 billion

- Dividend yield: 8.7%

New York Community Bancorp (NYCB (opens in new tab), $7.37) is a regional bank with about 240 branches and about $60 billion in total assets. It operates in New York, New Jersey, Ohio, Florida and Arizona. The bank is involved with the regular grind of financial services including residential loans, savings accounts and other various financial products for consumers and businesses.

But what makes NYCB really interesting is that in 2021, it acquired Flagstar, one of the largest mortgage brokerages in the nation. This gives it the ability to be much more than just a regional bank, particularly since 30-year mortgage rates have more than doubled from their lows of under 3% during 2021.

Sure, there's risk of a decline in mortgage activity if the U.S. economy or housing market hits a snag. And regional banks are risky for short-term investors following the collapse of Silicon Valley Bank and Signature Bank.

But as a long-term move, this is a very shrewd bet for NYCB as it grows the company's top line by more than 50% over the current fiscal year. New York Community Bank is also expected to grow profits in the next fiscal year after things are settled in the wake of this acquisition and it cashes in on the rising rate environment.

The icing on the cake for one of Wall Street's best cheap stocks is a 17 cents per share quarterly dividend that is only about 60% of total profits, but adds up to a generous annualized yield of 8.7%. This is more than five times the current S&P 500 yield.

NL Industries

- Market value: $314.9 million

- Dividend yield: 4.1%

NL Industries (NL (opens in new tab), $6.45) has a long and complex history. Formerly known as the National Lead Company, the smelting company was one of the 12 original stocks included in the Dow Jones Industrial Average in the late 1800s. It eventually got into the paint game – with lead paint before the health risks were well known, and then eventually via titanium dioxide pigments that are known for their brilliant white finish on appliances, cars and other goods.

NL is still in the machined metals game, with a subsidiary that manufactures exhaust systems, gauges, throttle controls and other hardware for the marine industry. It also has a security products business that focuses on various locks, cabinets and other products.

You may think a cheap stock like NL Industries, tied to cyclical manufacturing trends and with a modest market cap of just $315 million in market value, might be a risky bet right now. However, shares are down about 4% in the last 12 months, compared with a nearly 10% loss for the S&P 500 in the same period. It's also up about 130% in the last 36 months, more than doubling the return for the broad market.

Payoneer Global

- Market value: $2.2 billion

- Dividend yield: N/A

Payment and e-commerce platform provider Payoneer Global (PAYO (opens in new tab), $6.18) is a mid-cap stock in the tech sector valued at about $2 billion. It's currently running at break-even on its bottom line as it invests heavily in growth. However, that's to be expected for a company that didn't exist until 2005 and only became publicly traded in 2021.

Amid the rise of mobile and cashless transactions, PAYO has a great long-term tailwind for its business. The firm is not like consumer-facing brand PayPal Holdings (PYPL (opens in new tab)), and instead is focused on B2B payment operations. Specifically, Payoneer's technology is built for international payments, managing a digital business, or accessing capital to open up new opportunities. Its cross-border payment solutions support an ecosystem of marketplaces in approximately 190 countries and territories worldwide.

Shares of PAYO stock are up more than 40% in the last year thanks in part to its growing business. There's assuredly risk here if we hit a widespread downturn in global spending, and thus reduced transaction volume. But PAYO, one of Wall Street's best cheap stocks to buy, could have a very bright future in a digital age. In 2022, it hired former Alibaba.com (BABA (opens in new tab)) executive John Caplan as its CEO, and it is looking to expand even further in the years ahead.

In November, Payoneer reported strong growth of 30% on a year-over-year basis. And at the end of February, it hit the same mark as it reported record fourth-quarter and full-year revenue, generating more than 30% year-over-year growth for both periods. Looking forward, PAYO expects growth to continue in the 25% to 30% range, which bodes well for investors in this cheap stock.

Prospect Capital

- Market value: $2.7 billion

- Dividend yield: 10.3%

Prospect Capital (PSEC (opens in new tab), $6.78) regularly pops up on lists of the best cheap stocks for income investors. This company has a reputation for its internal investment prowess – which makes it a natural vehicle for other outside investors looking to share in its success.

PSEC is a business development company. BDCs function more like a private equity firm or hedge fund than your typical financial stock, taking in cash and then redeploying it wherever it thinks it can get the best return. All told, the company commands about $8 billion in assets. That cash is primarily invested in mid-sized corporations with less than $150 million in annual profits. This means they are "goldilocks" operations: not so big they require very deep pockets, but not so small a single executive departure or outside disruption can ruin things.

What's more, PSEC has made a business out of financing troubled companies that may not find it easy to get capital elsewhere. This is a bit of a risky proposition, but can result in windfall profits when things work out. Plus, its portfolio includes includes 130 companies spread across 37 separate industries, including packaged foods, healthcare, software and machinery. This provides investors with deep diversification to help smooth out any bumps in the road.

Shares have more or less tracked the market over the last year or two. But PSEC is a monthly dividend stock that yields 10.3%, which makes the total return of this BDC worth a look.

Sirius XM

- Market value: $14.3 billion

- Dividend yield: 2.6%

When it comes to cheap stocks, satellite radio service provider Sirius XM Holdings (SIRI (opens in new tab), $3.67) is an interesting one to consider because of two big advantages it holds over traditional media companies. First, it's a legal monopoly, with no realistic alternatives beyond terrestrial radio or using your cellphone. That means those who have come to rely on SIRI tend to be very sticky customers – as evidenced by the fact the company hiked its subscription costs for in-car services in March.

The second is that Sirius XM's operating model is not ad-driven – which allows it to forgo the army of salespeople used by traditional broadcasters and instead focus on on-air talent. Consider that even after the acquisition of Pandora Media back in 2019, only about 20% of Sirius XM's $9 billion in fiscal 2022 revenue last year came from advertising. That lends reliability to operations, particularly if you think the U.S. economy may be at risk of recession in the coming months.

Last but not least, SIRI has a commitment to shareholder value that includes a solid capital-return program. It's doling out a 2.6% regular yield on top of a special 2022 distribution and consistent stock buybacks on top of that.

Organic revenue growth for SIRI has admittedly been slow going, but there's a lot to like about this company thanks to its unique business model and a robust listenership of some 34 million subscribers and counting.

Yamana Gold

- Market value: $5.0 billion

- Dividend yield: 2.3%

The name of Yamana Gold (AUY (opens in new tab), $5.21) pretty much says it all. The Canada-based mining company boasts nearly 14 million ounces of proven gold reserves, and another 111 million ounces of silver to make it a direct play on precious metals.

In an age where market participants are looking for investments that are hedges against inflation or low-risk alternatives to the typical tech stocks of yesteryear, there's a lot to be said about a miner like Yamana. The company's most recent reserves report shows more than 380 million metric tonnes of gold and more than 330 million tonnes of silver. As AUY brings those goods to market, it will cash in. And considering the massive reserves it owns underground, there's little risk of this top gold stock going under anytime soon.

That doesn't mean it won't see ups and downs based on market pricing. Like all commodity stocks, metal producers like this one can be volatile based on the short-term market dynamics. However, in the near future, we are set to see persistent inflation lifting prices of gold and silver – and lifting AUY in kind.

As proof, shares are up roughly flat over the last year while the S&P 500 has lost about 10% or so in the same period. Yamana pays a healthy 2.3% dividend yield on top of that to provide a decent stream of income along with an inflation hedge via one of Wall Street's best cheap stocks.

Jeff Reeves writes about equity markets and exchange-traded funds for Kiplinger. A veteran journalist with extensive capital markets experience, Jeff has written about Wall Street and investing since 2008. His work has appeared in numerous respected finance outlets, including CNBC, the Fox Business Network, the Wall Street Journal digital network, USA Today and CNN Money.

-

-

Longevity: The Retirement Problem No One Is Discussing

Longevity: The Retirement Problem No One Is DiscussingMany people saving for retirement fail to take into account how living longer will affect how much they’ll need once they stop working. What should they do?

By Brian Skrobonja, Chartered Financial Consultant (ChFC®) • Published

-

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax Bombs

Capital Gains Taxes Trap: How to Avoid Mutual Fund Tax BombsIt’s bad enough when your mutual fund’s assets lose value, but owing unexpected capital gains taxes after those losses is doubly frustrating.

By Samuel V. Gaeta, CFP® • Published

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

By Dan Burrows • Published

-

Best AI Stocks to Buy: Smart Artificial Intelligence Investments

Best AI Stocks to Buy: Smart Artificial Intelligence Investmentstech stocks AI stocks have been bloodied up in recent months, but the technology's relentlessly growing importance should see the sun shine on them again.

By Tom Taulli • Published

-

9 Best Stocks for Rising Interest Rates

9 Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and it's likely not done yet. Here are nine of the best stocks for rising interest rates.

By Jeff Reeves • Published

-

The 6 Safest Vanguard Funds to Own in a Bear Market

The 6 Safest Vanguard Funds to Own in a Bear Marketrecession Batten the hatches for continued market tumult without eating high fees with these six Vanguard ETFs and mutual funds.

By Kyle Woodley • Published

-

9 Best Commodity ETFs to Buy Now

9 Best Commodity ETFs to Buy NowETFs These commodity ETFs offer investors exposure to the diverse asset class, which is a helpful hedge against inflation.

By Jeff Reeves • Last updated

-

Stock Market Today: Stocks Rise as Inflation Eases

Stock Market Today: Stocks Rise as Inflation EasesData from the Labor Department showed consumer prices fell for a sixth straight month in December.

By Karee Venema • Published

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

By Louis Navellier • Published

-

7 Best Small-Cap Stocks to Buy for 2023 and Beyond

7 Best Small-Cap Stocks to Buy for 2023 and Beyondsmall cap stocks Analysts say a tough 2022 has left these small-cap stocks priced for outperformance in the new year and beyond.

By Dan Burrows • Published